It took 10 years for Bitcoin to obtain its first spot-traded, exchange-traded fund (ETF). Up till January 2024, the sort of Bitcoin investing was dominated by futures-traded ETFs which don’t maintain precise BTC.

By holding the precise asset, spot-traded ETFs provide not solely direct publicity to Bitcoin with out the hassles of BTC custody, however minimal value deviation comparable to contango in futures contracts.

Most significantly, by opening the doorways to each retail and institutional traders, Bitcoin ETFs drove the worth of Bitcoin up, as custodial exchanges, sometimes Coinbase, purchased BTC of their identify. However does that imply it’s a good suggestion to spend money on crypto ETFs as effectively?

Let’s first study what precisely does it imply to have such publicity within the case of Bitcoin?

Publicity to Custodial Bitcoin as ETF Shares

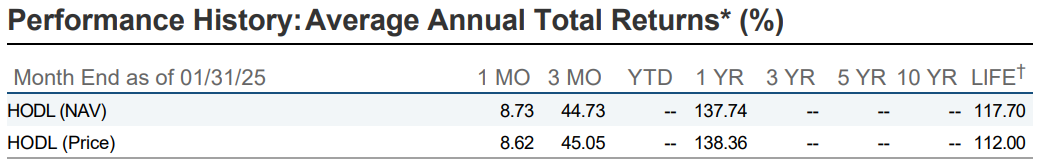

As elevated liquidity crashed towards the wall of Bitcoin’s shortage of 21 million BTC, traders gained outsized returns. Working example, because the launch of VanEck’s Bitcoin ETF (HODL) from January 2024 by the top of January 2025, the fund had a life return of 117.70%.

Final week, VanEck Bitcoin ETF executed a four-for-one ahead inventory cut up, elevating the variety of the fund’s shares from 12.8 million to 51.2 million. As with corporations represented by shares, the entire worth of the fund’s property remained unchanged, now holding 14,430 BTC value round $1.42 billion.

And similar to Nvidia did a inventory cut up to decrease the barrier to entry for traders, so did VanEck. The fund’s Internet Asset Worth (NAV) is the entire worth of ETF’s property divided by the variety of shares. Following the 4x enhance, HODL is presently priced at $27.88 per share.

If the NAV value is in a constant premium vary, when its market value is larger than NAV value, this implies bullish market situations as a result of traders are paying extra for ETF shares than the worth of underlying holdings.

Vice-versa, if the NAV value is in a constant low cost vary, when its market value is decrease than NAV value, traders are shopping for ETF shares for lower than the underlying worth, suggesting bearishness. After all, this could signify an investing alternative

Within the case of VanEck’s HODL, its 12-month low (low cost) was $14.44 on February 23, 2024, whereas its 12-month excessive (premium) was $30.16 on January 21, 2025.

Lastly, for the comfort of delegated custody, traders pay a small payment to cowl the prices of managing the fund. Nevertheless, to draw the preliminary capital inflows, many Bitcoin ETFs waived such charges. VanEck will begin charging 0.20% Sponsor Price after January tenth, 2026, or sooner if the funds’ property exceed $2.5 billion.

Are Crypto ETFs Price It?

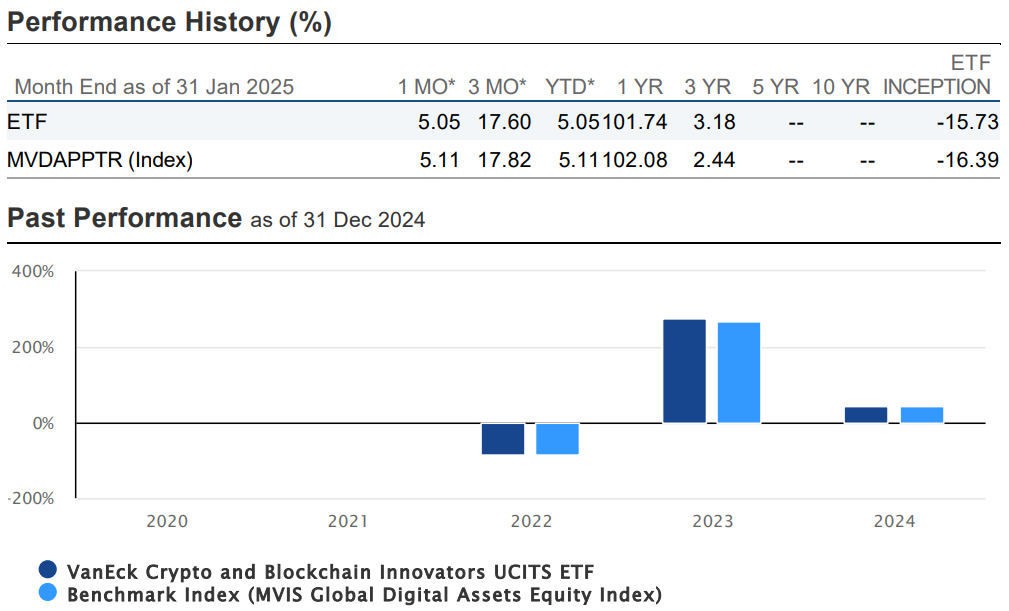

Crypto ETFs shouldn’t be confused with bundled-up, blockchain-related corporations. For instance, the VanEck Crypto ETF (DAPP) is named as such however as a substitute of holding cryptocurrencies apart from Bitcoin, it holds publicity to corporations.

These vary from Coinbase and Microstrategy to Riot Platforms and Bitdeer, with every carrying a unique weight within the portfolio. To date, DAPP’s efficiency seems extremely cyclical, yielding enormously decrease returns vs HODL, at unfavourable 15.73 life returns.

Picture credit score: VanEck

Nevertheless, retail traders might discover that in each instances, one yr publicity to such ETFs yielded above 100% returns. For comparability, the common inventory market return yielded round 11.3% yearly during the last 10 years, per S&P Dow Jones Indices.

With regards to ETFs holding bodily altcoins, beneath the umbrella of exchange-traded merchandise (ETPs), they sometimes cowl the most important market cap cryptos, comparable to Ether (ETH), Ripple (XRP) or Solana (SOL).

The issue is that with tens of hundreds of tokens unleashed, the altcoin market suffers from fragmentation and capital dilution. On prime of that, it stays unclear which general-purpose sensible contract platform – Solana, Ethereum, or a future newcomer – will achieve the higher hand.

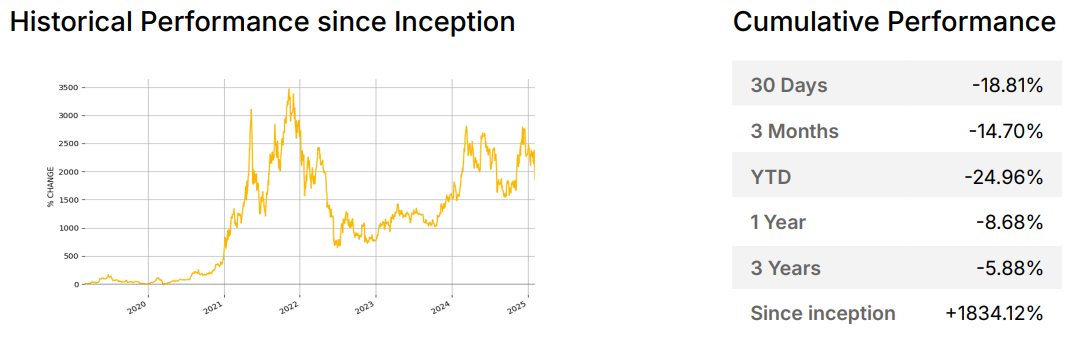

Working example, even the ETP that reinvests staking yields, 21Shares Ethereum Staking ETP (AETH), underperforms vs Bitcoin ETFs.

Holding the second largest cryptocurrency, ETH, AETH fund has a 1.49% payment, having launched in March 2019. Picture credit score: 21shares

With out the staking profit, iShares Ethereum Belief (ETHA) yielded unfavourable 20.58% returns over one yr. Given early launch, AETH’s inception efficiency is excellent, however traders ought to anticipate continued underperforming divergence of cryptos from Bitcoin.

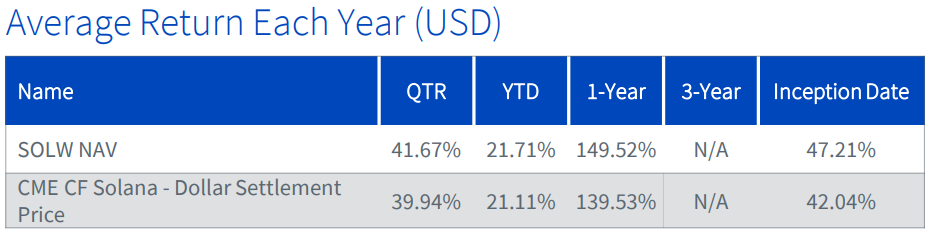

In any case, as a proof-of-work-backed sound cash, Bitcoin lacks competitors. At current, evidently Solana blockchain, owing to its quick execution and low charges, is a more sensible choice than legacy sensible contract platforms. Additionally it is the principle hub for launching numerous memecoins.

Launched in March 2022 with 0.50% payment, even WisdomTree Bodily Solana (SOLW) has poorer life efficiency than Bitcoin ETFs.

In brief, retail traders ought to anticipate the capital dilution of the altcoin market to hold over into exchange-traded merchandise. If new crypto ETFs launch, the chosen altcoins might achieve a momentary value increase, however they’re unlikely to beat the long-term efficiency of Bitcoin ETFs.

In the long run, there’s solely a finite quantity of capital, and the crypto market does itself a disservice by launching so many cash. This particularly applies to memecoins, which frequently erode the reputational standing of your complete crypto market.

Evidently, such erosion of belief tends to learn Bitcoin.

Should you spend money on cryptocurrencies, are you extra centered on speculative, probably larger beneficial properties in altcoins or regular beneficial properties in Bitcoin? Tell us within the feedback under.