This can be a section from the 0xResearch e-newsletter. To learn full editions, subscribe.

We name this trade the “blockchain” trade. However individuals are fed up with too many chains.

If you happen to’re launching a brand new chain in 2025, count on loads of skepticism on Twitter. It’s what all of the L1 blockchain raises within the final week needed to confront.

- Camp Community, an mental property-focused L1, raised $30 million at a valuation of $400 million.

- Unto, an SVM-based L1, raised $14.4 million at a valuation of $140 million.

- Miden, a zk rollup, raised $25 million (undisclosed valuation).

“One other chain, why?”

The best rationalization is “greed.” It’s the fabled L1 premium!

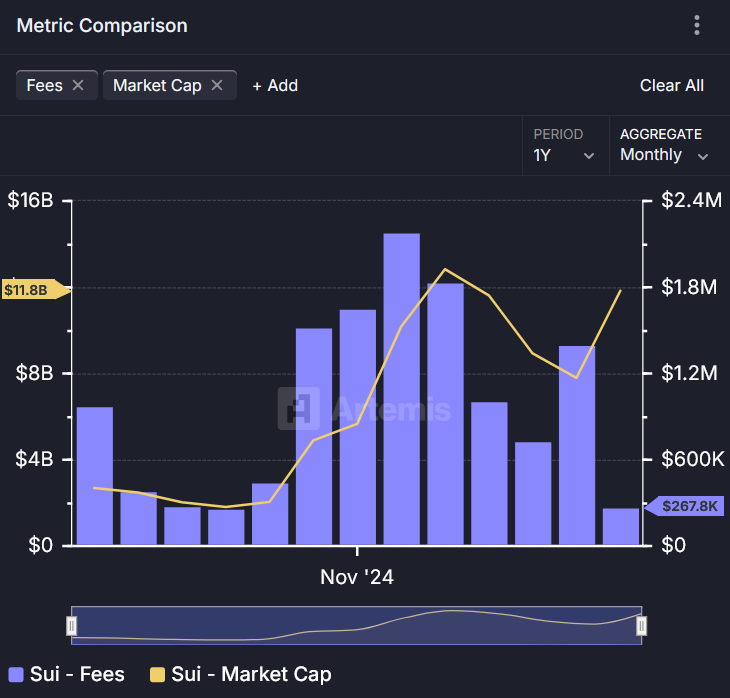

Take a look at SUI’s value efficiency currently — what explains a $6.8 billion-market-cap token virtually doubling in half a month?

We will all agree that it’s not primarily based on fundamentals. Charges generated on Sui are at paltry lows in comparison with its highs final December.

Possibly I’m cherry-picking, and SUI is an anomaly. Possibly the L1 premium is dying, nevertheless it’s not fairly useless but.

Till then, the incentives to launch new L1s nonetheless exist.

The second (and charitable) rationalization is solely that founders launching chains have competing visions of how a series needs to be optimized.

How ought to the execution surroundings be designed? How is MEV captured? What information availability layer to make use of? Ought to there be a standardized oracle or fuel token?

These items aren’t trivial. They decide the place software builders go to construct, and make or break the long-term success of a series.

Anticipating protocol builders to agree is like getting 100 individuals to agree on a buffet’s menu.

It’s not all technical, both — there are social layer concerns. Take for instance Rogue, @fede_intern’s upcoming zk rollup that desires to have zero VCs, insider allocation, and a totally honest launch like Bitcoin did.

Builders have totally different opinions. They launch their very own chains. It’s so simple as that. That’s financial freedom. We must always rejoice it.

An answer?

But, there could also be some comfort in the truth that L1 valuations are already compressing.

One of many highest profile L1 raises final 12 months was Monad. Valuations have been undisclosed, nevertheless it was rumored to be at unicorn standing in accordance with Pitchbook, in order that places Monad within the vary of a billion.

Or take into account the Initia L1, which was valued at $350 million final 12 months.

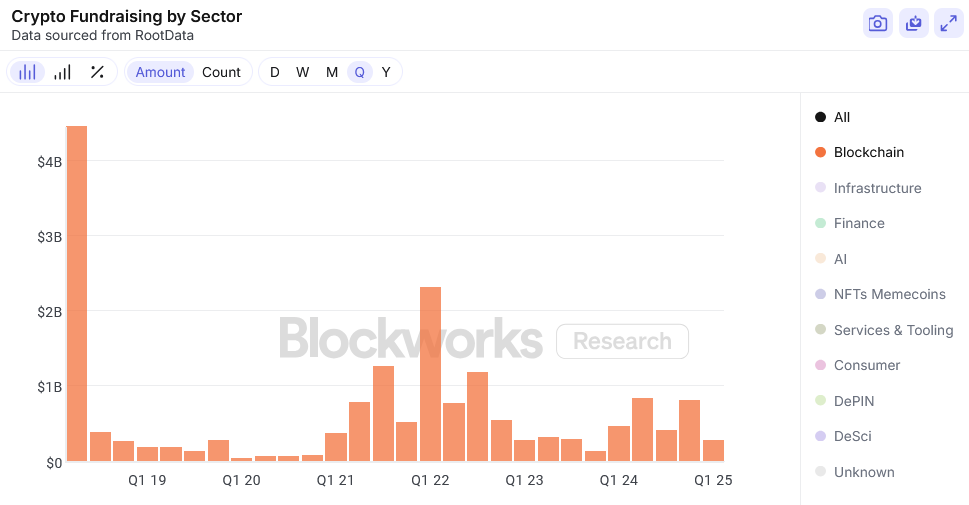

These raises are nothing like what was seen within the final cycle.

Distinction this to when Avalanche reportedly raised at a valuation of $5.25 billion in 2022. Or Circulation, which raised at a valuation of $7.6 billion.

These numbers are dramatically down for L1s.

Public markets have responded to the distaste for extra chains, and personal markets are correcting extra time. The free market is working.

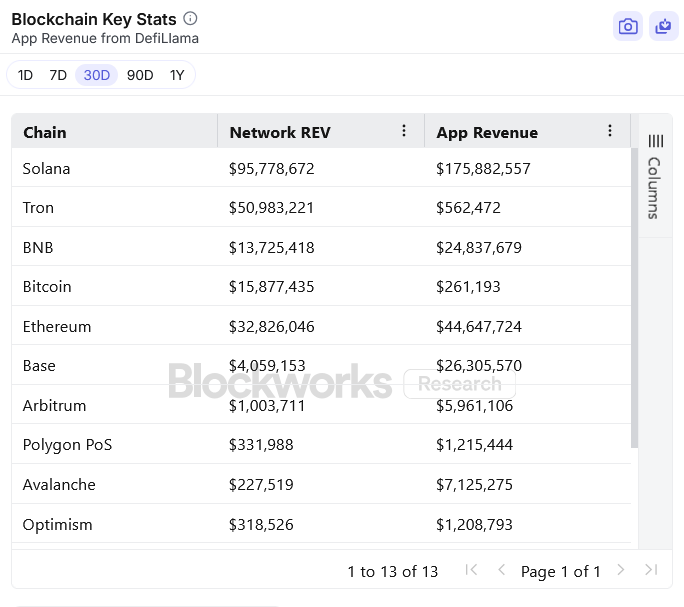

The information checks out after we zoom out. The under chart exhibits a downward trajectory for complete funding raised for blockchains.

For these annoyed with “too many chains” who want to see none in any respect, it’s most likely not a satisfying reply.

Tied to that frustration can be an underlying need to see extra functions.

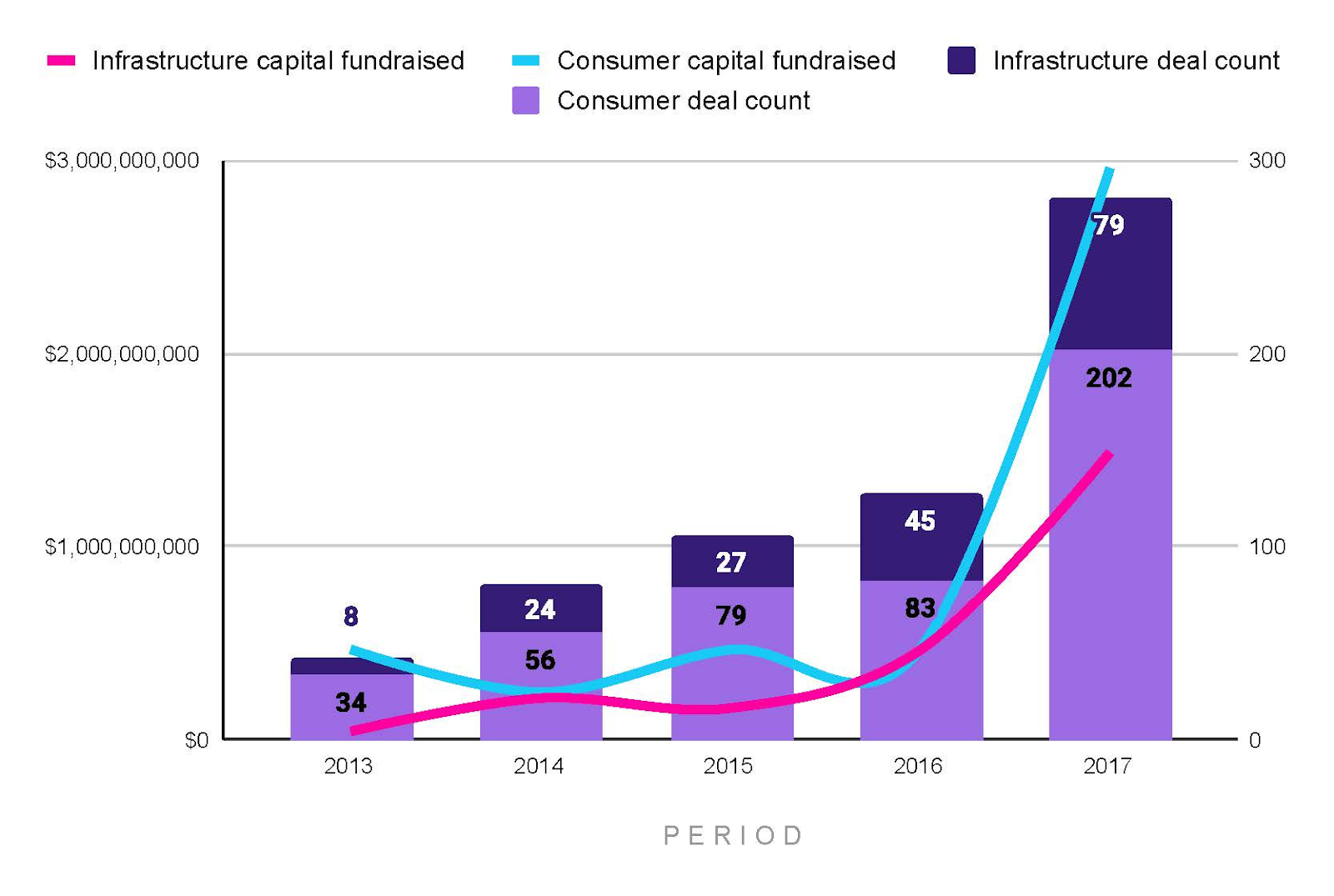

Enjoyable reality: Shopper apps sarcastically acquired the lion’s share of enterprise funding vs. infrastructure again in 2013-2017 (Joel Monegro’s Fats Protocol thesis was written in 2016).

Supply: Outlier Ventures

That has, in fact, flipped in the present day. Is there some purpose why software funding has fallen out of favor with VCs?

Take it from 1kx, which claims to be one of the lively buyers in shopper apps.

1kx associate Peter Pan advised me: “Purposes dwell and die by their traction and comply with via — it’s a right away suggestions loop. Whereas with infrastructure, you possibly can proceed to search out funding in a pre-launch state primarily based off current market comps, and push actuality additional and additional out.”