Ethereum (ETH) broke out forward of the complete crypto market, after months of sideways buying and selling below $2,000. The present ETH rally led to over $430M in liquidations for the previous 24 hours.

Ethereum (ETH) confirmed its capability to rally, including over 20% in a single day. ETH recovered to $2,445.37, gaining to 0.023 BTC. The robust each day worth transfer, nevertheless, immediately attacked quick positions. ETH recovered as BTC traded at $103,419.00, boosting all different cash and tokens with elevated optimism.

Because of this, ETH was the chief briefly liquidations, with over $430M prior to now 24 hours. Brief liquidations affected each the centralized market and high-risk single-trader positions on the Hyperliquid perpetual DEX.

On the identical time, whales continued their shopping for, together with from a pockets in all probability belonging to World Liberty Fi.

ETH open curiosity recovers, whereas wiping out quick positions

The liquidations adopted a spike in open curiosity, again above $12B. The current ETH rally is seen as a possible shift in sentiment and the general market course. Within the quick time period, Alphanomics information reveals ETH had essentially the most profitable day of buying and selling because the 2021 bull market.

$ETH simply had its largest single-day pump since 2021 yesterday…and the ripple impact is actual. ⚡️

Ethereum ecosystem tokens are seeing a surge in exercise, with rising DEX quantity over the previous 24h:

• $PEPE

• $AAVE

• $LINK

• $MOGTwo memes, $PEPE and $MOG, are wanting… pic.twitter.com/ca0rdVpPRe

— Alphanomics 💧 (@Alphanomics_io) Might 9, 2025

The current worth transfer can also be a uncommon spike in unison with BTC, because the main coin broke out to $103,000. Even after the value restoration, BTC dominated 60.4% of the market, whereas Ethereum dominance was down to eight.4%.

ETH is but to show whether or not its rally is sustainable and displays the enhancements from the Pectra improve. In the course of the current market restoration, many of the high crypto belongings moved into the overbought class, probably signaling a reversal from the native worth peak.

ETH ecosystem nonetheless recovers after a interval of low costs

On account of the ETH rally, the complete Ethereum ecosystem recovered. DeFi tokens and memes additionally gained inflows, with indicators of whales re-entering Ethereum meme positions. ETH worth locked returned to over $59B, with vital enlargement for Lido and Aave.

Ethereum on-chain exercise additionally picked as much as over 450K each day energetic wallets. In the course of the rally, the largest fuel burners have been normal ETH and USDT transfers, burning round 25 ETH prior to now 24 hours.

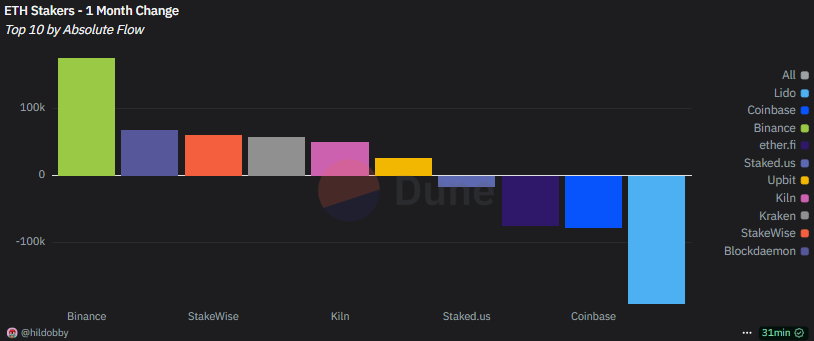

Ethereum staking nonetheless holds over 34M cash, although there’s a shift in possession. Lido noticed outflows of 191,872 ETH prior to now month, whereas Binance’s validators noticed an influx of 174,976 ETH.

ETH stakers shifted their steadiness prior to now month, with outflows from Lido and peak internet inflows into Binance. | Supply: Dune Analytics

The ETH ecosystem is but to recuperate its lending liquidity after the current worth dip to the $1,400 vary. DeFi lending has round $902M in loans to be liquidated, although at a variety below $1,400 and the largest variety of loans at a worth stage of $853 per ETH. Virtually no loans may be discovered at above $1,500, following earlier fast corrections for ETH.

The low worth displays fears that ETH could dip even decrease, regardless of the present breakout. On the constructive facet, ETH is predicted to return to the $3,000 vary and probably proceed its rally as excessive as $10,000.