Ethereum’s worth motion has began to calm after a steep drop from the $3,400 swing excessive, however the broader 4-hour construction nonetheless seems fragile. ETH hovered close to $3,010 on the newest studying as merchants watched for indicators of stability after a number of Fibonacci helps failed.

Whereas the rebound try has diminished near-term panic, analysts monitoring momentum instruments say bulls nonetheless want greater than a bounce. They want a clear reclaim of key resistance zones to shift sentiment again to restoration mode.

Help Zones Outline the Subsequent Threat Level

ETH now sits on an vital help cluster round $3,010–$2,990, which has acted as the present maintain space. In addition to that, merchants have additionally highlighted $2,965 as a short-term pivot the place consumers not too long ago stepped in. If ETH loses $2,965 with power, focus shifts towards $2,922, a stage tied to the 0.236 Fibonacci zone.

Consequently, a break under $2,922 might open the door to $2,773, which stands as a deeper draw back goal. That stage additionally marks the decrease boundary of the present Fibonacci construction. Analysts say these zones matter as a result of the market has moved right into a reactive section. Value now responds sooner to every technical break.

ETH Value Dynamics (Supply: Buying and selling View)

On the upside, ETH’s first problem sits close to $3,014, aligned with the 0.382 Fibonacci mark. Moreover, $3,089 stays a key mid-range stage that bulls should reclaim to scale back promoting stress. Above that, $3,163 stands out as a rejection zone, with $3,268 appearing as a stronger breakout affirmation stage.

Considerably, reclaiming the $3,163–$3,268 band would sign consumers are regaining management of the development. Till then, the rally nonetheless seems like a short-lived restoration try. The $3,403 swing excessive stays the bigger provide zone, the place sellers beforehand took management.

Open Curiosity and Spot Flows Add Context

Derivatives exercise provides one other layer to the setup. Ethereum open curiosity expanded sharply into late 2025 and stayed elevated into January. The most recent determine sat close to $38.57 billion as ETH traded round $2,979. Therefore, liquidation threat stays excessive, since merchants nonetheless maintain massive leveraged positions.

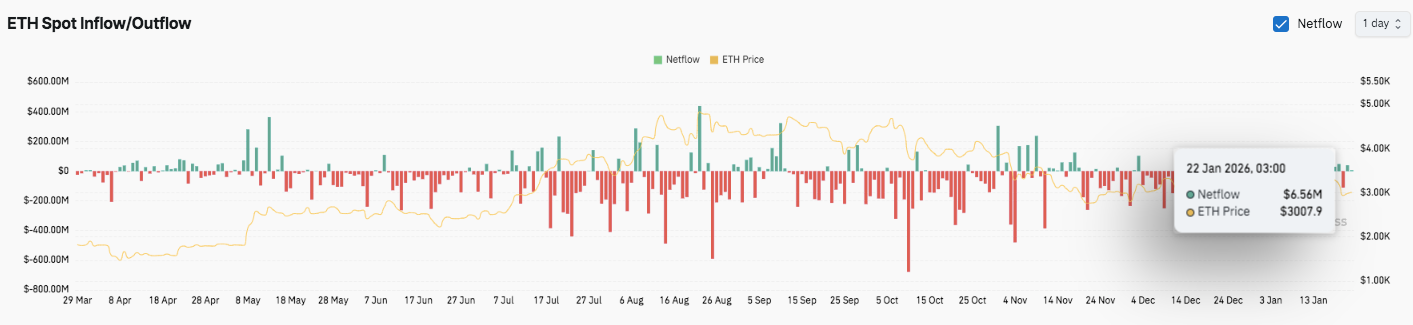

Supply: Coinglass

Furthermore, spot move traits confirmed prolonged alternate outflows throughout 2025, with heavier clusters in August, October, and mid-November. Nonetheless, latest flows turned extra combined. The most recent netflow got here in barely optimistic at about $6.56 million, hinting at near-term stabilization.

Technical Outlook For Ethereum Value

Key ranges stay clear as ETH makes an attempt to stabilize after the $3,400 rejection.

- Upside ranges: $3,014, $3,089, and $3,163 stand as the primary hurdles, the place sellers could defend aggressively. A clear breakout might prolong towards $3,268, with $3,403 appearing as the key provide ceiling that bulls should flip to verify a broader restoration.

- Draw back ranges: $3,010–$2,990 is the fast help zone, adopted by $2,965 because the short-term pivot. Beneath that, $2,922 turns into the important thing protection stage, whereas $2,773 sits because the deeper breakdown goal if weak spot returns.

The technical image suggests ETH stays fragile on the 4H chart, with momentum nonetheless bearish-to-neutral till worth reclaims the mid-resistance cluster.

Will Ethereum Go Up?

ETH’s short-term path relies on whether or not consumers can maintain $2,965 and rebuild above $3,089–$3,163. If inflows enhance and worth flips resistance into help, ETH could regain bullish traction.

Failure to defend $2,965, nonetheless, dangers one other slide towards $2,922 and probably $2,773. For now, ETH stays in a pivotal zone.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be accountable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.