Ethereum’s value has failed to interrupt above the important thing $4,000 degree and has been experiencing bearish value motion since then.

Buyers are actually anxious that ETH may be reversing its total value trajectory.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Day by day Chart

The each day chart reveals that Ethereum’s value has fashioned a transparent double-top sample on the $4,000 resistance degree whereas getting rejected twice. The $3,500 degree has additionally been damaged to the draw back, and the market has did not reclaim it following a number of unsuccessful makes an attempt.

On the present stage, a drop decrease towards the $3,000 help zone and the 200-day shifting common, situated across the similar degree, seems possible. Worth’s response to this key degree may decide the mid-term destiny of the market.

The 4-Hour Chart

Wanting on the 4-hour timeframe, a drop towards the $3,000 degree appears much less possible, because the market is seemingly climbing towards the $3,500 degree to check it once more.

With the RSI additionally on the verge of rising above the %50 threshold, the market is demonstrating bullish momentum on this timeframe. This could point out {that a} breakout above the $3,500 degree is extra possible this time. This state of affairs is in fact, legitimate if the value is ready to attain the extent quickly.

On-Chain Evaluation

By Edris Derakhshi (TradingRage)

Ethereum Trade Reserve

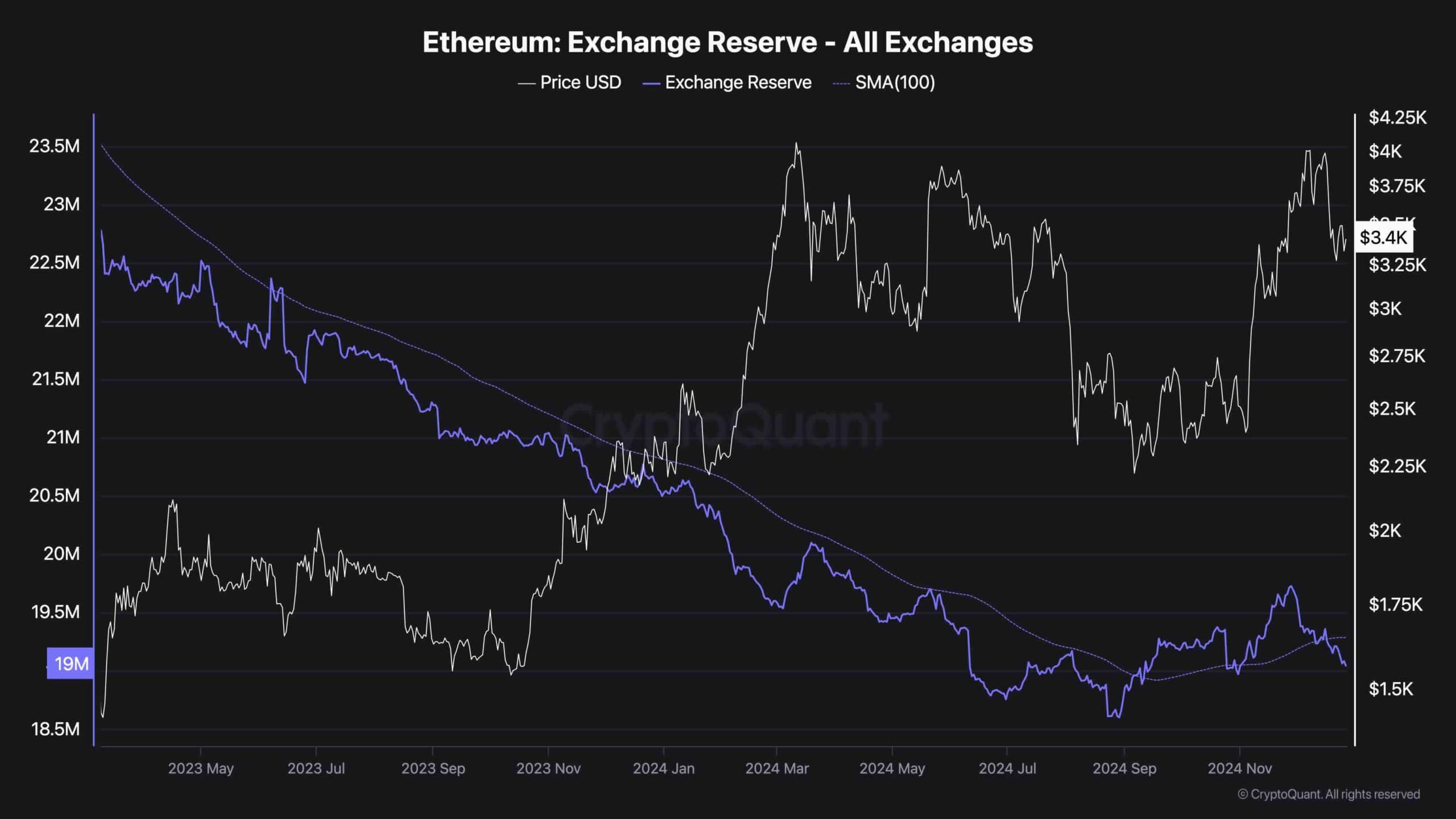

Whereas Ethereum’s value has been dropping after getting rejected by the $4,000 resistance degree, on-chain community exercise supplies an fascinating clue to buyers’ behaviour.

This chart presents the Ethereum change reserve metric, which measures the quantity of ETH that’s held in buying and selling platforms. This worth can be used as a proxy for provide, because the cash held in exchanges might be offered nearly any time.

Because the chart presents, the change reserve metric has been progressively rising over the previous few months, indicating that the buyers are promoting their cash, probably for a revenue, as the value reaches the $4,000 degree. This has been one of many key contributing elements to the present halt in Ethereum’s bullish run.

In the meantime, through the latest value correction, the change reserve metric has been dropping and is presently declining beneath its 100-day shifting common. This could point out a possible accumulation by market individuals, that would quickly result in a rally increased for ETH.