Ethereum value at present:$2,600

- Ethereum value finds help round its 50-day EMA at $2,538, suggesting a potential rally forward.

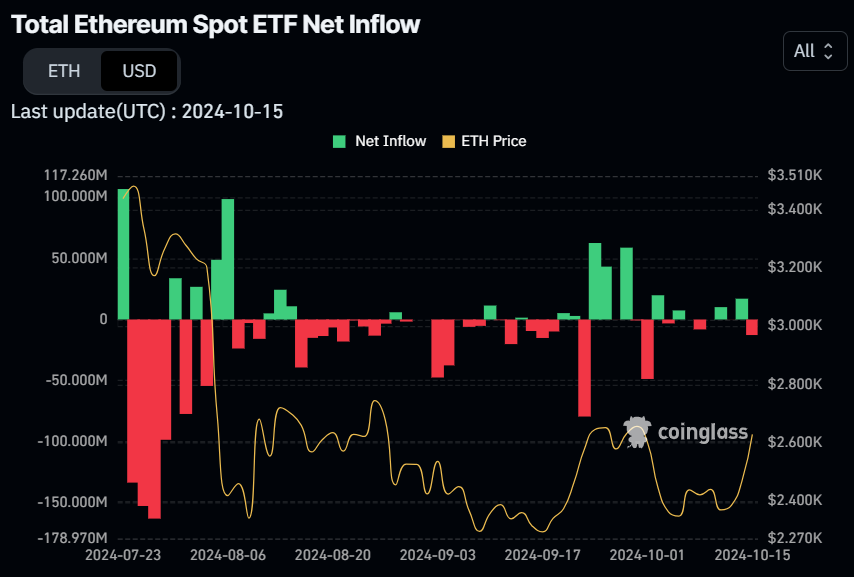

- On Tuesday, US spot Ethereum ETFs recorded a light outflow of $12.70 million.

- Lookonchain information and Sentiments Community Realized Revenue/Loss present some traders are reserving income.

Ethereum (ETH) edges greater once more on Wednesday after retracing and testing its essential help degree the prior day. Supporting Tuesday’s retracement, US spot Ethereum Change Traded Funds (ETFs) recorded a light outflow on the day, adopted by some traders reserving income, as proven by Lookonchain information and the Sentiments Community Realized Revenue/Loss metric.

Ethereum traders promoting their luggage

US Ethereum spot ETF posted a light outflow of $12.70 million on Tuesday, in response to information from CoinGlass. Learning the ETF stream information might be helpful for observing institutional traders’ sentiment towards Ethereum. If the magnitude of outflows will increase and continues, demand for Ethereum will lower, resulting in a fall in its value.

Complete Ethereum Spot ETF Web Influx chart. Supply: Coinglass

On Tuesday, the Ethereum Basis pockets offered 100 ETH value $258,000. Moreover, one other whale pockets offered all of the remaining 4,802 ETH value $12.56 million. The pockets purchased 9,050 ETH in early September and offered them on September 30, October 2, and Tuesday, reserving whole income value $2.8 million.

The #EthereumFoundation offered 100 $ETH($258K) at $2,580 once more 1 hour in the past.#EthereumFoundation has offered a complete of three,966 $ETH($11M) at a median value of $2,765 this yr.https://t.co/eZVq7QeY3O pic.twitter.com/uYwPrIgZxv

— Lookonchain (@lookonchain) October 15, 2024

myparagon.eth offered all of the remaining 4,802 $ETH($12.56M) 40 minutes in the past, making a revenue of ~$2.8M in 38 days!

He purchased 9,050 $ETH($20.75M) at ~$2,293 on Sept 7 and Sept 9.

Then he offered all $ETH at ~$2,598 on Sept 30, Oct 2, and Oct 15, making ~$2.8M.https://t.co/XFRkut6fb4 pic.twitter.com/jfBt8h8d0Q

— Lookonchain (@lookonchain) October 15, 2024

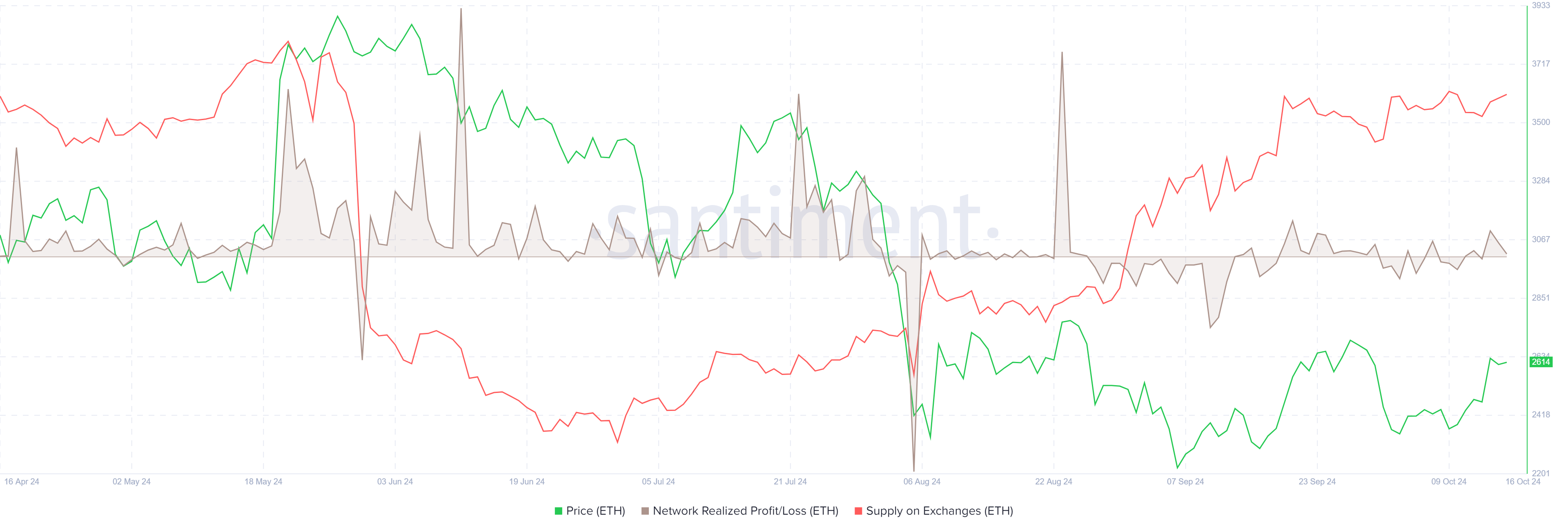

The Sentiments Community Realized Revenue/Loss (NPL) metric offers a transparent image of promoting strain. This indicator computes a every day network-level Return On Funding (ROI) primarily based on the coin’s on-chain transaction quantity. Merely put, it’s used to measure market ache. Robust spikes in a coin’s NPL point out that its holders are, on common, promoting their luggage at a major revenue. However, sturdy dips indicate that the coin’s holders are, on common, realizing losses, suggesting panic sell-offs and investor capitulation.

In ETH’s case, the NPL indicator spiked from -8.82 million to 110.44 million from Sunday to Monday. This uptick signifies that the holders offered their luggage for a major revenue. Though the depth of promoting strain is low, merchants should preserve a watchful eye on the metric.

Ethereum Community Realized Revenue/Loss chart. Supply: Santiment

Ethereum Worth Forecast: ETH finds help round 50-day EMA

Ethereum value broke above the every day resistance degree of $2,461 and rallied 6.5% on Monday, closing properly above its 50-day Exponential Transferring Common (EMA). On Tuesday, ETH declined to check and discover help across the 50-day EMA at $2,538. On the time of writing on Wednesday, ETH’s value edges greater and trades at round $2,600.

If the 50-day EMA at $2,538 continues to carry as help, ETH may prolong the rally to retest its August 24 excessive of $2,820.

The Transferring Common Convergence Divergence (MACD) indicator helps Ethereum’s rise, signaling a bullish crossover on the every day chart. On Monday, the MACD line moved above the sign line, giving a purchase sign. It exhibits rising inexperienced histogram bars above the impartial line zero, additionally suggesting that Ethereum’s value may expertise upward momentum.

Moreover, the Relative Power Index (RSI) on the every day chart trades at 59, above its impartial degree of fifty, suggesting bullish momentum is gaining traction.

ETH/USDT every day chart

Conversely, if Ethereum’s value closes under the every day help degree at $2,461, ETH may prolong the decline by 13% to retest its September 6 low of $2,150.