Ethereum worth at present: $2,620

- Ethereum’s long-term holders elevated their promoting strain up to now three days, distributing over 300,000 ETH.

- Nonetheless, whales have been shopping for the dip with Ethereum change reserves plunging by over 800,000 ETH up to now week.

- Ethereum may expertise a decline to $2,200 if it fails to beat the $2,817 resistance.

Ethereum (ETH) declined by 2% on Tuesday on account of elevated promoting exercise from long-term holders (LTHs) and a buy-the-dip technique from whales. If this promoting pattern continues, ETH may drop to the help degree close to $2,200.

Ethereum on-chain information exhibits blended sentiment amongst LTHs and whales

Ethereum long-term holders have begun displaying weak spot these days as they stepped up their promoting strain up to now three days.

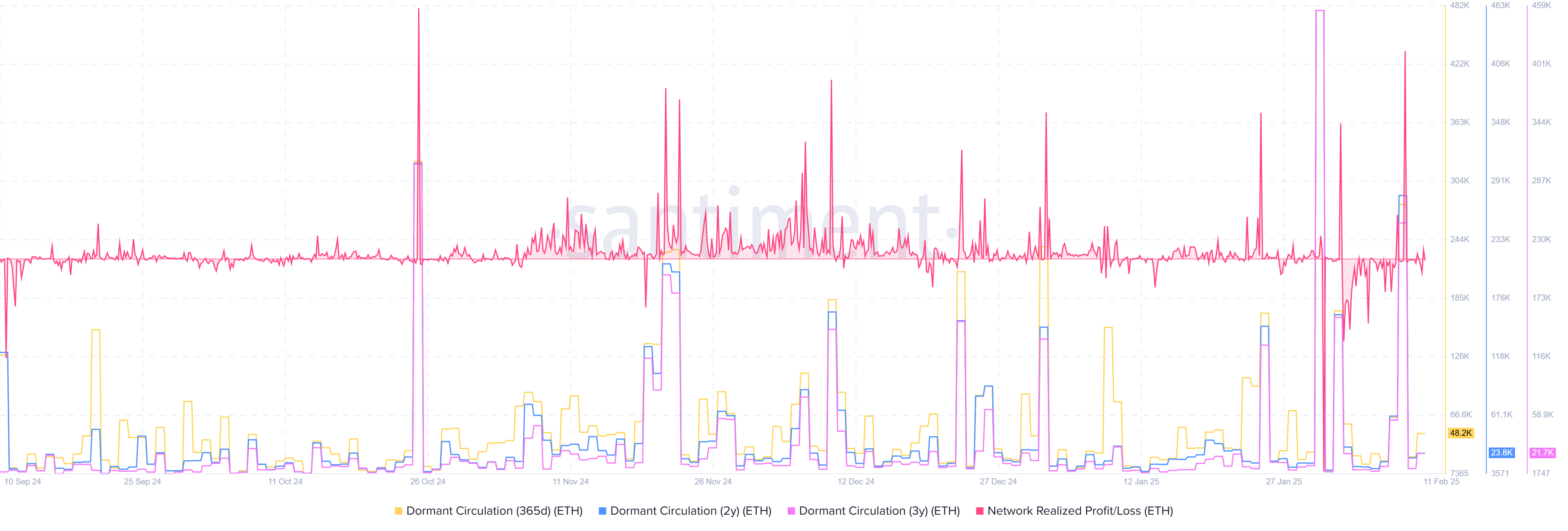

The Dormant Circulation metric, which measures the quantity of beforehand idle tokens that modified addresses, reveals that traders throughout the 2-year to 3-year cohort moved over 300,000 ETH up to now three days.

ETH Dormant Circulation (2Y & 3Y) and Community Realized Revenue/Loss. Supply: Santiment

The promoting exercise has seen traders e-book over $700 million in earnings and $70 million in losses throughout the identical interval.

This marks the continuation of a pattern that was evident all through final week the place traders continued promoting to lock in earnings and reduce losses.

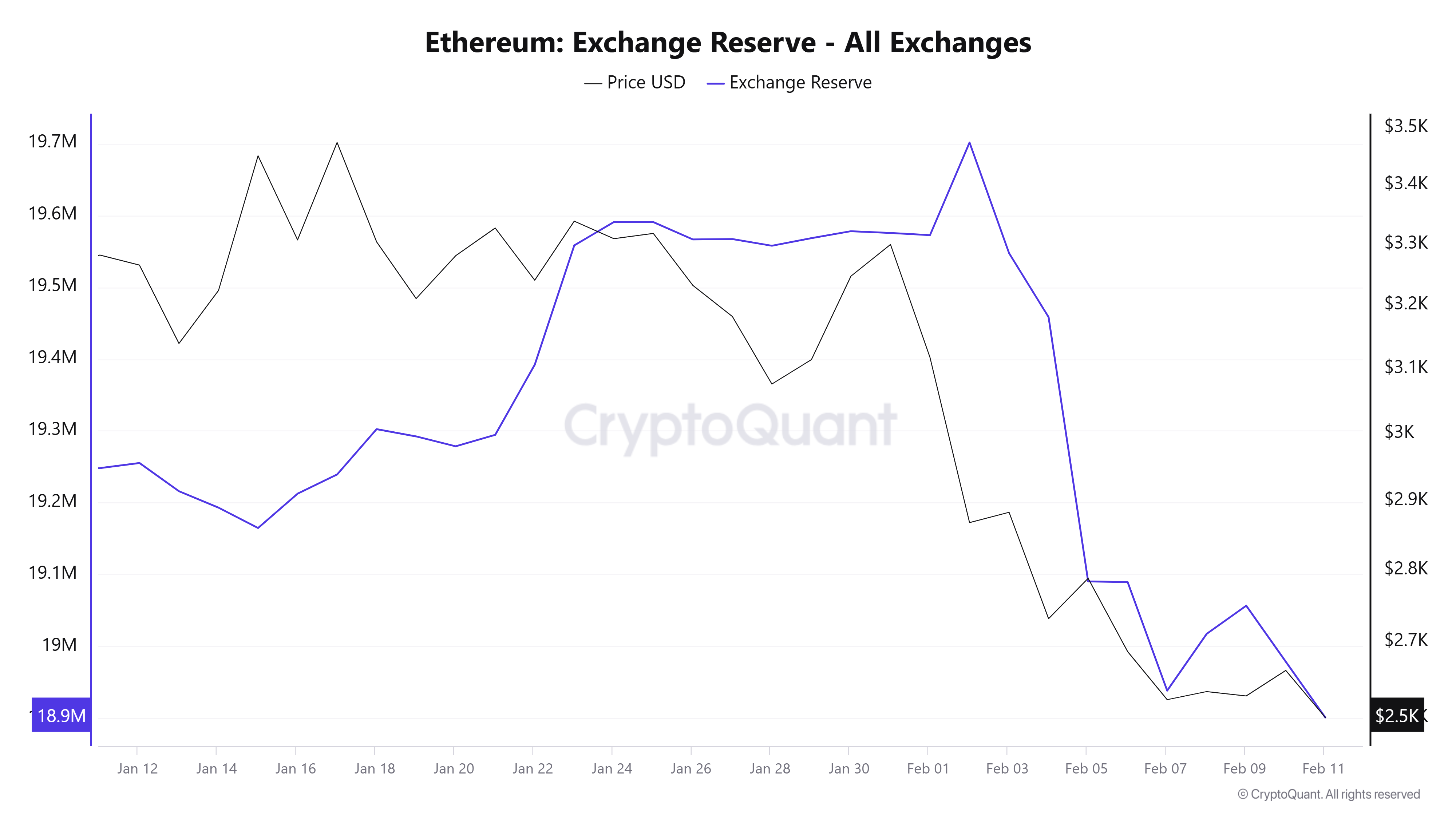

Nonetheless, bulls have been quietly shopping for the dip, as indicated by a decline of over 800,000 ETH within the Ethereum change reserves over the previous week.

ETH Alternate Reserve. Supply: CryptoQuant

The above chart additionally aligns with information from Lookonchain, which reveals that whales have been accumulating ETH up to now three days.

These 2 whales withdrew one other 49,250 $ETH($131M) from #Binance and #Bitfinex.https://t.co/pH4TE7jFKz pic.twitter.com/53wbpvkAFa

— Lookonchain (@lookonchain) February 11, 2025

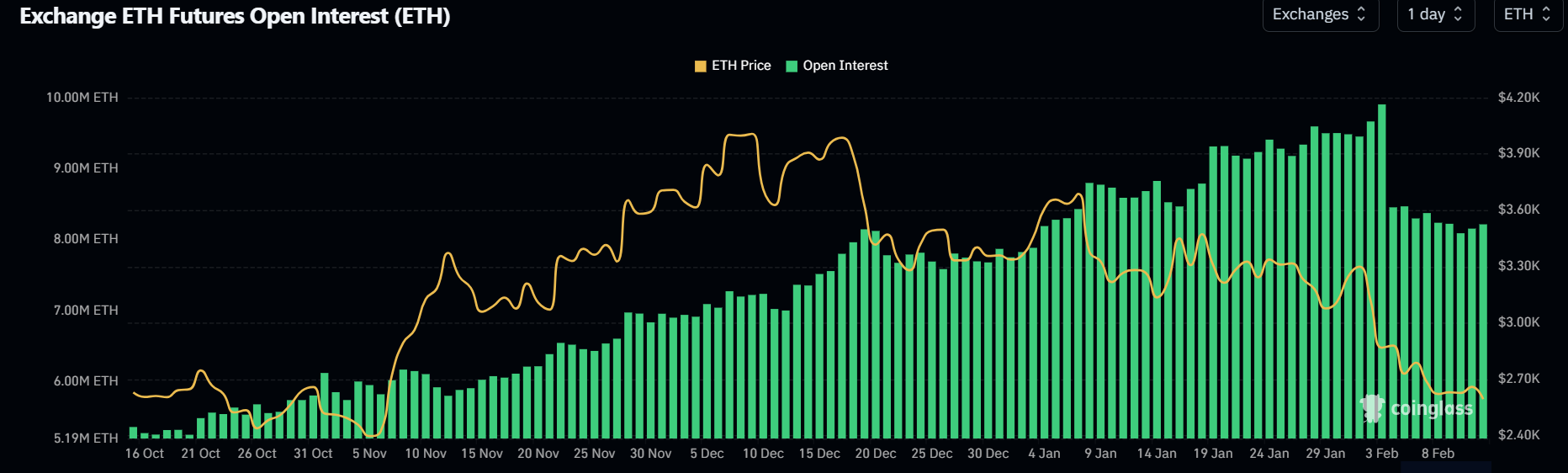

Whereas traders are shopping for the dip, Ethereum’s derivatives market has continued to indicate weak spot, with its open curiosity within the futures market hovering round 8.20 million ETH since declining from an all-time excessive of 9.90 million ETH on February 3.

ETH Open Curiosity. Supply: Coinglass

In the meantime, Ethereum exchange-traded funds (ETH ETFs) broke their six-day constructive flows streak after recording web outflows of $22.5 million on Monday, per Coinglass information.

Moreover, Tracy Jin, Vice President of cryptocurrency change MEXC, shared her insights in the marketplace outlook for Ethereum in a observe to FXStreet:

“Within the brief time period, the volatility of ETH quotes could develop on account of elevated consideration from merchants and traders. Traditionally, any main Ethereum replace, particularly whether it is related to improved scalability, efficiency, or decreased charges, causes speculative purchases on expectations of constructive modifications.

Nonetheless, earlier than a profitable launch on the principle community, corrective rollbacks could also be noticed within the occasion of technical issues or delays within the testing course of. Not one of the main Ethereum upgrades have been with out technical difficulties, delays, and modifications, which signifies a excessive chance of a repeat of this state of affairs with the Pectra improve and elevated volatility inside 3-6 months.”

Ethereum Worth Forecast: ETH dangers decline to $2,200 if it fails to beat $2,817

Ethereum noticed $29.15 million in futures liquidations up to now 24 hours, per Coinglass information. The full quantity of lengthy and brief liquidations accounted for $19.95 million and $9.20 million, respectively.

For the reason that heavy worth decline sparked by world commerce tensions on February 3, Ethereum has struggled to see a restoration as bears proceed to dominate the market.

The highest altcoin’s decline into the oblong channel, marked by the $2,817 and $2,200 key ranges, may sign the start of an prolonged consolidation. ETH traded inside this channel for 4 months between August and November earlier than President Donald Trump’s election victory sparked a crypto market rally.

ETH/USDT each day chart

To interrupt out of the potential bearish pattern, ETH has to beat the $2,817 key resistance — which is strengthened by the 14-day Exponential Transferring Common (EMA) — and maintain it as a help degree.

If ETH sees a rejection close to $2,817 and declines under the decrease boundary of a key descending channel, it may discover help at $2,200.

The Relative Power Index (RSI) and Stochastic Oscillator (Stoch) are under their impartial ranges, indicating dominant bearish momentum. The Transferring Common Convergence Divergence (MACD) is posting receding histogram bars, that means the unfavourable momentum is weakening.