As geopolitical tensions between Iran and Israel escalate as soon as once more, international threat urge for food is taking successful. These conflicts typically inject short-term volatility throughout conventional and crypto markets, and Ethereum is not any exception.

Whereas ETH has held comparatively regular above $2,500 in current weeks, the rising worry in macro markets is starting to floor in value construction and sentiment shifts.

It is a delicate second for merchants: ETH sits on the sting of a vital vary, and what occurs subsequent might hinge as a lot on exterior occasions as technical elements.

Technical Evaluation

By ShayanMarkets

The Each day Chart

Ethereum’s every day chart reveals a transparent rejection from the $2,800 resistance space, which additionally aligns with the 200-day shifting common and a bearish order block. After a robust reduction rally from the $1,500 area earlier this quarter, ETH consolidated in an ascending channel sample however is now more likely to break under the decrease trendline of that channel.

This construction usually indicators exhaustion in bullish momentum, particularly when the market fails to push increased regardless of favorable short-term setups. The RSI has additionally dropped again underneath the 50 mark, reflecting bearish momentum.

The worth is now re-entering the mid-range zone, between $2,800 and $2,150. If Ethereum fails to reclaim $2,800 quickly, the door will open for a doable transfer again towards the $2,150 help stage, which coincides with the 100-day shifting common and the highest of the final main accumulation vary. A bounce from there can be vital to protect the broader bullish bias in current months.

The 4-Hour Chart

On the 4H chart, the asset has damaged down from the ascending channel it had been respecting for weeks. The rejection from the $2,800 order block created a pointy drop that left behind an imbalance (FVG) close to the $2,600 zone, at the moment appearing as short-term resistance. The construction now resembles a possible distribution part, notably if the worth breaks under the channel with out recent shopping for stress.

The RSI additionally stays weak, hovering slightly below 50, and reveals no indicators of bullish divergence. There’s additionally a notable lack of quantity on current bounces, suggesting that demand is drying up as macro uncertainty looms. If the channel breakdown happens, ETH may retrace towards the $2,300 demand zone. Holding that space can be essential, as dropping it may invite a deeper correction towards $2,100, the place stronger bullish curiosity doubtless awaits.

Sentiment Evaluation

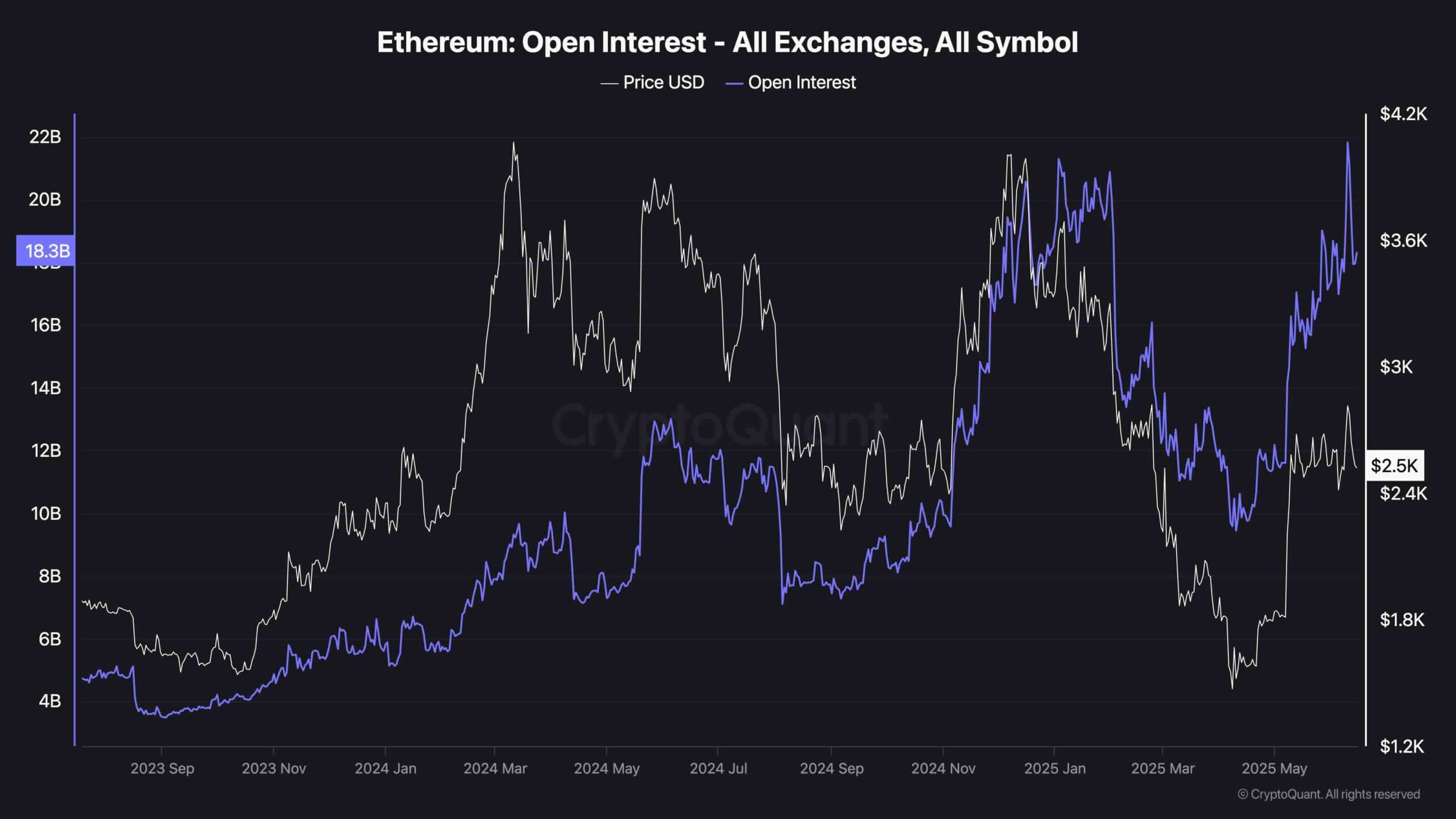

Open Curiosity (OI) on Ethereum derivatives has briefly reached its highest level over the previous couple of years, exceeding $21B, earlier than experiencing a marginal drop because of the liquidity brought on by the tensions within the Center East. What makes this improvement much more fascinating is that this surge in OI is happening whereas ETH is buying and selling considerably decrease than it did the final time OI was this elevated.

This divergence usually indicators a buildup of leveraged positions—each lengthy and brief—which might be but to be flushed out of the system.

Traditionally, such OI-price divergence typically precedes large-scale liquidation occasions. If the market can’t generate a clear breakout quickly, a volatility spike triggered by the unwinding of over-leveraged positions may occur. This aligns with the rising geopolitical threat, which may catalyze a quick repricing if international traders transfer to risk-off belongings. In different phrases, derivatives are flashing a warning. Even when the worth seems calm, the undercurrent is something however secure.