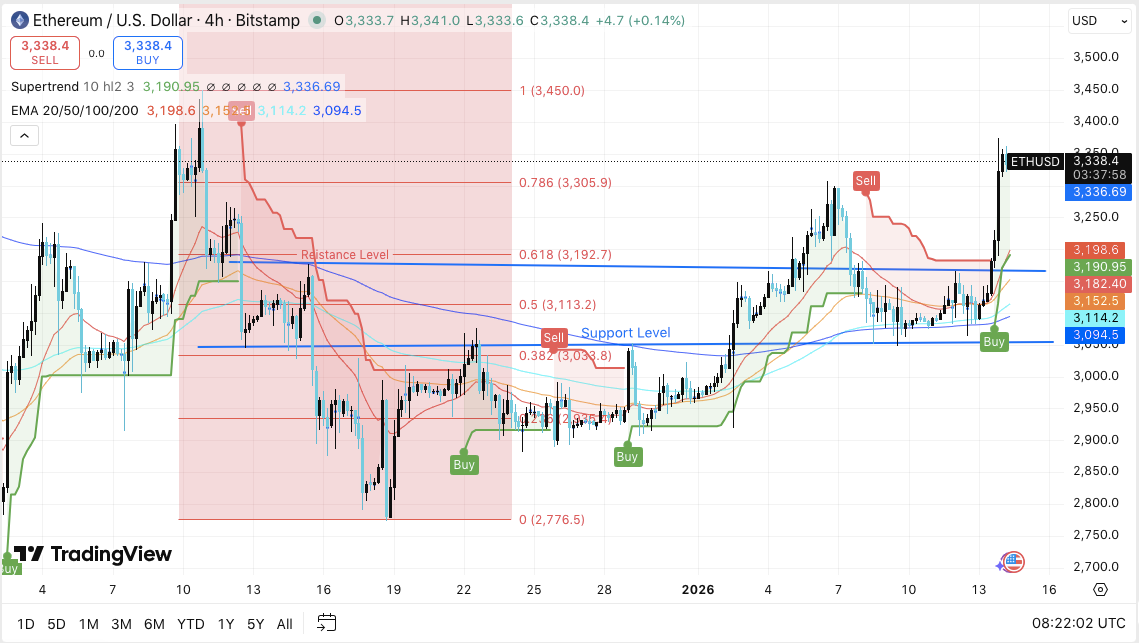

Ethereum prolonged its short-term restoration as costs stabilized close to the $3,335 stage throughout the newest 4-hour session. Market information reveals ETH breaking out of a multi-week consolidation, shifting sentiment towards upside continuation. The transfer adopted a number of failed makes an attempt earlier this 12 months, which stored value motion capped under the $3,250 space.

This time, consumers returned with stronger conviction. Buying and selling exercise elevated as Ethereum reclaimed key technical ranges, signaling a change in short-term construction. Consequently, analysts monitoring intraday traits now view the market as constructive, offered current good points maintain.

Breakout Construction Reinforces Bullish Bias

Ethereum’s newest rally pushed value decisively above the $3,200 to $3,250 congestion zone. In addition to clearing horizontal resistance, ETH additionally reclaimed all main exponential shifting averages on the 4-hour chart. These embrace the 20, 50, 100, and 200 EMAs. This alignment displays renewed pattern energy and sustained shopping for curiosity.

Considerably, the breakout got here after a chronic compression part, typically related to volatility enlargement. Therefore, merchants now monitor follow-through value motion moderately than chasing the preliminary impulse.

ETH Worth Dynamics (Supply: Buying and selling View)

Speedy resistance stands between $3,350 and $3,380, the place sellers beforehand stepped in. A agency maintain above this vary would strengthen confidence in continuation. Furthermore, the following upside reference sits close to $3,450, aligning with a previous swing excessive. If momentum accelerates additional, the $3,500 psychological stage might come into focus.

On the draw back, Ethereum holds near-term help between $3,305 and $3,310. This space aligns with a key Fibonacci retracement stage. Moreover, the $3,190 to $3,200 zone stays vital.

Associated: Solana Worth Prediction: $5.54M Spot Inflows Assist Rising Trendline as Open Curiosity…

That vary combines Supertrend help and an EMA cluster. A sustained break under it will weaken the bullish construction. Consequently, consideration would shift towards the $3,110 to $3,115 area, marking the prior breakout base.

Derivatives and Spot Movement Indicators

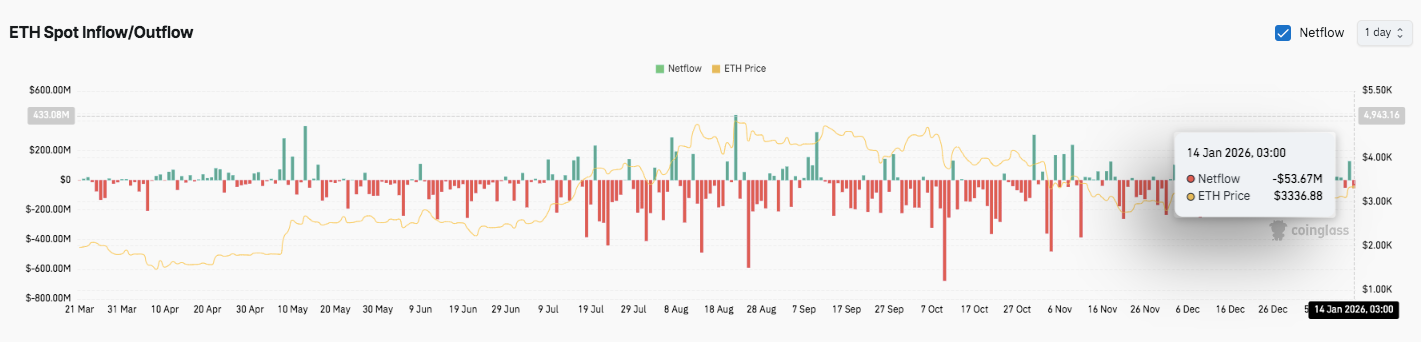

Supply: Coinglass

Derivatives information provides complexity to the outlook. Ethereum open curiosity expanded sharply throughout current value advances, surpassing $40 billion. This pattern displays rising leveraged participation moderately than pure spot accumulation.

Nevertheless, sharp pullbacks earlier this 12 months triggered short-term open curiosity flushes. Notably, positions rebuilt shortly after every reset. This habits suggests persistent speculative engagement, growing sensitivity to liquidation-driven volatility.

Supply: Coinglass

Spot movement information tells a extra cautious story. Ethereum skilled prolonged web outflows, signaling distribution stress throughout pullbacks. Nevertheless, outflows narrowed just lately close to the $3,300 zone.

Associated: Pepe Worth Prediction: PEPE Eyes Restoration as Assist Holds and Market Exercise…

Furthermore, intermittent influx spikes appeared round native lows. This shift suggests promoting stress could also be easing. If contemporary demand emerges, ETH might consolidate earlier than trying one other leg greater.

Technical Outlook for Ethereum (ETH/USD)

Key ranges stay clearly outlined as Ethereum trades at a pivotal technical zone heading into the approaching periods.

On the upside, $3,350–$3,380 stands because the rapid resistance band. A confirmed breakout above this space might open the trail towards $3,450, adopted by the psychological $3,500 stage if momentum accelerates. These zones align with prior swing highs and Fibonacci extensions, making them vital upside targets.

On the draw back, preliminary help rests at $3,305–$3,310, the place short-term consumers beforehand stepped in. Beneath that, the $3,190–$3,200 area marks a powerful demand zone, strengthened by the Supertrend indicator and a clustered EMA base. A deeper pullback might expose $3,110–$3,115, which represents the prior breakout base and a key Fibonacci midpoint.

From a structural perspective, ETH stays constructive after reclaiming all main shifting averages. The worth motion suggests continuation energy moderately than exhaustion.

Nevertheless, derivatives information reveals elevated open curiosity, pointing to leverage-driven momentum that would amplify volatility. Spot flows, in the meantime, proceed to indicate muted accumulation, which retains the rally delicate to sentiment shifts.

Will Ethereum Go Increased?

Ethereum’s short-term outlook is dependent upon whether or not consumers can proceed defending the $3,200 space. Holding above this stage retains the bullish bias intact and helps a possible push towards $3,450.

Failure to keep up $3,190, nevertheless, would weaken the construction and danger a broader pullback towards $3,110. For now, ETH trades in a decisive zone the place affirmation from quantity and sustained inflows will possible decide the following main transfer.

Associated: Sprint Worth Prediction 2026: Evolution Good Contracts and Privateness Surge Battle July 2027 EU Ban

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.