Ethereum is at the moment in a robust uptrend, exhibiting resilience above key ranges because it consolidates after a pointy transfer from $2,200 to round $4,000. But, there are some indicators of exhaustion starting to floor on the decrease timeframes, which might translate to a deep pullback on the upper ones.

Technical Evaluation

By ShayanMarkets

The Every day Chart

ETH continues to consolidate beneath the $4,000 zone after its aggressive rally from the $2,800 breakout degree. The asset is holding above the earlier resistance-turned-support on the $3,400 space, and the consumers are defending that zone effectively to date. The 100-day transferring common has additionally began to curve up and is chasing the value, confirming the bullish construction and momentum.

Trying forward, the main resistance stays at $4,100, which is the 2024 excessive. If the consumers handle to reclaim momentum and push above $3,800, a retest and breakout above the $4,100 degree might be on the desk. On the flip facet, shedding $3,400 would doubtless set off a deeper correction towards the $2,800 space, which additionally coincides with the 100-day transferring common.

The 4-Hour Chart

The 4-hour chart reveals that ETH swept the $3,700 highs and was rejected twice, forming equal highs and suggesting some exhaustion within the quick time period. The asset has now created a decrease excessive and doubtlessly a decrease low after weeks of bullish construction, which might be the start of a deep pullback if the $3,700 resistance degree holds.

But, for now, ETH is respecting the native demand zone at $3,500. So long as this degree holds, short-term bias stays impartial to bullish. A break beneath $3,500, nevertheless, might entice sellers and set off a transfer towards $3,300 and even decrease. However, reclaiming $3,700 and holding above it will open the door towards $3,900 and presumably $4,100.

Sentiment Evaluation

Open Curiosity

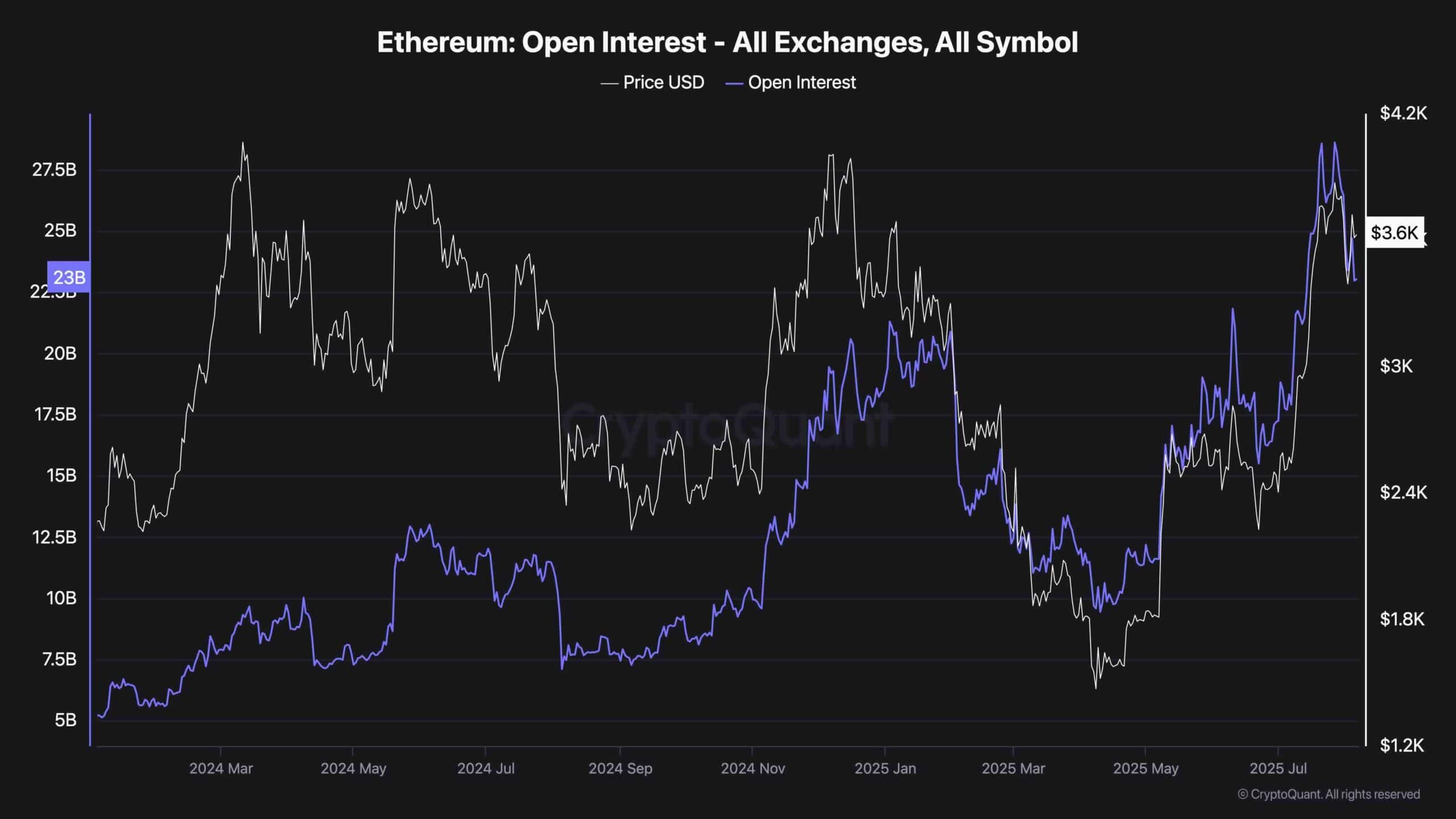

Open Curiosity has began ticking decrease after peaking close to $28B simply as ETH reached $3,800. This slight drop in OI throughout consolidation suggests some lengthy positions have been closed or liquidated. Nonetheless, the broader pattern continues to be clearly upward, with open curiosity doubling since Might.

This pattern reveals that merchants are nonetheless closely collaborating in ETH derivatives, though the market could also be due for a reset. But, there’s nonetheless room for extra upside earlier than extreme danger builds up. For now, it’s wholesome to see a slight decline in leverage as worth consolidates.