After weeks of uneven worth motion, Ethereum is again in focus as volatility brews throughout the crypto market. Whereas ETH has maintained key ranges just lately, the rising divergence between worth motion and futures open curiosity is elevating eyebrows.

With macro uncertainty easing and altcoin narratives slowly rotating again into the highlight, ETH is establishing for a possible directional transfer—but it surely stays to be seen whether or not that’s to the upside or draw back.

Technical Evaluation

By ShayanMarkets

The Every day Chart

Ethereum continues to consolidate slightly below the $2,800 resistance zone after reclaiming the 200-day transferring common yesterday. The worth has been hovering inside a slender vary, caught between the important thing resistance space round $2,800 and the $2,500 demand zone.

It has additionally been creating a good ascending channel sample beneath $2,800, which is normally a reversal sample if damaged to the draw back. Nevertheless, a bullish breakout from this sample may invalidate the reversal and add gas to a possible rally larger.

The RSI additionally chart stays steady across the 60 degree, indicating there’s nonetheless room for upward motion earlier than the asset enters overbought territory. However and not using a convincing break above $2,800, the transfer may nonetheless be categorized as a spread relatively than a pattern continuation.

If $2,500 offers means, and the channel is damaged to the draw back, a deeper pullback into the $2,100-$2,200 imbalance zone turns into more and more seemingly, particularly as resting liquidity stays uncollected there.

The 4-Hour Chart

Zooming in on the 4H timeframe, ETH’s worth motion contained in the ascending channel turns into clear. This sample has shaped after an virtually vertical impulse transfer from the $1,800 area, which left behind noticeable imbalances which might be but to be stuffed. There’s additionally a Honest Worth Hole shaped across the $2,600 degree, which is now appearing as short-term help.

This space is vital for the consumers to defend in the event that they need to protect the present market construction. Up to now, the asset has attacked the upper trendline of the channel a number of instances, however every retest is coming with reducing bullish momentum.

Furthermore, the RSI is printing decrease highs whereas the value holds regular, suggesting a possible bearish divergence is forming. If confirmed, this might result in a drop again to the decrease boundary of the channel and even a possible breakdown, sending ETH towards the $2,350 liquidity pool and even deeper into the imbalance zone round $2,000. For a bullish breakout, ETH should clear $2,800 with power and continuation, ideally backed by quantity and liquidation circulation to gas the rally.

Sentiment Evaluation

By ShayanMarkets

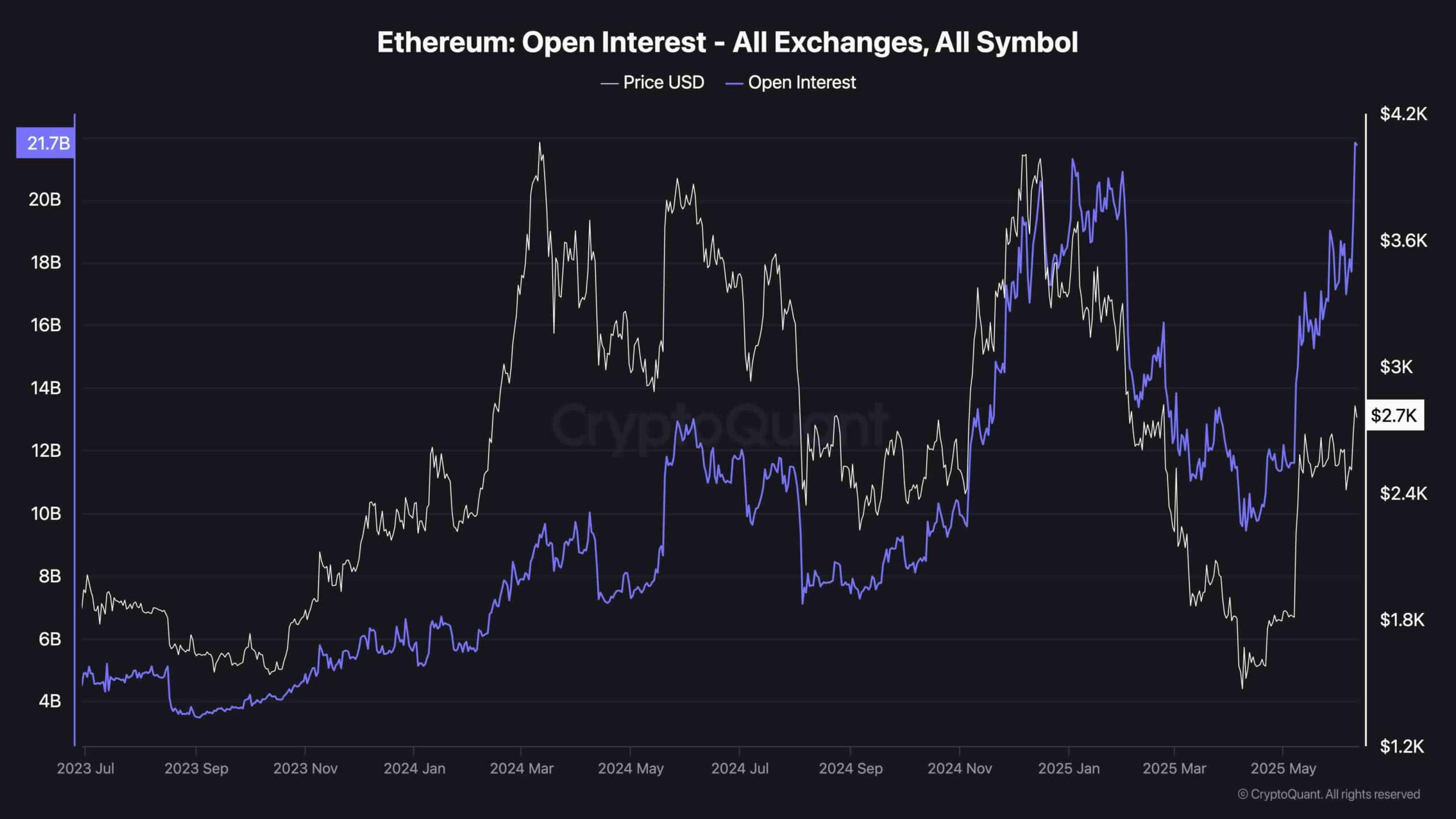

One of the notable shifts in current days has been in Ethereum’s open curiosity (OI). As proven within the chart, the metric has hit a brand new excessive of over $21.7B throughout all exchanges, regardless of the ETH worth nonetheless sitting beneath current highs.

This creates a transparent divergence: OI is climbing aggressively whereas worth stays comparatively muted. This type of divergence usually precedes sharp volatility, both within the type of a liquidation flush or a breakout squeeze. Merely put, the market is closely positioned, however the worth isn’t validating the buildup.

This situation can result in two outcomes. If ETH breaks above key resistance, the heavy open curiosity may gas a fast quick squeeze and continuation rally. On the flip aspect, if the value fails to reclaim $2,800 quickly and loses $2,500 help, a cascade of lengthy liquidations may kick in, doubtlessly wiping out current bullish leverage.

Merchants ought to put together for an enlargement transfer quickly, as compression between rising OI and flat worth is never sustainable. It’s a volatility lure ready to spring. Timing it proper shall be essential for short-term positioning.