Gold has been beneath stress whereas Bitcoin has thrived for the reason that US presidential election because the trade expects a powerful shift to crypto belongings.

The main funding asset, additionally used as the first inflation hedge, plunged to a one-month low of $2,543 on Nov. 14, lower than a day after the US Shopper Worth Index report surfaced — the U.S. inflation price got here on the anticipated 2.6% in October.

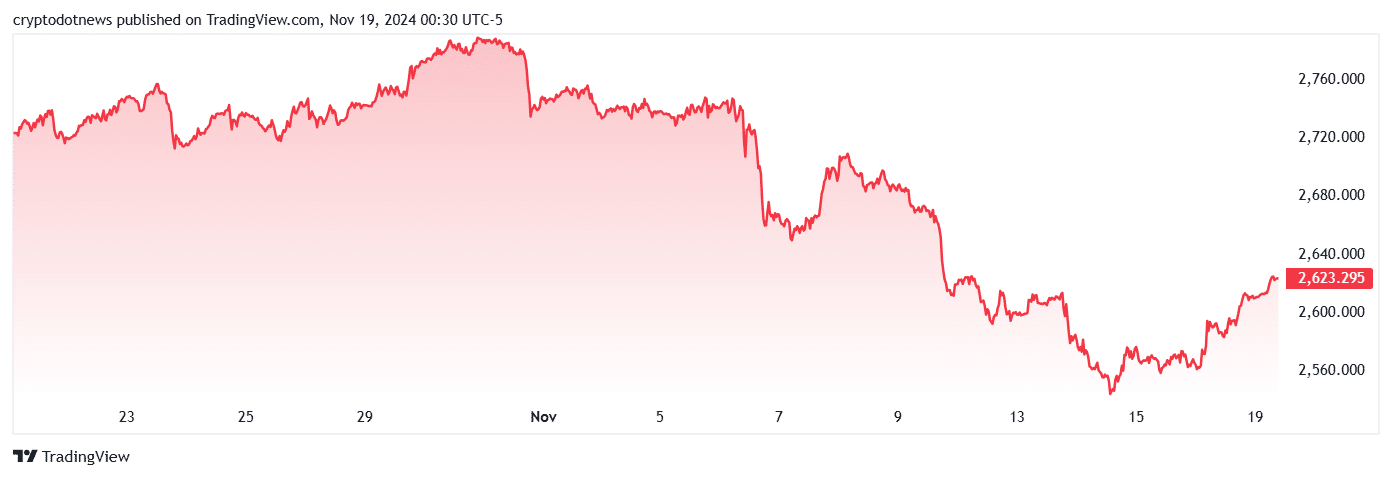

Gold worth | Supply: Buying and selling View

Regardless of its current surge to $2,623, gold continues to be down by 2.6% over the past 30 days.

Alternatively, Bitcoin (BTC), the digital gold, rallied to an all-time excessive of over $93,400 simply hours after the U.S. CPI information was launched.

You may additionally like: Goldman Sachs-backed blockchain infrastructure supplier Blockdaemon eyes 2026 IPO: report

Along with Bitcoin, limiting price cuts may additionally make the U.S. Treasury yields look extra interesting than gold.

Maruf Yusupov, the co-founder of the gold-backed stablecoin Deenar, expects a powerful shift within the attraction of gold with Donald Trump’s robust deal with taxes, tariffs, and crypto.

“Regardless of its century-old relevance, the deal with Bitcoin would possibly stem the dominance of gold as a hedge towards inflation shifting ahead. This suggests that buyers would possibly shift funds from gold to Bitcoin, fueling a speedy rally for the latter.”

Yusupov advised crypto.information.

The Federal Reserve’s hawkish stance — elevating rates of interest — may “put financial metrics again on monitor,” the co-founder of Deenar added. Nonetheless, this might additionally negatively influence the “attractiveness of gold.”

“Traders who need to diversify their capital might select Bitcoin as a substitute, as it’s identified for its comparatively greater yield.”

Yusupov says.

Yusupov believes that strengthening the U.S. greenback may threaten gold in the long run because the “have to embrace gold or different hedges turns into pointless total.”

Republican US Senator Cynthia Lummis proposed on Nov. 17 to promote a few of the Fed’s gold to build up Bitcoin as a nationwide reserve. As of Q2 2024, the U.S. had 8,133 tons of gold reserves, in response to Gold.org information.

Learn extra: Gold vs. Bitcoin: A tough cash showdown in unsure occasions