With solely 15 days left till the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) assembly, it’s scheduled to observe simply two days after the U.S. election on Nov. 7. As of now, market forecasts through CME Group’s Fedwatch software are leaning towards a 25 foundation level (bps) discount within the goal fee.

The Fed’s Nov. 7 FOMC Assembly: What Merchants Are Betting On

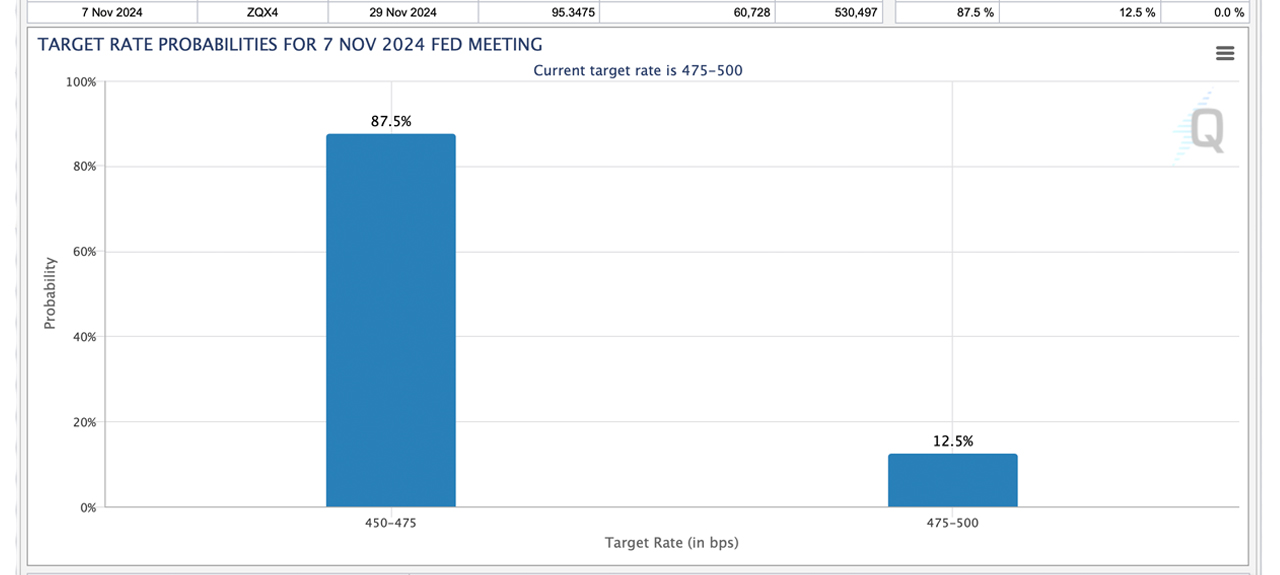

Whereas the 2024 U.S. election between former President Donald Trump and Vice President Kamala Harris is grabbing headlines, one other main occasion is drawing consideration: the Federal Reserve’s upcoming assembly on the federal funds fee and the economic system’s well being. In keeping with the Fedwatch software from CME Group, as of 11 a.m. Japanese Time on Wednesday, the percentages of no fee change are sitting at a slim 12.5%.

The Fedwatch Instrument works its magic by monitoring 30-day Federal Funds futures costs to foretell how the Federal Reserve would possibly regulate rates of interest. It takes these futures contract costs, calculates implied charges, and matches them towards the Fed’s present goal vary. From there, the software spits out market-based chances for various outcomes, giving buyers a real-time view of potential financial coverage shifts.

Proper now, the software exhibits an 87.5% likelihood of a 25bps minimize, which means nearly all of merchants are banking on a quarter-point discount on the Nov. 7 assembly. Polymarket bettors are driving the identical wave, with $6.6 million in play and an 83% chance of a quarter-point minimize matching at the moment’s Fedwatch studying. On the flip aspect, there’s solely a 12% likelihood of no fee minimize, a slim 5% likelihood of a half-point discount, and a laughably low -1% likelihood for a three-quarter-point slash.

Because the U.S. Federal Reserve’s subsequent choice on rates of interest approaches, market sentiment seems strongly aligned towards a quarter-point minimize. With each CME’s Fedwatch software and Polymarket bettors closely favoring this consequence, the anticipation surrounding the Nov. 7 assembly is palpable. Whereas the U.S. election attracts nationwide consideration, the FOMC’s alternative will doubtless play an important function in shaping financial expectations transferring ahead, whatever the political local weather.