After bouncing from a weak low at $2,200 earlier this week, the Ethereum worth at present is buying and selling close to $2,485, recovering sharply from current losses. The restoration has been technically clear, with ETH reclaiming key EMAs and invalidating a current bearish break of construction (BOS). Nonetheless, worth is now approaching the decrease sure of a cussed provide zone between $2,500 and $2,600 — an space that beforehand triggered a number of sell-offs.

What’s Taking place With Ethereum’s Value?

ETH worth dynamics (Supply: TradingView)

Current Ethereum worth motion has been marked by a pointy restoration from the $2,200–$2,240 liquidity block. The day by day chart exhibits ETH forming a bullish engulfing candle on June 25, adopted by continuation above the 50 EMA. The transfer has flipped the short-term development again in favor of patrons, particularly with the day by day shut reclaiming the $2,470 demand space.

ETH worth dynamics (Supply: TradingView)

The 4-hour chart signifies a recent break of construction (BOS) above $2,480 after a number of failed makes an attempt, whereas the Sensible Cash Ideas software exhibits a transparent bullish CHoCH across the identical area. ETH is at present urgent into an area provide zone between $2,500 and $2,560. If this stage is damaged with quantity, the subsequent leg might take a look at the weekly Fib 0.5 zone close to $2,746.

By way of historic significance, the $2,420–$2,480 cluster additionally marked the breakout area in Could, including additional significance to this retest. Value is now again above the ascending trendline that was misplaced final week.

Why is the Ethereum Value Going Up In the present day?

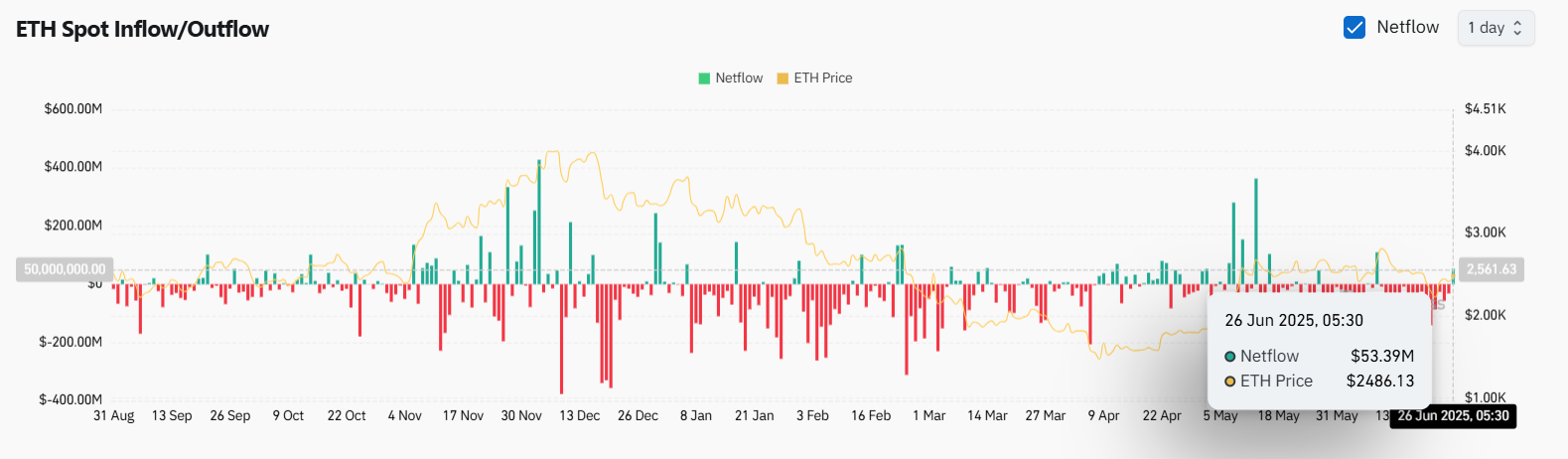

ETH spot/influx (Supply: Coinglass)

The important thing cause why Ethereum worth going up at present is the sturdy spot demand return, as proven within the ETH netflow chart. On June 26, a web influx of over $53M was recorded, marking one of many largest single-day inflows in weeks. This aligns with reclaim patterns on the day by day and 4-hour construction charts.

ETH worth dynamics (Supply: TradingView)

Furthermore, Ethereum has reclaimed the 20/50/100 EMA cluster on the 4H chart, with present worth at $2,485 above all short-term shifting averages. From an indicator standpoint, the Keltner Channel bands on the 4H are increasing upward with ETH using the higher channel, confirming sturdy directional momentum. The 4H Bollinger Bands are additionally widening, suggesting constructing Ethereum worth volatility into the $2,500 zone.

ETH worth dynamics (Supply: TradingView)

The Bull Market Assist Band on the 1D chart — beforehand appearing as resistance round $2,380 — has now flipped into assist, with ETH closing above it for the primary time in over per week.

Ethereum Value Indicators Present Important Retest at $2,500–$2,560 Zone

ETH worth dynamics (Supply: TradingView)

On the 4-hour chart, worth has entered the primary take a look at of the crimson provide block between $2,500 and $2,560. This area has rejected three prior upside makes an attempt in June, and this retest might decide whether or not ETH resumes its macro bullish development or retraces.

True Power Index (TSI) on the 1D chart is beginning to curve upward from deeply unfavorable territory, with a pending bullish crossover. This additional strengthens the argument for continuation if the breakout succeeds.

ETH worth dynamics (Supply: TradingView)

In the meantime, Ethereum’s weekly Fib retracement chart locations the 0.382 stage at $2,637 and the 0.5 mark close to $2,746 — each of which is able to develop into practical upside targets if the $2,560 barrier is damaged with quantity.

Nonetheless, merchants should word the presence of equal highs and low-timeframe bearish CHoCH zones close to $2,560. With out sturdy bullish affirmation, this space could once more act as a reversal set off.

Ethereum Value Prediction: Quick-Time period Outlook (24h)

ETH worth dynamics (Supply: TradingView)

So long as ETH stays above the $2,420 assist band, bulls are in management. A 4H candle shut above $2,500 would sign short-term breakout power, with the subsequent upside stage seen at $2,560. If that will get cleared, $2,637 and $2,746 shall be on the radar.

On the draw back, a rejection beneath $2,470 reopens the door towards $2,425, adopted by $2,300. The 200 EMA on the 4H sits at $2,305 and will act as a powerful dynamic assist if worth fails to keep up bullish construction.

Spot outflows have began to gradual, which implies bulls want sustained momentum or the breakout try could fizzle. Given the rising volatility and reclaim of key zones, short-term bias stays Ethereum worth bullish, however cautious.

Ethereum Value Forecast Desk: June 27, 2025

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.