Ethereum (ETH) has been buying and selling inside a broad consolidation vary of $2,800 to $4,000 for practically 10 months, signaling a part of market indecision.

Notably, an evaluation by CredibleCrypto suggests this vary might be a perfect entry level for traders, as Ethereum gears up for a possible breakout.

Ethereum’s consolidation part

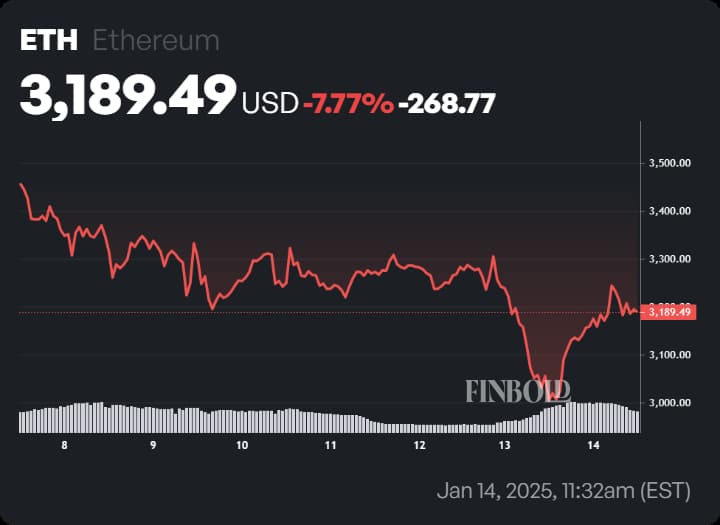

At present buying and selling close to $3,189, Ethereum is positioned simply above the decrease boundary of its 10-month consolidation vary. After briefly climbing to a neighborhood excessive of $3,716, Ethereum has undergone a correction, which analysts see as a part of a broader accumulation course of.

This prolonged sideways motion is seen as a precursor to a bullish transfer, aligning with historic patterns noticed earlier than main value rallies within the cryptocurrency market.

CredibleCrypto has recognized the excessive timeframe (HTF) demand zone between $2,400 and $2,800 because the ‘final purchase zone.’ This area is taken into account a essential assist stage the place draw back dangers are minimal, and the potential for substantial upside is powerful.

“I don’t assume you’ll be able to go flawed choosing up some ETH on the HTF demand zone at vary lows if/once we get there. That is the area between $2400-$2800.That is the final word purchase zone on ETH”

Traditionally, such zones inside accumulation phases have served as launchpads for important bullish developments, and Ethereum seems to observe an analogous trajectory.

ETH breakout potential and value targets

The consolidation part means that Ethereum is constructing momentum for a breakout above the $4,000 resistance stage.

A profitable breach of this vary may see Ethereum concentrating on its prior all-time excessive of $4,891, with the potential to surpass this stage because the market gears up for the subsequent bull cycle.

Echoing this sentiment, Crypto Patel identifies an accumulation zone between $2,900 and $3,150, which has already been tapped.

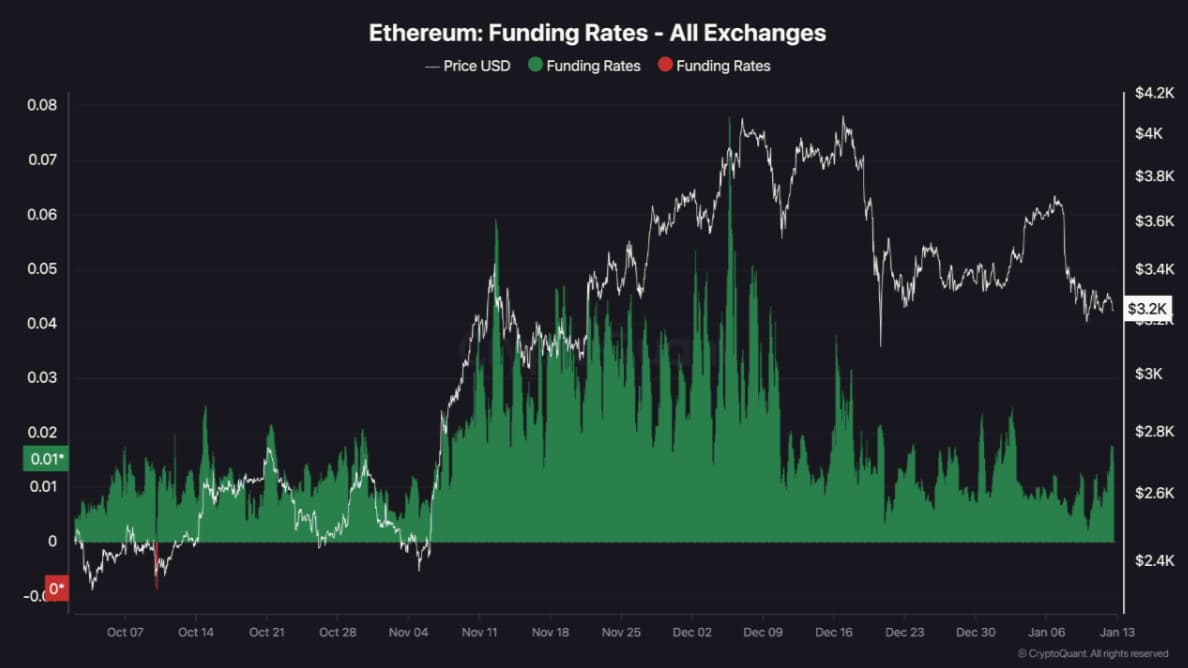

Nonetheless, as Ethereum approached the essential $3,000 assist stage, funding charges started to get well.

A bullish spike within the metric signifies renewed shopping for curiosity, with merchants beginning to open lengthy positions in anticipation of a value rebound.

If this development continues, it may sign rising demand and the chance of a sustained rebound from the $3,000 assist. Nonetheless, if the restoration in funding charges stalls or reverses, it may pave the way in which for renewed bearish sentiment and a deeper correction.

Ethereum (ETH) value evaluation

At press time, Ethereum was buying and selling at $3,189.49, posting a every day achieve of over 4%. Nonetheless, the cryptocurrency stays down by greater than 7% on the weekly chart.

Regardless of the latest volatility, robust assist zones, recovering market sentiment, and bullish technical setups counsel Ethereum’s present value motion presents a compelling alternative for long-term traders getting ready for its subsequent potential rally.

Featured picture through Shutterstock