U.S. inventory indices fell as weak jobs knowledge spooked buyers, regardless of earnings beats from Apple and Amazon.

Abstract

- Dow Jones fell greater than 600 factors on weak jobs knowledge.

- Apple inventory fell regardless of sturdy earnings.

- Fed could need to decrease rates of interest to spice up hiring.

Weak jobs knowledge hit shares onerous, regardless of enhancing odds of the Federal Reserve chopping rates of interest. On Friday, April 1, the Dow Jones dropped 620 factors, or 1.42%, whereas the S&P 500 misplaced 1.75%. On the similar time, the tech-heavy Nasdaq declined as a lot as 2.33%. The principle driver of the declines was July’s labor market report, which confirmed simply 73,000 new jobs versus the anticipated 104,000.

Tech shares had been among the many greatest losers, and even Apple fell 2.5% regardless of sturdy earnings. The tech large reported its highest income progress since December 2021. The report indicated that U.S. customers continued spending regardless of inflation issues stemming from the commerce warfare. Apple additionally acknowledged it plans to considerably improve its funding in AI.

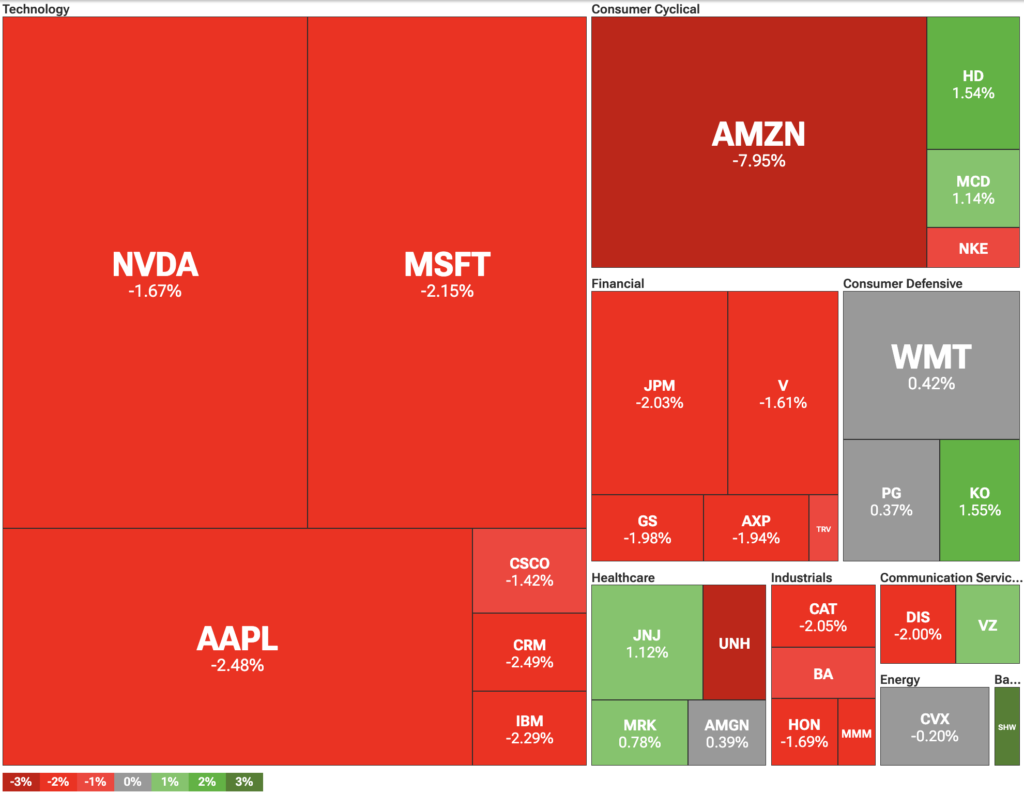

Dow Jones Industrial Common heatmap | Supply: TipRanks

Amazon’s earnings additionally exceeded expectations, with earnings per share of $1.68 in comparison with the $1.33 estimate. Nevertheless, the corporate’s third-quarter steering was comparatively modest. This fell wanting investor expectations, particularly following the corporate’s multibillion-dollar funding in AI. In consequence, its inventory was among the many greatest losers, falling 8%.

You may additionally like: Dow dips 500 factors amid weak jobs knowledge, commerce warfare jitters

Fed could have to chop charges on weak jobs knowledge

Whereas tech shares took a beating, there could also be a silver lining. Particularly, the weak labor market may drive the Federal Reserve to chop rates of interest. CME FedWatch futures markets are actually pricing in an 83% probability of a price lower in September, up sharply from 38% only a day earlier—probably because of the disappointing employment knowledge.

The Fed has a twin mandate to keep up low inflation and excessive employment. To this point, the central financial institution has resisted strain from President Donald Trump’s White Home to decrease charges, regardless of a break up amongst FOMC members.

You may additionally like: Dow Jones edges increased, Fed maintains charges in a break up vote