Ethereum is dealing with a vital resistance area, together with the 200-day shifting common and the descending wedge’s decrease boundary.

The value motion at this degree is vital, as a possible rejection might result in a decline towards the $2.5K threshold.

Technical Evaluation

By Shayan

The Every day Chart

After rebounding from the $2.5K help area, Ethereum has skilled elevated shopping for exercise, resulting in a minor surge. Nonetheless, the value now confronts a big resistance zone, which incorporates the 200-day shifting common and the important thing $2.9K degree.

This space is predicted to be stuffed with provide, making it a difficult barrier for consumers to beat. A rejection from this area might set off one other drop towards the $2.5K mark. Conversely, if Ethereum breaks above this threshold, a short-squeeze might happen, driving the value towards the $3K degree.

The 4-Hour Chart

On the decrease timeframe, ETH has been experiencing a interval of low-volatility consolidation after breaking beneath the decrease boundary of the descending wedge. This muted value motion means that merchants are awaiting a decisive breakout.

Presently, the asset is hovering just under a vital resistance zone, outlined by the 0.5-0.618 Fibonacci retracement ranges, the place elevated promoting stress might emerge. Nonetheless, if bullish momentum builds and the value surpasses this resistance, it might set off a renewed upward surge. The short-term pattern stays unsure, with the subsequent important transfer hinging on how value motion unfolds within the coming days.

Onchain Evaluation

By Shayan

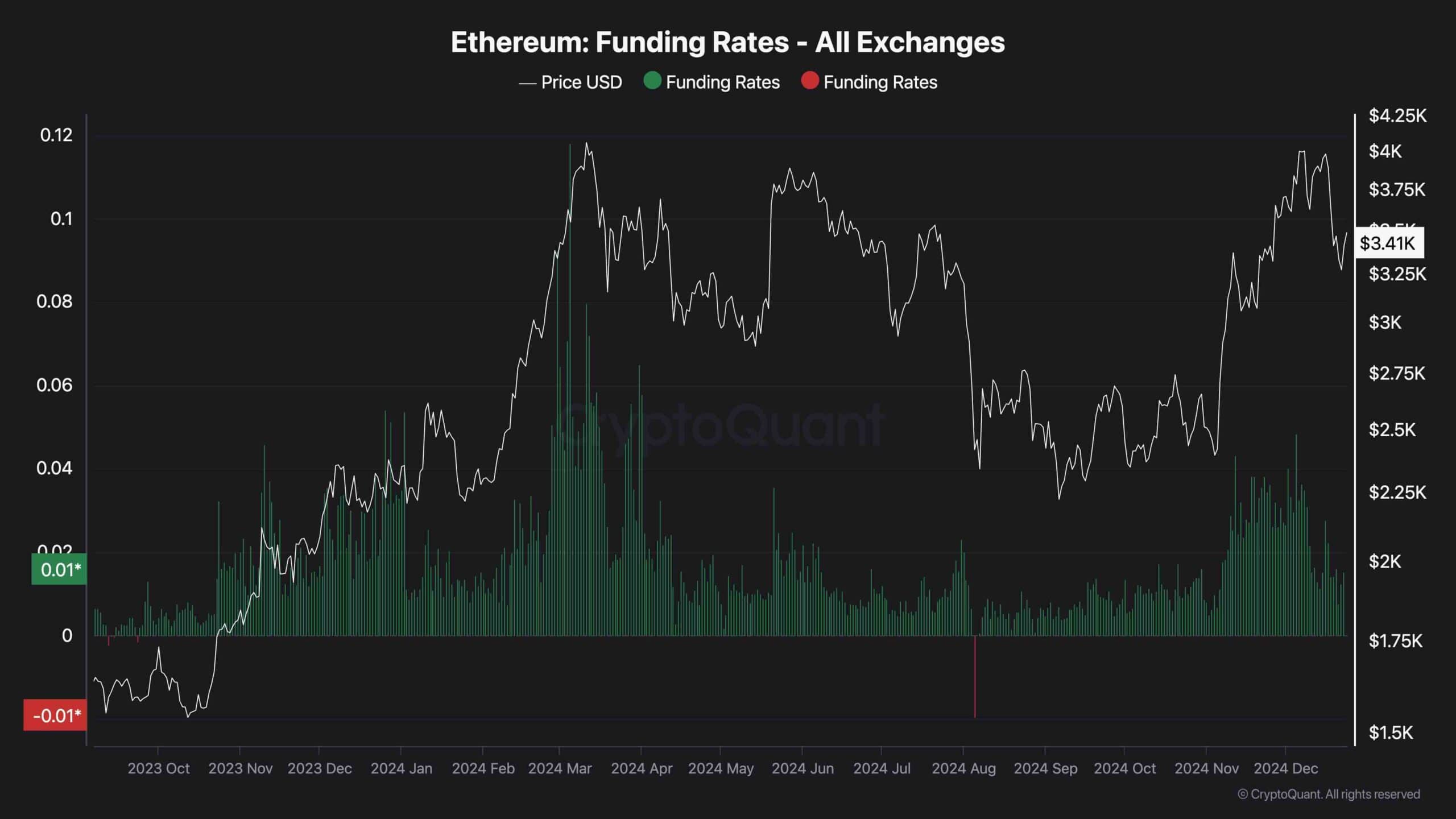

Traditionally, the futures market has performed a vital function in shaping Ethereum’s value actions. One key sentiment indicator on this market is the funding price, which displays the urgency of consumers or sellers in executing their trades.

As proven within the chart, funding charges have been trending downward amid current market turbulence. This decline alerts lowered exercise within the futures market, indicating a scarcity of momentum for a powerful, bullish transfer. If this pattern continues, particularly alongside persistent promoting stress across the $3K resistance, the market might see additional declines, with sellers concentrating on the $2.5K degree as the subsequent key help.