$Ethereum is buying and selling round $3,030, regaining the important thing $3,000 psychological stage after a decisive rebound from help. Renewed ETF inflows, rising whale accumulation, and enhancing technical momentum all contributed to the bounce. With ETH now consolidating slightly below main resistance, merchants are watching whether or not it might set off a breakout towards greater ranges.

Under is the total breakdown of why $ETH is up — and the place the worth may go subsequent primarily based on the chart.

Why Ethereum Worth Is Up

1. ETF Demand Returns (Bullish Affect)

Overview

After dealing with $1.4B in web outflows by way of November, Ethereum ETFs flipped optimistic with $368M in inflows in the course of the last week. This shift aligned with lowered geopolitical rigidity and ETH’s extended underperformance in comparison with Bitcoin.

What This Means

Establishments seem like rotating again into ETH, treating it as a catch-up play. ETF inflows lower promote stress and act as affirmation that the $3,000 help space is basically backed by institutional demand.

Watch For

Whether or not inflows proceed into early December

If ETH ETF demand outpaces BTC for the primary time in weeks

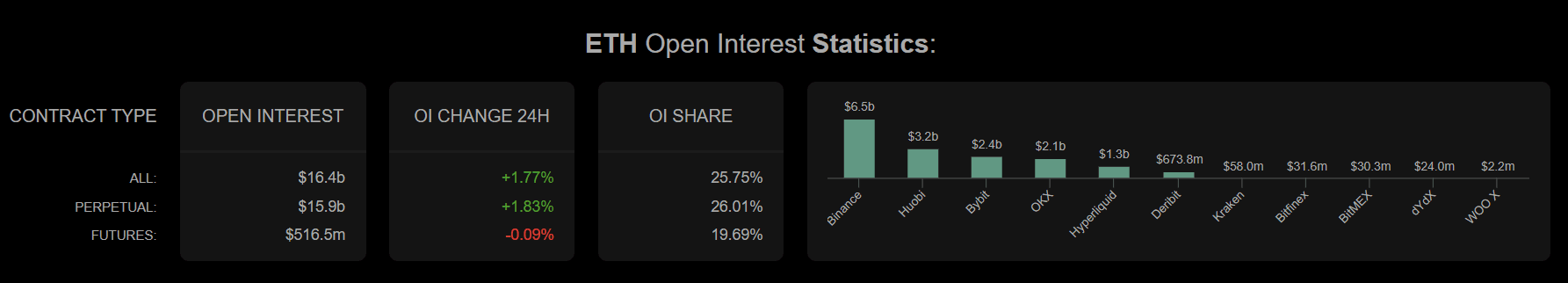

2. Whale & Derivatives Exercise (Combined Affect)

Overview

On-chain information exhibits whales added 14,618 ETH (~$185M) in late November. On the identical time, ETH derivatives open curiosity rose $700M, with longs dominating shorts 2:1 close to $2,960.

What This Means

Massive gamers are aggressively defending the $2,960–$3,000 zone. Nonetheless, rising leverage — 3.97M open contracts — introduces liquidation dangers if ETH fails to interrupt above $3,100 resistance.

Watch For

Lengthy liquidations if ETH rejects at $3,100–$3,200

Leverage resets that might set off both volatility spike

3. Technical Momentum (Bullish Brief-Time period)

Overview

ETH has reclaimed the 20-day EMA ($2,968) and printed a bullish MACD crossover with a powerful histogram at +37.73. The zone between $2,960 and $3,000 now acts as confirmed help.

What This Means

If ETH maintains a each day shut above $3,000, merchants anticipate continuation towards key Fibonacci ranges, particularly the 38.2% retracement at $3,270. Nonetheless, the 200-day MA at $3,520 stays a serious resistance barrier.

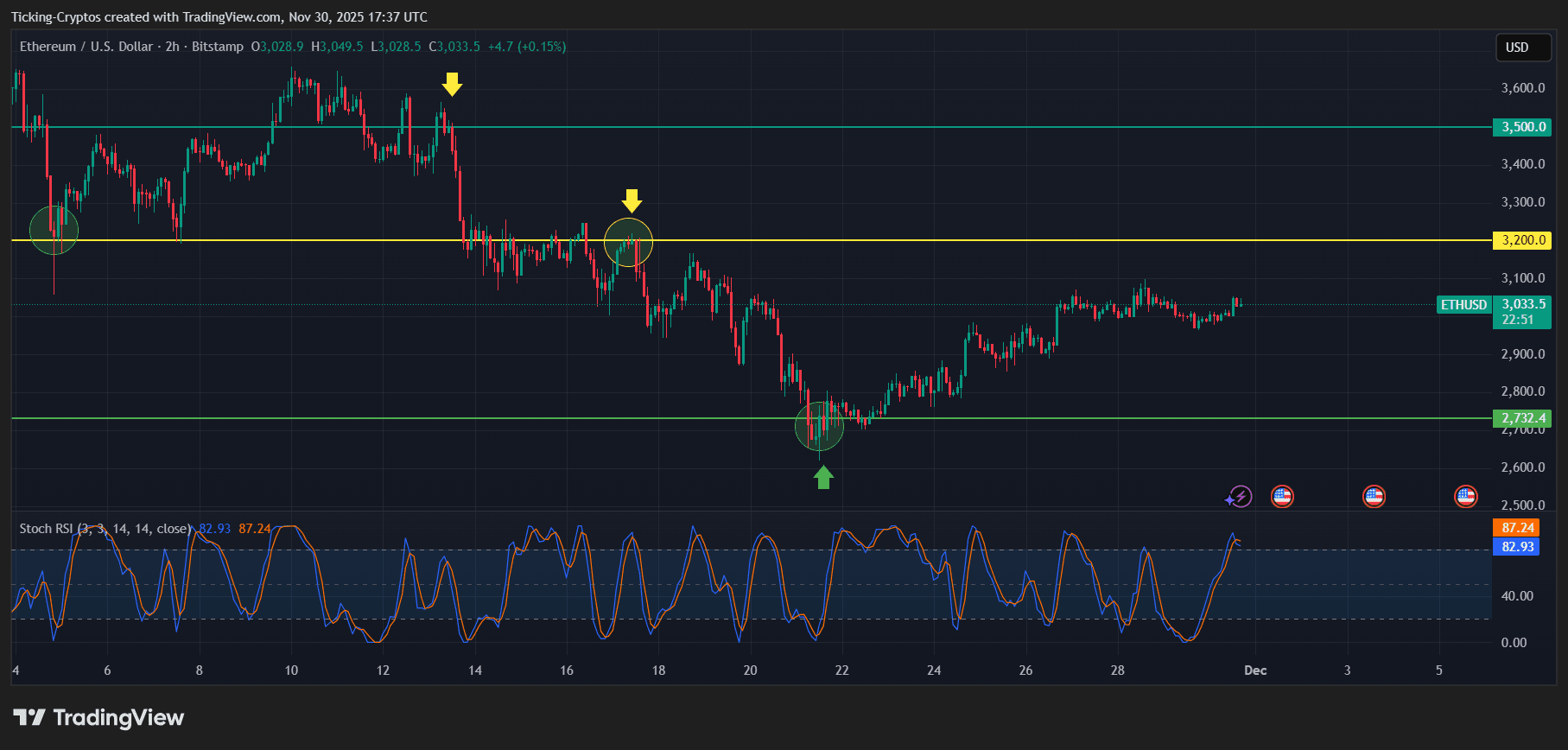

Ethereum Chart Evaluation: What Simply Occurred

Trying on the connected chart, we discover a transparent sample.

ETH/USD 2-hour chart – TradingView

1. ETH Rejected Repeatedly at $3,200 (Yellow Line)

The chart exhibits a number of rejections at $3,200, marked by yellow arrows and circles. This zone has acted as mid-range resistance for a number of weeks.

2. Robust Bounce From $2,732 Help (Inexperienced Line)

ETH bottomed completely on the $2,732 structural help, the place a inexperienced arrow confirms a high-volume reclaim. Every historic contact at this stage triggered sturdy reversals.

3. Present Sideways Consolidation Round $3,030

ETH is now stabilizing in a slim band just below resistance — which regularly precedes a breakout try.

4. Stoch RSI Reveals Overbought Momentum

The Stoch RSI at the moment reads:

- 82.93 (blue)

- 87.24 (orange)

ETH is short-term overbought, which means a quick cooldown could happen earlier than continuation.

Ethereum Worth Prediction: The place will Ethereum Attain Subsequent?

Primarily based on the present chart construction, momentum alerts, and market fundamentals:

Bullish State of affairs (Most certainly if ETH holds above $3,000)

ETH pushes greater from present consolidation.

Upside Targets

- $3,200 (first main breakout zone)

- $3,270 (38.2% Fibonacci stage)

- $3,500 (sturdy resistance)

- $3,520 (200-day MA — key trend-flip stage)

If ETH closes above $3,500–$3,520, the subsequent macro goal opens towards $3,800+.

Bearish State of affairs (If ETH fails to carry $3,000)

A rejection at $3,200 may ship ETH right into a corrective transfer.

Draw back Targets

- $2,960

- $2,850

- $2,732 (important help zone)

A breakdown under $2,732 would shift the development right into a mid-term bearish part.