It is a section from the Empire e-newsletter. To learn full editions, subscribe.

Air visitors management is usually pegged as probably the most nerve-racking job on the earth.

Managing non-public key safety at Coinbase would possibly simply take the cake.

Coinbase is large. Influential. On the entrance strains of the battle for hearts, minds and regulatory readability.

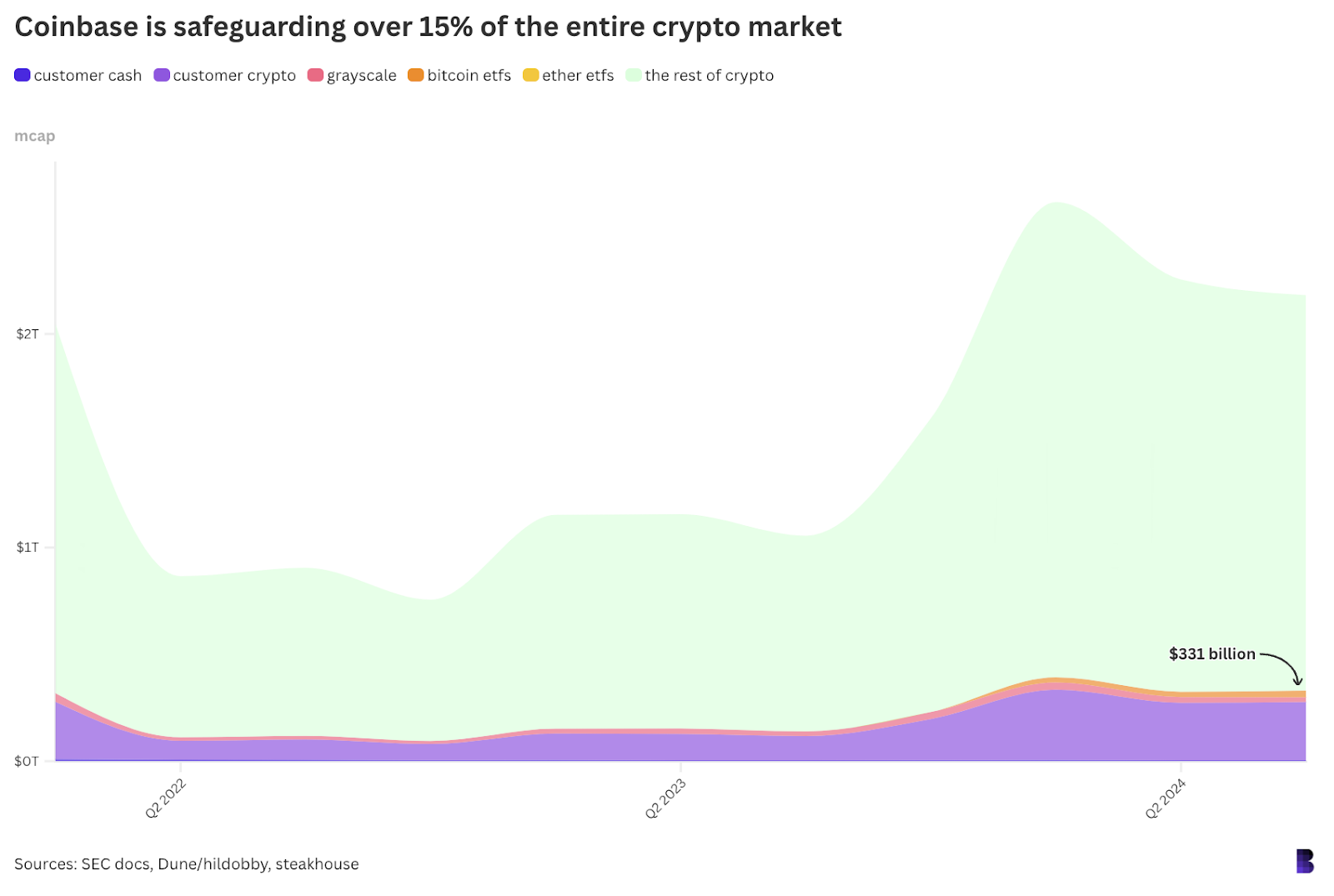

There’s no larger solution to show Coinbase’s standing within the crypto house than by simply how a lot of it’s given to it for safekeeping.

We all know now that Coinbase customers held $272.7 billion in crypto on the finish of September, plus an extra $4 billion in money.

That’s almost $3.5 billion extra crypto than on the finish of June — most likely partially boosted by rising asset costs — and $200 million much less money than the prior interval.

Then, there’s all of the crypto tied up in Grayscale’s suite of ETPs and ETFs: $22.62 billion at Q3’s shut, per Arkham Intelligence knowledge. Grayscale went all-in on Coinbase Custody again in 2019.

One other $31.7 billion is custodied on behalf of different ETF issuers like BlackRock, Bitwise and Ark/21Shares.

A nickel of each greenback of crypto worth on the planet is saved with Coinbase

Coinbase’s ultimate complete for Q3: $331 billion, the equal of 15% of the full crypto market cap on the time.

And if you wish to go even deeper: Chainalysis lately estimated that about 1.8 million BTC may very well be misplaced endlessly — or 9.1% of the circulating provide.

Scrub that from crypto’s market cap, together with the 1.1 million misplaced Satoshi cash, and Coinbase would technically be sitting on nearer to 17% of crypto’s remaining paper worth.

Little doubt, Coinbase acknowledges the importance of all of it. Nonetheless, the best way issues are going, Coinbase might go down as some of the aptly named firms in fintech historical past:

A base for actually all of the cash.