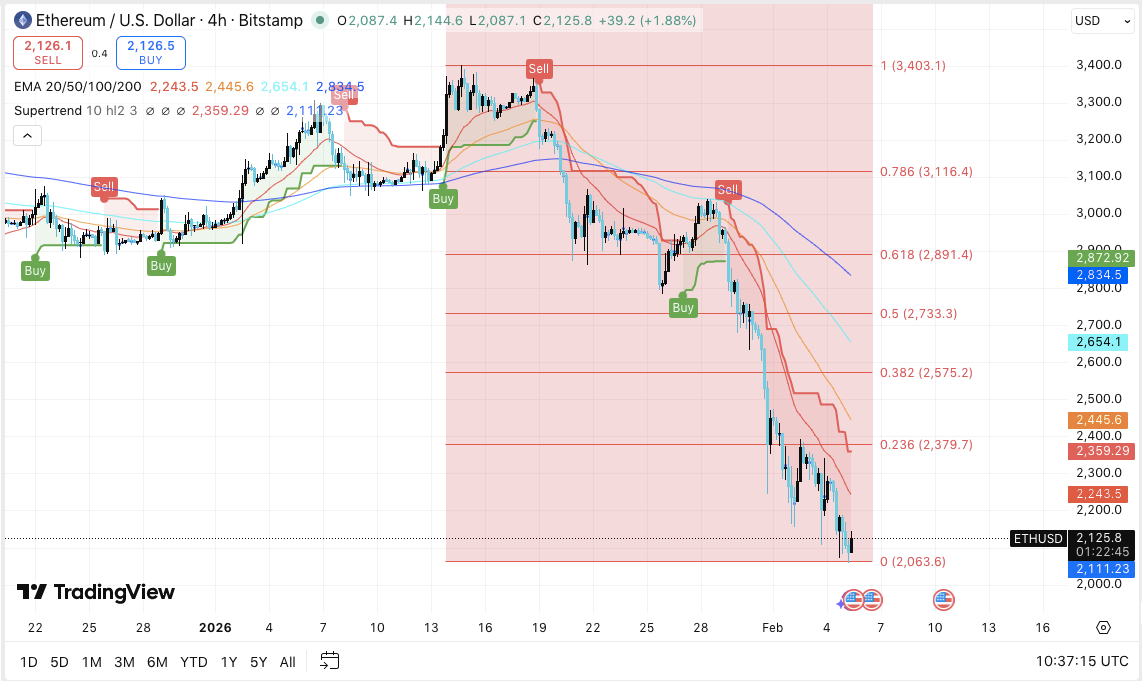

Ethereum continues to face technical strain as short-term value construction weakens and broader market confidence stays fragile. On the 4-hour chart, $ETH maintains a transparent bearish pattern, with decrease highs and decrease lows guiding value motion.

The latest restoration try towards the $2,125 space failed to change this construction, reinforcing the view that the transfer lacked conviction. Therefore, merchants stay cautious as value stays under crucial resistance zones.

Bearish Construction Dominates the 4H Chart

Ethereum trades under all main exponential shifting averages, together with the 20, 50, 100, and 200 EMAs. These ranges now slope downward and cap upside makes an attempt. Moreover, pattern indicators proceed to favor sellers, displaying restricted momentum from consumers.

The broader decline accelerated after $ETH misplaced key Fibonacci ranges, with promoting strain intensifying throughout every breakdown. Consequently, value now hovers close to a crucial demand zone between $2,063 and $2,080.

$ETH Worth Dynamics (Supply: Buying and selling View)

This space represents the final seen short-term help. A transparent break under this vary might expose the psychological $2,000 stage. Apart from its psychological significance, that zone typically attracts heightened volatility.

Associated: Bitcoin ($BTC) Worth Prediction: $BTC Slips Under Key Ranges as Derivatives Cool…

If sellers push by means of it, draw back liquidity between $1,920 and $1,880 might come into play. On the upside, $ETH should reclaim the $2,245 to $2,260 area earlier than any restoration positive aspects traction.

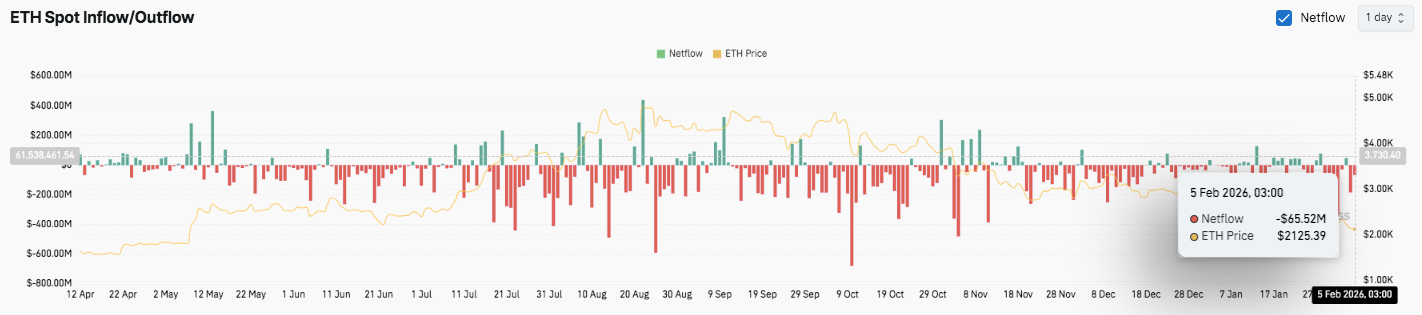

Derivatives and Spot Information Sign Market Reset

Ethereum’s derivatives market displays a broader reset in speculative positioning. Open curiosity expanded aggressively throughout earlier rallies, peaking above $60 billion as leverage constructed quickly.

Every enlargement ended with sharp contractions, highlighting compelled liquidations throughout corrections. Lately, open curiosity dropped towards the mid-$20 billion vary, signaling widespread deleveraging. Furthermore, this discount lowers near-term volatility whereas clearing extreme threat from the system.

Supply: Coinglass

Spot circulation information provides additional context. Ethereum skilled sustained internet outflows for an prolonged interval, pointing to ongoing distribution. Temporary influx bursts appeared throughout short-lived rebounds, but they lacked follow-through.

Associated: World Cellular Token (WMTX) Worth Prediction 2026-2030

Considerably, latest flows present contraction on either side, suggesting indecision and weak spot demand. The market now seems to attend for a clearer accumulation sign.

Innovation Debate Provides Lengthy-Time period Uncertainty

Past value motion, strategic considerations have entered the dialog. Ethereum co-founder Vitalik Buterin lately challenged builders to rethink present constructing traits.

Have been following reactions to what I mentioned about L2s about 1.5 days in the past.

One essential factor that I consider is: “make yet one more EVM chain and add an optimistic bridge to Ethereum with a 1 week delay” is to infra what forking Compound is to governance – one thing we have finished…

— vitalik.eth (@VitalikButerin) February 5, 2026

He warned that repeated deployment of comparable EVM chains and acquainted scaling designs dangers slowing significant progress. As a substitute, he inspired exploration of latest execution fashions, privateness techniques, and low-latency architectures.

Technical Outlook for Ethereum Worth

Key ranges stay well-defined for Ethereum as value trades close to a pivotal inflection zone heading into the approaching periods.

On the upside, $2,245–$2,260 stands as the primary resistance cluster. A breakout above this vary might open a path towards $2,360–$2,380, adopted by $2,445–$2,460, the place heavy EMA resistance sits. A sustained reclaim of $2,575 (0.382 Fibonacci) can be required to sign a broader pattern shift and restore medium-term bullish momentum.

On the draw back, fast help rests at $2,063–$2,080, which has acted as a short-term demand zone. A failure to carry this space will increase draw back threat towards the $2,000 psychological stage. Under $2,000, the following liquidity pocket sits between $1,920 and $1,880, the place consumers might try to stabilize value.

The technical construction suggests Ethereum stays beneath bearish management, with value compressing under key shifting averages. This compression hints at a volatility enlargement forward.

Will Ethereum Go Up?

The near-term $ETH value outlook hinges on whether or not consumers can defend the $2,060 space lengthy sufficient to problem overhead resistance. Stronger inflows and rising open curiosity would help a restoration towards $2,360 and better.

Nonetheless, failure to carry present help dangers extending the downtrend towards $2,000 and under. For now, Ethereum stays in a decisive zone, with affirmation wanted earlier than the following directional transfer.

Associated: XRP Worth Prediction: Token Crashes to Submit-Election Low at $1.43 as $1 Goal Comes Into View

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be accountable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.