BlackRock, the world’s largest asset supervisor with over $10 trillion in belongings beneath administration, has made headlines once more — this time with an enormous transfer into Ethereum (ETH). The agency simply bought 10,955 ETH price roughly $20.1 million.

This buy follows a earlier ETH funding from BlackRock totaling $54 million, exhibiting a transparent and rising curiosity in Ethereum-based ETFs. On the similar time, BlackRock additionally poured $674.91 million into Bitcoin ETFs, exhibiting continued confidence in main digital belongings.

BREAKING 🚨 BLACKROCK JUST BOUGHT $20M WORTH OF $ETH pic.twitter.com/bLqf6GInsc

— That Martini Man ₿ (@MartiniGuyYT) Might 3, 2025

ETH Value Muted Regardless of Main BlackRock Funding

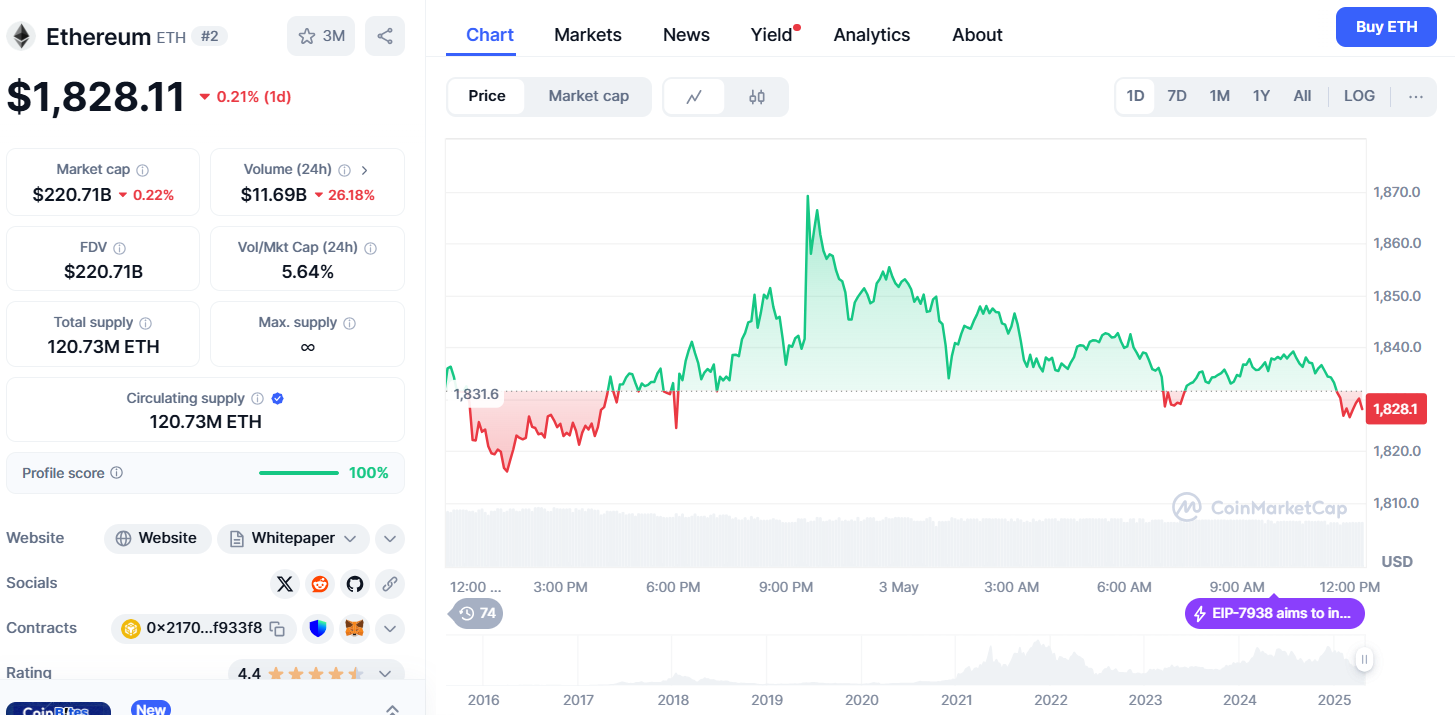

Regardless of BlackRock’s aggressive shopping for spree, Ethereum’s worth has remained comparatively stagnant. ETH is presently hovering across the $1,860 mark, exhibiting little to no fast response to the information. This lack of motion has shocked some market watchers, particularly contemplating the size of the funding.

Analysts suggest the market should still be absorbing the information or awaiting clearer technical indicators earlier than committing to a big directional transfer.

Ethereum not too long ago tried to climb previous $1,872 however was pushed again down. After that, the worth fell to round $1,813, which is seen as a short-term help stage. Up to now, this help has held, which means the market may nonetheless attempt to transfer larger.

Associated: Ethereum’s Highway to Restoration: Will New Market Developments Spark a Bullish Flip?

Technical Outlook: Can ETH Maintain Assist for Push to $1900?

Up to now, the $1,813 space has acted as short-term help. If Ethereum can preserve buying and selling above this stage, some technical analysts see potential for a transfer larger in the direction of the $1,925 resistance goal.

Nonetheless, if shopping for stress falters and ETH breaks under the $1,813 help, focus would doubtless shift to the April thirtieth low round $1,732. Falling under which may sign a deeper pullback, although it wouldn’t essentially imply the upward pattern is over—simply that the market would wish extra indicators earlier than transferring larger once more.

Supply: CoinMarketCap

Associated: Ethereum’s Q2 Restoration: What Historic Developments Say About Its Potential in 2025

For now, Ethereum stays in a state of technical indecision. Nonetheless, the size of BlackRock’s latest strikes means that institutional curiosity in Ethereum shouldn’t be solely intact however rising—presumably setting the stage for bigger market strikes forward.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.