President Trump has as soon as once more referred to as on Fed Chair Jerome Powell to chop rates of interest, however the crypto group doesn’t appear anymore. Charge cuts appear as unlikely as ever, however the market has new bullish narratives.

Between a US-China commerce deal, new buyers, and technological developments, recession fears have apparently left the crypto market.

Trump Retains Pushing for Charge Cuts

When Trump’s tariffs threatened to disrupt the worldwide financial system, the crypto trade pinned its hopes on one bullish narrative: cuts for US rates of interest.

The US President repeatedly harangued Jerome Powell, even threatening to fireplace him earlier than relenting, but Powell and his allies had been agency: this was not occurring. Trump has continued asking, interesting to Powell once more right this moment:

All through these proceedings, the crypto trade repeatedly urged extra price cuts, claiming that the “cash printer” would stave off financial collapse.

Trump requested Powell to chop rates of interest lately, however the newest FOMC assembly reaffirmed the established order. How did crypto react to this? Up to now, it looks like it lastly bought the memo.

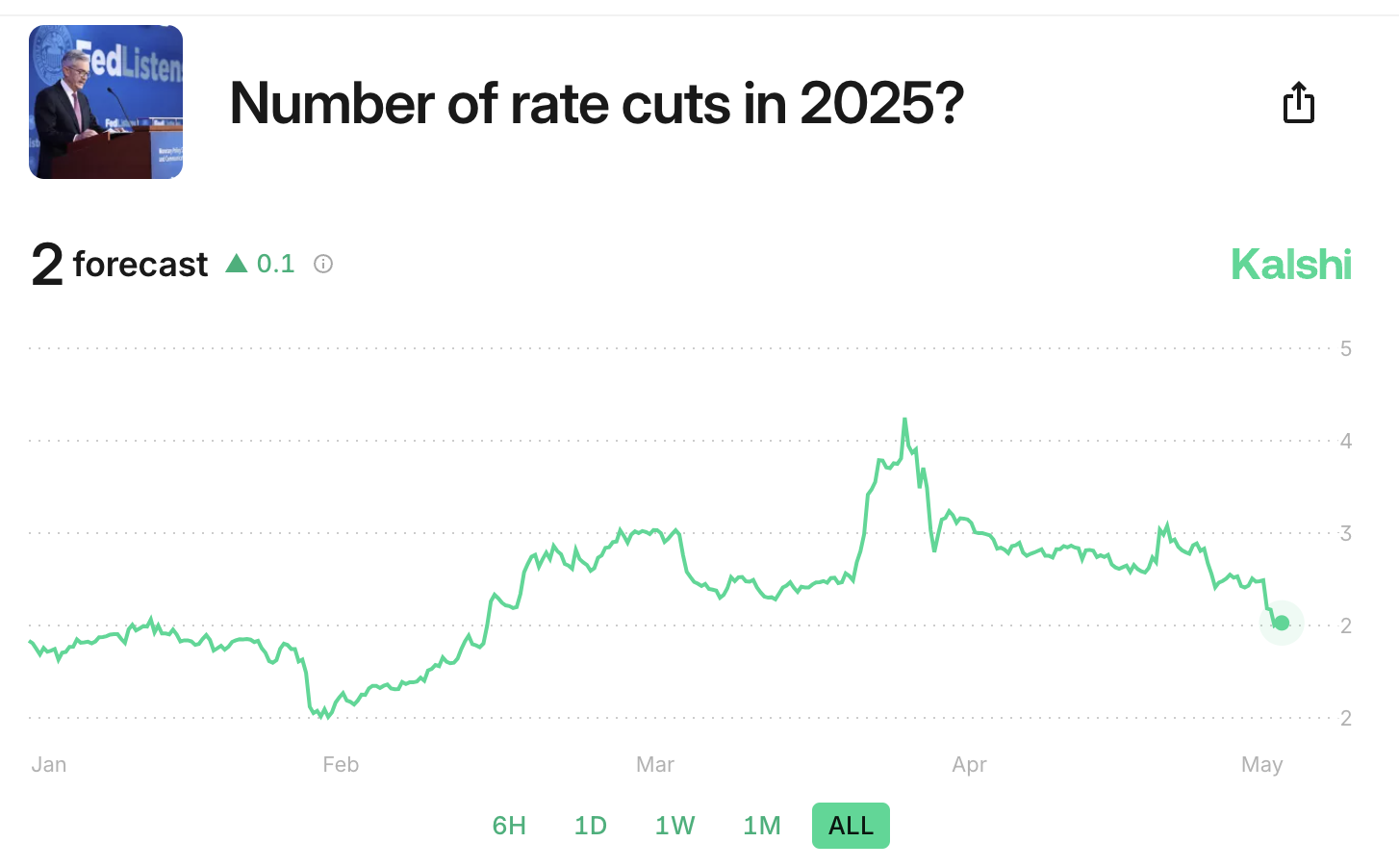

Crypto-affiliated prediction markets like Kalshi have repeatedly posted optimistic odds of Trump’s price cuts in comparison with TradFi assessors just like the CME Group. For instance, the final time Trump made this request, Kalshi predicted that three cuts would occur this yr.

On the time, this could have signified a minimize at half of the yr’s remaining FOMC conferences. In March, Kalshi even anticipated 4! The CME, then again, put over 98% odds on no cuts in Might.

Certainly, this situation is what occurred, and Kalshi has since lowered its expectations. It at the moment anticipates solely two cuts for the remainder of the yr, far more in keeping with different companies’ predictions.

How Many Curiosity Charge Cuts in 2025? Supply: Kalshi

What can crypto conclude from this? The group has apparently internalized that Trump can’t power cuts to rates of interest. Nevertheless, issues are going nicely regardless.

A US-China commerce deal pushed Bitcoin over $105,000, buyers are returning in droves, and know-how is advancing. Worry has largely left buyers’ calculations. Who wants price cuts, anyway?

All that’s to say, Trump’s proposed rate of interest cuts had been only one strategy to doubtlessly increase crypto funding. If Powell spontaneously modified his thoughts right this moment, it’d be bullish, however as of now, the crypto market is slowly transferring away from these macroeconomic drivers.