- Dormant ETH whale strikes $20M after 8 years, triggering market hypothesis.

- ETH value drops 3.5% regardless of spike in quantity and whale exercise.

- Alternate information exhibits bearish tilt, however prime merchants stay bullish on ETH.

An extended-inactive Ethereum pockets has come again after eight years, initiating two main transfers which have captured the eye of blockchain analysts and market watchers. The whale pockets, beforehand dormant since 2017, executed transactions totaling almost $20 million price of ETH inside the final 24 hours.

In response to blockchain information, pockets deal with 0x2178602E5a25E5eCa759939c7D56… transferred 10,856 ETH, valued at roughly $19.53 million, to a newly created deal with, 0x23FB435DD0D25718A80EA105AB63…, by means of two separate transactions round 13 hours in the past. Previous to this, the identical pockets deposited 247.93 ETH, or $443,960, right into a Coinbase deal with, together with a smaller 0.0015 ETH switch.

A whale deposited 248 $ETH($444K) into #Coinbase right now after 8 years of dormancy and transferred the remaining 10,856 $ETH($19.5M) to a brand new pockets.

This whale purchased 11,104 $ETH(value $2.5M) at $226 in 2017 and is now sitting on a $17.5M revenue.https://t.co/I4fjf3EqFL pic.twitter.com/PWTPF1qCkv

— Lookonchain (@lookonchain) April 6, 2025

The actions have sparked hypothesis over potential liquidation or pockets restructuring. Historic transaction data point out that this pockets gathered its ETH holdings eight years in the past through giant inflows from centralized exchanges together with Kraken and Gemini.

One recorded influx totaled 7,467 ETH, whereas others different within the lots of. On the time, ETH was buying and selling close to $226, inserting the unique funding round $2.5 million. The holdings now signify a revenue of over $17 million.

Value Dips as Ethereum Faces Market Strain

Whereas whale exercise usually coincides with market shifts, Ethereum’s value has dropped 3.51% within the final 24 hours, falling to $1,722.77. The decline adopted a short rally earlier within the day on April 6 that noticed the asset buying and selling close to $1,800. After peaking near that mark, the value started a downward slide that accelerated after 4:00 PM UTC.

The adjustment happened throughout a large 10.44% growth of the common buying and selling quantity which is now equal to $8.78 bln; it factors to the strengthening of the events’ exercise. Ethereum’s market capitalization is now at $207.89 billion, nevertheless the circulating provide has not modified since September and is presently at 120.67 million.

Alternate Information Displays Blended Market Alerts

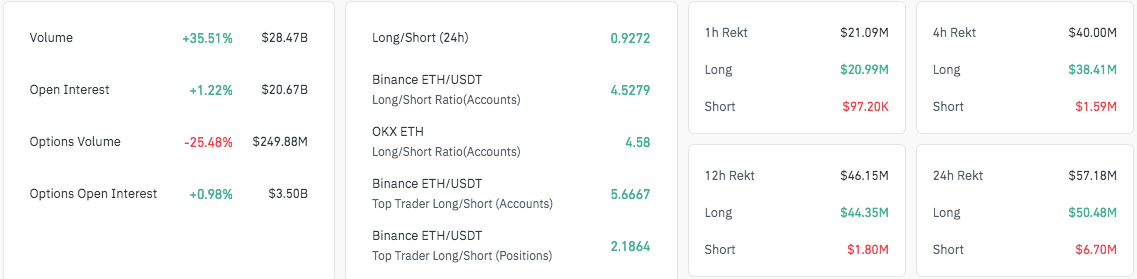

Ethereum’s buying and selling quantity has elevated by over 35% to $28.47 billion, whereas open curiosity can be up 1.22%, reaching $20.67 billion. In distinction, choices buying and selling quantity fell sharply by 25.48% to $249.88 million, suggesting diminished engagement in ETH derivatives.

The present lengthy/brief ratio stands at 0.9272, indicating a barely bearish bias. Regardless of this, prime accounts on Binance and OKX present a stronger lengthy sentiment. Binance’s ratio for ETH/USDT is 4.5279 for normal accounts and 5.6667 for prime merchants. OKX stories an analogous ratio of 4.58.

Supply: Coinglass

Over the previous day, there was $57.18 million in liquidations from each brief and lengthy positions of which $50.48 million belonged to the previous. Majority of those occurred within the final in the future, which means that there is perhaps present modifications in notion inside the inhabitants.

Analyzing the on-chain information identified that there have been on common adverse netflows from Ethereum since November 2023. A few of the outflows rose to above $200 million, particularly in December and March. Inflows, however, have simply been inflows and these have been erratic with considerably decrease quantities.

Supply: Coinglass