The continuing crypto worth restoration could be attributed to a gaggle of buyers often known as the bond vigilantes, a time period coined by economist Ed Yardeni.

These vigilantes are buyers who typically maintain the federal government in verify by promoting bonds when there’s a vital coverage change. By promoting their bond holdings, these buyers usually push yields excessive and make it costly for the federal government to borrow.

The rally mirrored the inventory market’s efficiency. US inventory indices, such because the Dow Jones and the Nasdaq 100, have all jumped by over 10% from their month-to-month lows. Worldwide indices just like the German DAX and French CAC 40 have additionally jumped.

You may additionally like: Bitcoin, gold rise whereas shares fall: is decoupling right here to remain?

Earlier this month, President Donald Trump delivered his Liberation Dayspeech. The best levies had been utilized to China, however a baseline 10% tariff was utilized throughout the board with extra reciprocal tariffs that adjust by nation.

However Trump blinked after so-called “bond vigilantes” sprung into motion. Traders primarily bought off bonds to strain the federal government to reverse course.

“The Bond Vigilantes have struck once more,” wrote Yardeni. “So far as we are able to inform, at the least with respect to U.S. monetary markets, they’re the one 1.000 hitters in historical past.”

US bond yields went larger, with the 10-year Treasuries hitting 4.585% and the 30-year retesting 5% for the primary time since January.

The rising bond yields meant that the US public debt servicing would go up. Additionally, they meant that the president would seemingly fail in his plan for enormous tax cuts. Vital unfunded tax cuts would have pushed bond yields larger.

Trump commented on the bond market bluntly:

“The bond market may be very difficult. I used to be watching it.”

Crypto rallies

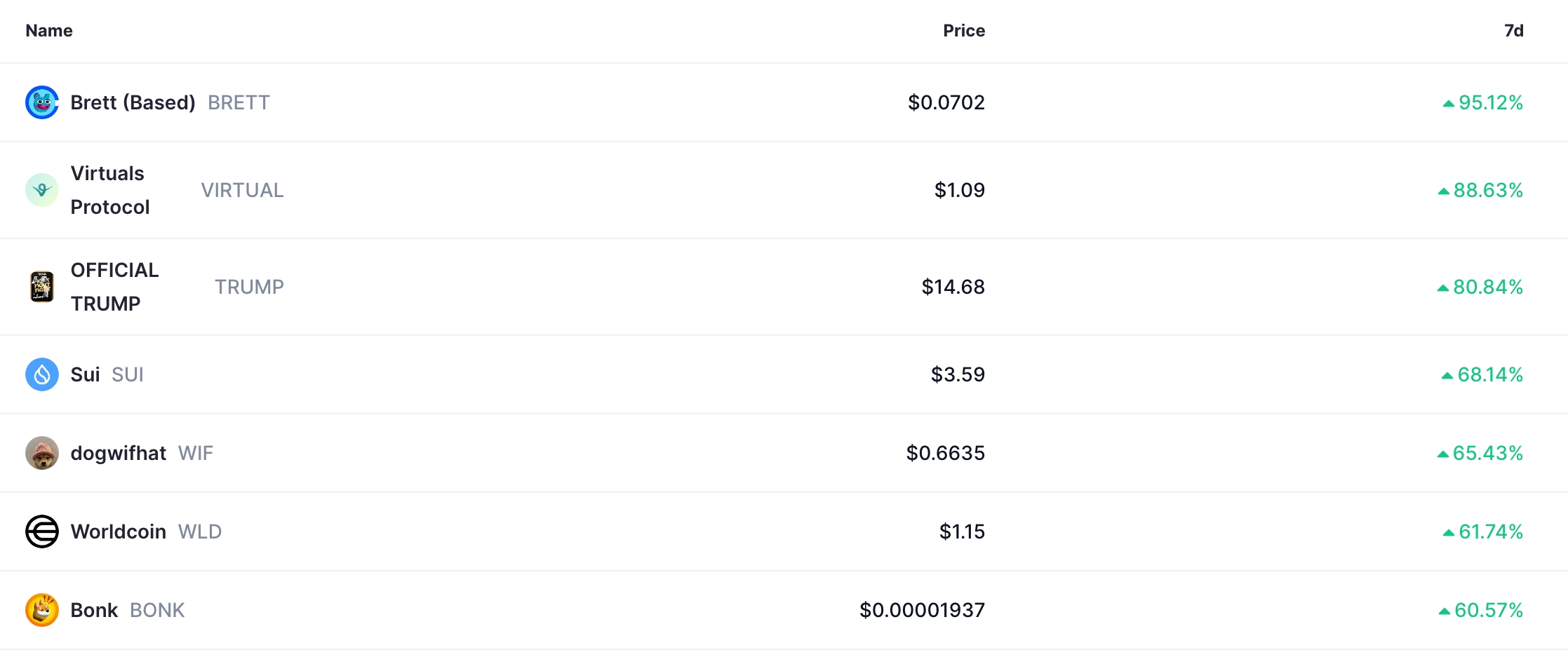

Bitcoin (BTC) worth rose and retested the necessary resistance at $95,000 for the primary time in over a month. Brett (BRETT), the largest meme coin on the Base blockchain, jumped by 95% within the final seven days.

Different prime cash, reminiscent of Digital Protocol (VIRTUAL), Official Trump (TRUMP), Sui (SUI), and Dogwifhat (WIF), have all jumped by over 50% within the final seven days. Because of this, the market cap of all cash jumped to $3 trillion.

High crypto performers | Supply: CoinMarketCap

Bond vigilantes additionally contributed to Trump’s choice to desert firing Jerome Powell from the Federal Reserve.

The U.S. president can’t legally take away the Fed chair with out trigger.

If the Supreme Courtroom allowed such a transfer to face, it could have led to a insecurity in U.S. bonds and the buck. It could have additionally seemingly pushed bond vigilantes to dump Treasuries once more.

Trump additionally hinted that he was able to strike a take care of China, despite the fact that China denied talks had been happening.

Subsequently, crypto costs might proceed to rise within the coming weeks as tariff dangers ease, and the percentages of Federal Reserve cuts improve.

Learn extra: ‘Basic enterprise method’: Trump’s Liberation Day tariffs stir crypto chaos