Bitcoin is altering palms at $78,199 per coin as of 9:55 a.m. Jap time on Feb. 1, 2026, whereas derivatives merchants quietly take their foot off the leverage pedal. Futures open curiosity and choices positioning level to a market extra desirous about danger management than moonshot bets.

Bitcoin Futures and Choices Present Defensive Shift

Throughout main derivatives exchanges this weekend, bitcoin futures open curiosity totals 677,730 $BTC, or $52.98 billion, in keeping with the newest alternate knowledge. That determine marks a broad pullback, with combination open curiosity down 6.83% over the previous 24 hours, signaling ongoing deleveraging after January’s volatility.

Futures positioning stays focused on a handful of venues. Binance and CME dominate, holding roughly 19.1% and 17.8% of whole open curiosity, respectively. Binance leads with 129,580 $BTC ($10.13 billion) in open contracts, whereas CME follows intently with 120,910 $BTC ($9.45 billion), reinforcing the cut up between offshore and institutional futures exercise.

Brief-term flows present merchants stepping again nearly all over the place. One-hour and four-hour open curiosity adjustments are broadly unfavourable throughout Binance, Bybit, Gate, and CME, whereas solely OKX and Bitget submit modest short-term will increase, suggesting selective positioning somewhat than a broad directional push.

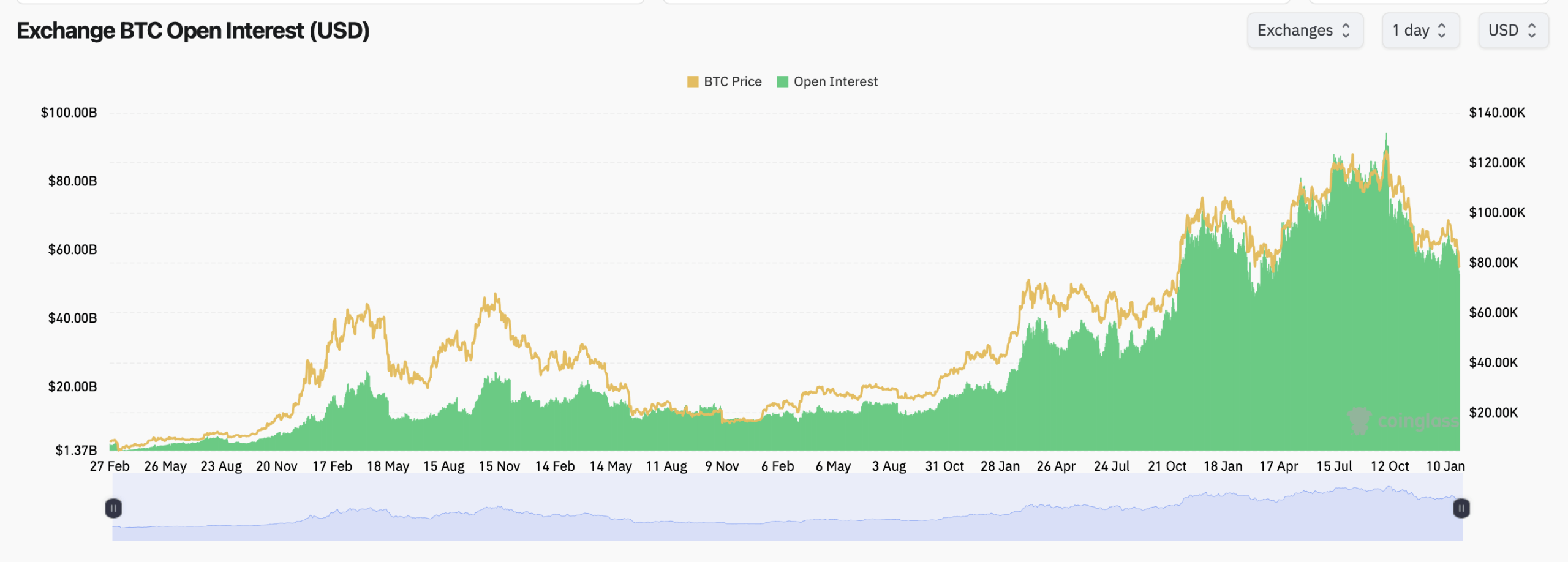

Zooming out, long-term knowledge reveals how dramatically futures publicity has expanded since 2023 earlier than rolling over. Complete futures open curiosity surged alongside bitcoin’s climb towards six figures final yr, then softened as bitcoin’s value retreated. The present contraction suggests merchants are trimming leverage with out absolutely abandoning directional publicity.

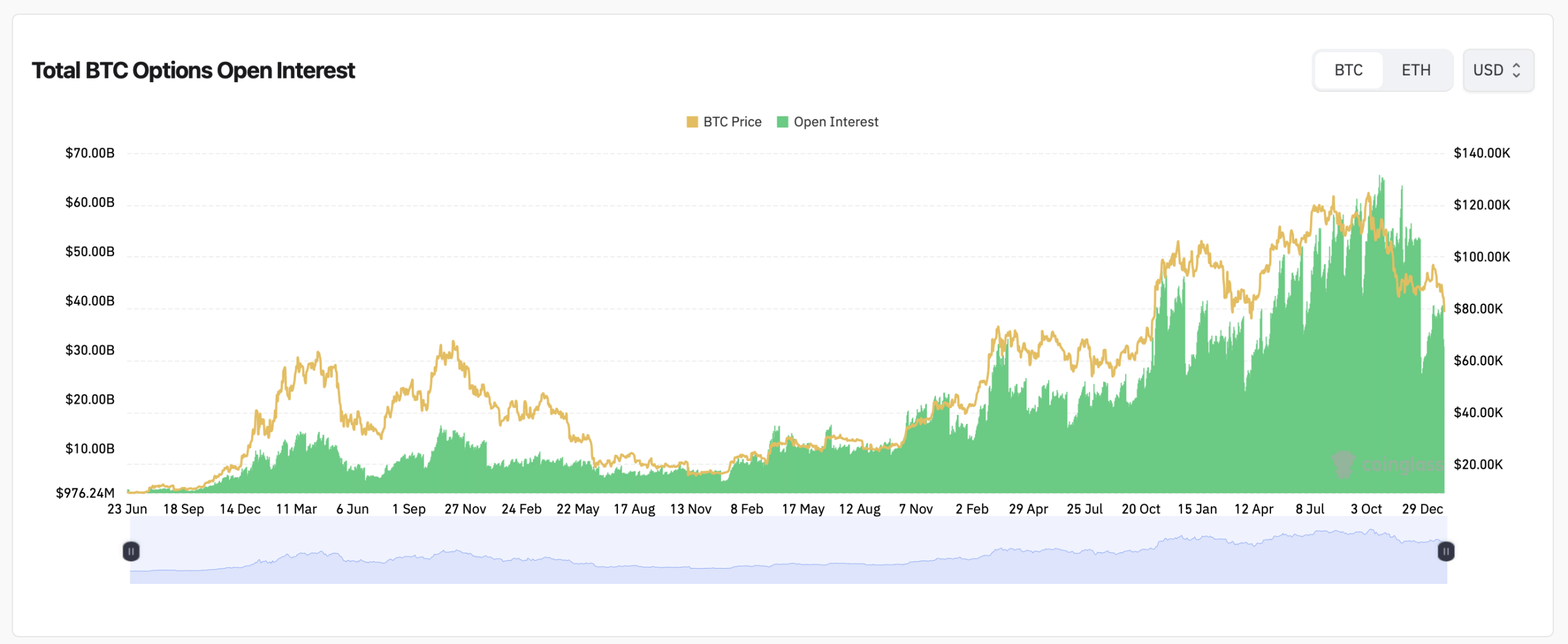

Choices market knowledge from coinglass.com tells a extra nuanced story. Complete bitcoin choices open curiosity stays pretty elevated, with name contracts holding 55.99% of whole open curiosity, versus 44.01% for places. That tilt implies merchants nonetheless see upside potential, at the same time as they hedge extra fastidiously.

Quantity paints a barely totally different image. Over the previous 24 hours, places edge out calls, accounting for 51% of traded choices quantity, whereas calls seize 49%. The imbalance hints at short-term warning, with merchants actively paying for draw back safety close to present value ranges.

Strike focus presents one other clue. On Deribit, the biggest open curiosity clusters sit at $100,000 and $105,000 calls, alongside heavy positioning in $75,000 and $85,000 places, reflecting a market bracing for volatility with out committing to a clear directional thesis.

Max ache ranges reinforce that rigidity. On Deribit, max ache hovers close to $90,000, whereas OKX facilities nearer to the mid-$80,000 vary. Binance’s max ache skews increased, pushing towards the low $90,000s, suggesting choice writers profit most if value stays pinned under latest highs however above panic ranges.

Additionally learn: Resistance In every single place, Reduction Nowhere: Bitcoin’s Rollercoaster Experience Continues

CME choices add an institutional twist. Stacked-by-expiration knowledge reveals rising publicity in near- and mid-term maturities, with contracts expiring inside six months dominating open curiosity. Stacked-by-position charts affirm calls nonetheless outweigh places over time, although latest progress favors draw back hedges somewhat than outright bearish bets.

Taken collectively, bitcoin’s derivatives markets are usually not flashing euphoria or concern. Futures merchants are decreasing leverage, choices merchants are clustering round key strikes, and max ache ranges recommend value gravity zones are tightening. For now, derivatives merchants seem content material to let spot value do the heavy lifting—whereas they wait.

FAQ ⏱️

-

What’s bitcoin futures open curiosity?

It measures the whole worth of open futures contracts that haven’t been settled or closed. -

Why is falling open curiosity necessary?

Declining open curiosity usually indicators deleveraging, lowered hypothesis, or merchants exiting positions. -

What does max ache imply in choices markets?

Max ache is the worth degree the place most choices expire nugatory, benefiting choice sellers. -

Are merchants bullish or bearish proper now?

Choices knowledge reveals a light bullish tilt in positioning, however short-term buying and selling favors warning.