Coinbase Prime, the institutional arm of the favored cryptocurrency change, has introduced it would finish custody assist for 49 altcoins by the tip of this month.

The transfer will have an effect on a variety of lesser-known tokens. These embrace property related to area of interest blockchain tasks and even actual estate-related tokens.

49 Altcoins Lose Custody Assist on Coinbase Prime

The choice was made public in an April 14 put up on X (previously Twitter).

“We commonly consider the property we assist to make sure they proceed to satisfy our requirements. Based mostly on current critiques, Coinbase Prime will finish custody assist for 49 property, efficient the tip of the month,” the put up learn.

The impacted tokens embrace BOSAGORA (BOA), 0chain (ZCN), pNetwork (PNT), Telcoin (TEL), and Oraichain Token (ORAI). The checklist additionally talked about Sentinel Protocol (UPP), Cellframe (CELL), Ideaology (IDEA), and RioDeFi (RFUEL), which cater to totally different use circumstances inside the blockchain ecosystem.

Even actual property and investment-related property had been impacted. 1717 Bissonnet (1717), The Edison (EDSN), Draper Garland Residences (GFDG), Forest Crossing Residences (GFFC), Whats up Albemarle (HLAB), and many others had been a number of the talked about tokens.

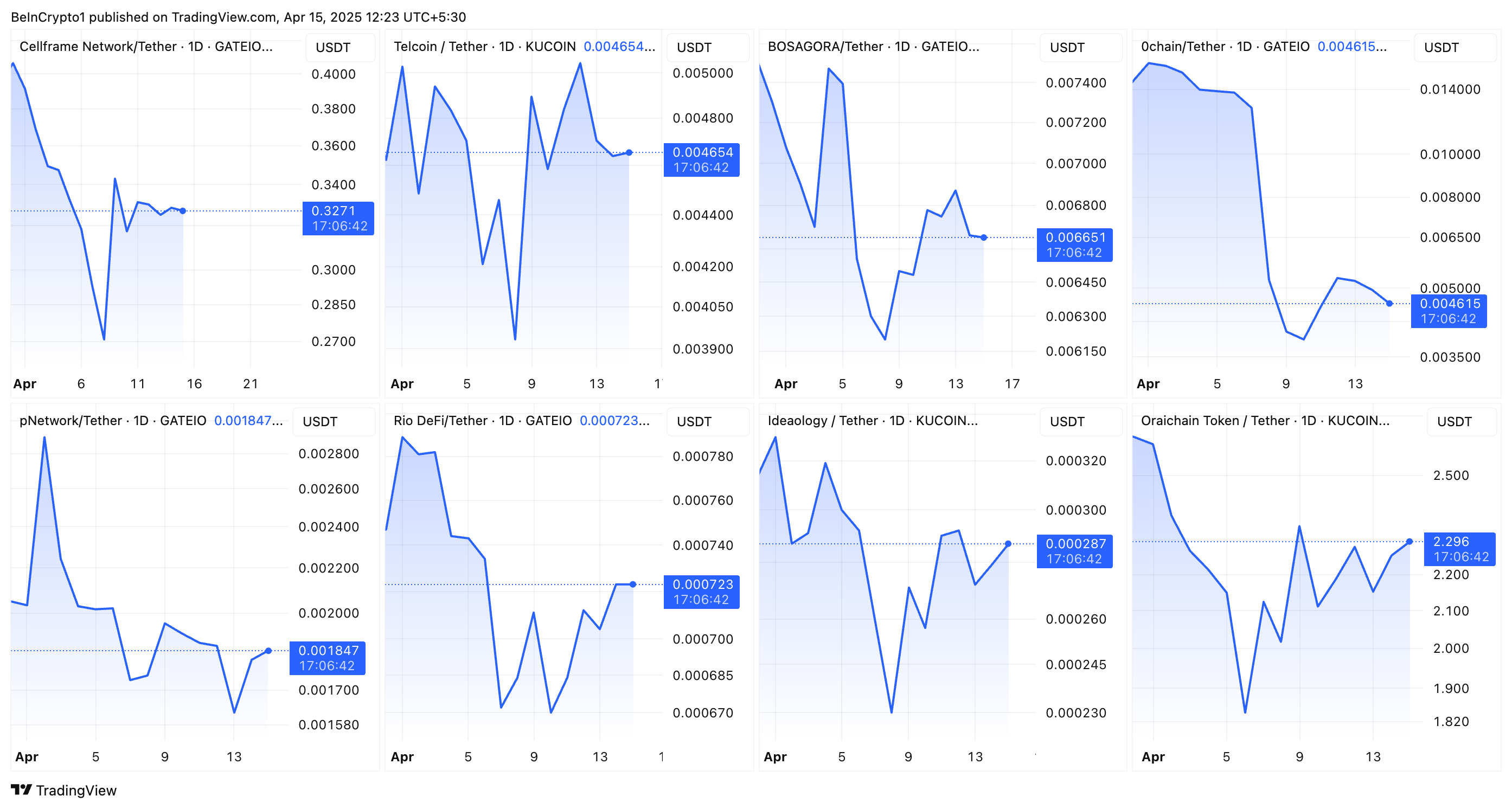

Whereas a number of the featured tokens noticed modest declines, others remained unaffected. As well as, PNT, ORAI, IDEA, and TEL have apprecaited in worth over the previous day.

CELL, TEL, BOA, ZCN, PNT, RFUEL, IDEA, ORAI Worth Efficiency. Supply: TradingView

For context, Coinbase Prime gives a collection of providers designed to satisfy the wants of institutional traders. The platform supplies custody, buying and selling, and financing options. The previous permits establishments to securely retailer digital property, guaranteeing compliance and safety for large-scale investments.

Nonetheless, the newest choice to take away these property means that the platform is reassessing its choices. Coinbase has not disclosed particular causes for eradicating these explicit property.

Nonetheless, the transfer could possibly be linked to elements similar to low liquidity, market exercise, or failure to satisfy institutional-grade compliance requirements. For institutional purchasers utilizing Coinbase Prime, this alteration means they might want to switch or liquidate their holdings earlier than the tip of April 2025.

In line with its web site, Coinbase Prime at the moment helps over 430 property. Thus, the shift represents a comparatively small adjustment within the broader providing.

The announcement comes because the change Coinbase continues to broaden its portfolio. A couple of weeks in the past, the change listed Doginme (DOGINME), Keyboard Cat (KEYCAT), after which Definitive (EDGE). The transfer led to notable worth upticks for the tokens.

Nonetheless, broader market circumstances have negatively impacted the change. BeInCrypto reported that Coinbase’s inventory skilled a 30% dip in Q1 2025. Furthermore, the interval marked the corporate’s worst quarter for the reason that defunct cryptocurrency change FTX collapsed.

As Coinbase strikes ahead in a unstable cryptocurrency market, this choice to delist sure property appears to be half of a bigger technique to focus on extra liquid tokens and higher serve the wants of institutional purchasers.