Whereas a current wave of company digital asset treasuries is beginning to present indicators of a bubble, the long-term outlook is optimistic, in response to TON Technique CEO Veronika Kapustina.

“I believe, look, clearly, it appears prefer it’s a bubble. As in, all the indications appear like it’s a bubble,” Kapustina informed Cointelegraph throughout the Token2049 convention in Singapore.

Kapustina defined that they’re completely different from different bubbles we’ve seen in crypto and TradFi “as a result of it’s a brand new phase of finance.” DATs turned “the commerce of the summer time,” and other people noticed it as “quick cash,” with a number of “quick cash stepping into,” she stated.

“So we’re now having smarter traders have a look at it intently and actually differentiate the wheat from the chaff.”

Kapustina described DATs as a “bridge between conventional finance and crypto,” including that she doesn’t suppose there will probably be a crash, however there might be consolidation as newly launched DATs wrestle to succeed in their targets.

“There’s a number of pleasure for a surge in one thing new. Then it peters out, and a little bit of consolidation, after which the actual medium to long-term capital is available in,” Kapustina stated.

Technique’s Michael Saylor, the treasury pioneer

Kapustina defined that whereas Michael Saylor’s Technique pioneered the DAT mannequin with Bitcoin (BTC), this 12 months has confirmed the mannequin works past simply Bitcoin, with profitable launches round Ether (ETH), Solana (SOL), and her personal firm, which is a treasury for The Open Community’s native token, Toncoin (TON).

Associated: Crypto treasury corporations pose the same danger to the 2000s dotcom bust

Kapustina stated there are a number of evolution paths for DATs, together with infrastructure provision, potential banking providers and buying banking licenses, mergers and acquisitions, and expertise bridges between chains.

Over the long run, traders will be capable to respect the true worth of DATs from a “performance perspective, from a utility perspective, for the networks they spend money on, when it comes to not simply being a bridge between TradFi and crypto, however securing the community,” she stated.

Crypto treasuries accumulate

Company crypto treasuries have been hoovering up digital property all 12 months, regardless of many cryptocurrencies being near all-time excessive values.

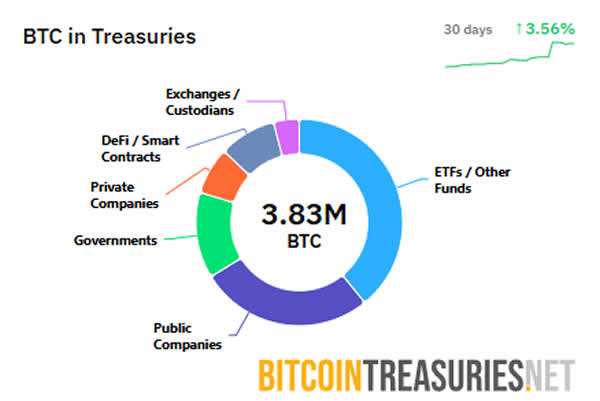

There may be presently greater than 1.3 million BTC price round $157.7 billion, equating to six.6% of the circulating provide, in private and non-private company treasuries, in response to BitcoinTreasuries.NET.

In the meantime, Ether DATs have scooped up 5.5 million ETH price roughly $24 billion and round 4.5% of the entire provide, in response to StrategicEthReserve.

Bitcoin DATs proceed to load up. Supply: BitcoinTreasuries.NET.

Journal: Quitting Trump’s high crypto job wasn’t straightforward: Bo Hines

Further reporting by Ciaran Lyons.