Perpetual decentralized exchanges (perp DEXes) registered $1.049 trillion in month-to-month quantity as of Oct. 24, marking the primary time on-chain derivatives markets crossed the $1 trillion threshold and establishing a brand new benchmark for decentralized buying and selling infrastructure.

DefiLlama knowledge exhibits roughly $1.241 trillion in 30-day quantity as of Oct. 24. But on-chain open curiosity stands at $15.83 billion, a 12% contraction over the previous 30 days, doubtless associated to the Oct. 10 washout.

The Oct. 10-11 interval delivered the catalyst, following a tariff-driven selloff that produced what CoinGlass termed “the biggest liquidation occasion in crypto historical past,” wiping out an estimated $19 billion to $30 billion throughout centralized and decentralized venues.

DefiLlama’s feed captured a file single-day excessive round Oct. 10, with roughly $78 billion in perp DEX quantity, a determine that dwarfs the early-October baseline.

The volatility stemmed from President Donald Trump’s announcement of a 100% tariff on Chinese language imports, which triggered huge liquidations in leveraged positions inside 24 hours.

That two-day flush stored funding charges elevated and drove sustained exercise on derivatives platforms by means of the next week, mechanically lifting perp turnover and resets throughout DEX infrastructure.

Rewards stored perpetual buying and selling working

Factors packages, airdrop farming, and buying and selling competitions stored customers transacting by means of and after the Oct. 10 washout.

As CoinGecko reported, airdrop farming for tokenless perpetual DEXs elevated in reputation in late 2025, as customers famous the usually beneficiant airdrop allocations from these platforms.

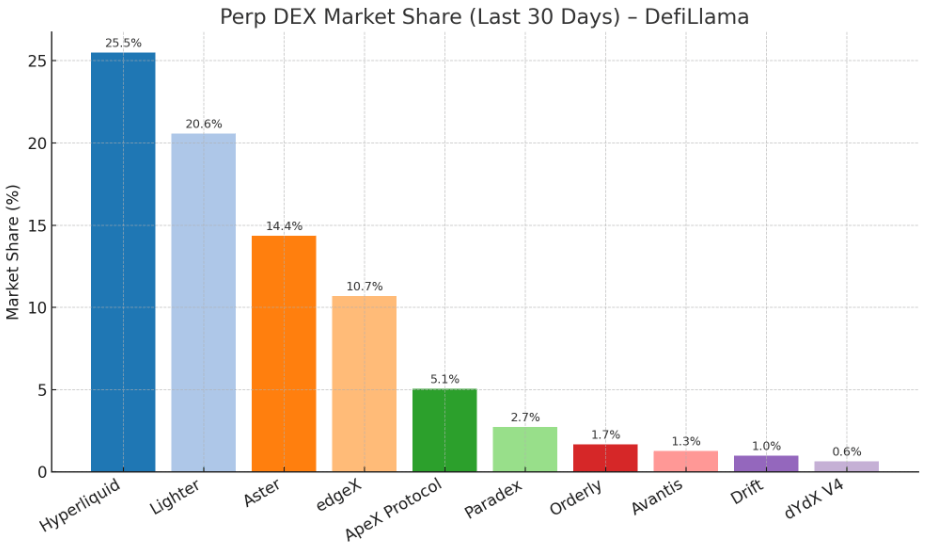

That is doubtless why Lighter posted $193.1 billion in month-to-month quantity, whereas Aster recorded $187.9 billion, as each platforms profit from the “perp DEX meta.” Regardless of having a token, Aster has an lively rewards marketing campaign as of press time.

Arbitrum’s DRIP initiative and Synthetix’s late-October mainnet buying and selling competitors characterize the kind of protocol-level incentives that drive repeated on-chain exercise, notably amongst customers optimizing for level accumulation on tokenless or just lately launched venues.

The construction of those packages of milestone-based unlocks, fee-sharing preparations, and yield-bearing collateral choices shifted the calculus for market makers and retail merchants.

Regardless of the rise in quantity from new platforms, Hyperliquid contributed roughly $316.4 billion in 30-day perp quantity and holds greater than $7.5 billion in open curiosity on its layer-1 blockchain.

Solana-based venues contributed measurably to the October surge. Drift and different SOL-native perp platforms registered step-ups in each day throughput, with Messari knowledge exhibiting SOL perps averaging roughly $1.8 billion in each day quantity in the course of the month.

Implications for decentralized derivatives

On-chain derivatives now function at a scale that rivals segments of centralized alternate exercise, bringing deeper liquidity swimming pools, payment income distribution to token holders, and market-maker engagement immediately onto public blockchains.

The shift carries systemic implications. Any failure in oracle feeds, threat engines, or chain liveness now impacts billions in open curiosity and each day quantity measured in tens of billions.

The Oct. 10 occasion served as a dwell stress take a look at for many venues. Centralized exchanges corresponding to Kraken, Coinbase, and Binance reported service instability amid the occasion.

In the meantime, other than a quick halt in dYdX, perp DEXes functioned as meant, processing liquidations with out downtime. This demonstrated that decentralized infrastructures can face up to excessive volatility whereas sustaining performance.

Regulatory consideration to leverage ratios and person safety will doubtless intensify as perp DEXs seize higher market share.

Aster’s providing of 1,001x leverage on sure pairs, mixed with the absence of KYC necessities throughout most platforms, creates friction with jurisdictions tightening guidelines on retail entry to high-leverage merchandise.

Function-built app chains and rollups optimized for derivatives buying and selling will proliferate as groups chase the payment income and community results that October’s volumes demonstrated.

The sustainability of the surge will depend on whether or not volatility persists and whether or not incentive budgets can help continued person acquisition with out diluting token worth or depleting treasuries.

October established that decentralized derivatives can operate at an institutional scale, but additionally widened the potential impression of technical failures and regulatory intervention because the sector continues to develop.