Ethereum’s value has been dropping persistently over the previous few months because it was rejected from the $4,000 degree.

In the meantime, there may be nonetheless the chance for a deeper decline within the coming weeks.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Each day Chart

On the each day chart, the asset has been trending decrease because it failed to interrupt above the $4,000 resistance zone. It has since damaged beneath a number of help ranges, together with the $3,000 line and the 200-day shifting common, positioned across the $2,900 mark.

Yesterday, the altcoin rebounded from the $2,400 help zone, nevertheless it’s nonetheless more likely to drop again towards it because the RSI continues to be exhibiting a transparent bearish momentum sign. If the $2,400 degree is misplaced, issues may get a lot worse, as a drop towards the $2,000 mark and even decrease might be anticipated.

The 4-Hour Chart

Trying on the 4-hour chart, the value has been consolidating for nearly 3 weeks because the huge drop from the $3,500 space.

Nonetheless, the asset has as soon as once more begun to drop decrease and will nonetheless expertise a deeper decline within the coming days. But, the $2,400 degree continues to be more likely to maintain the market and provoke a pullback towards the $2,800 degree if it stays intact.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

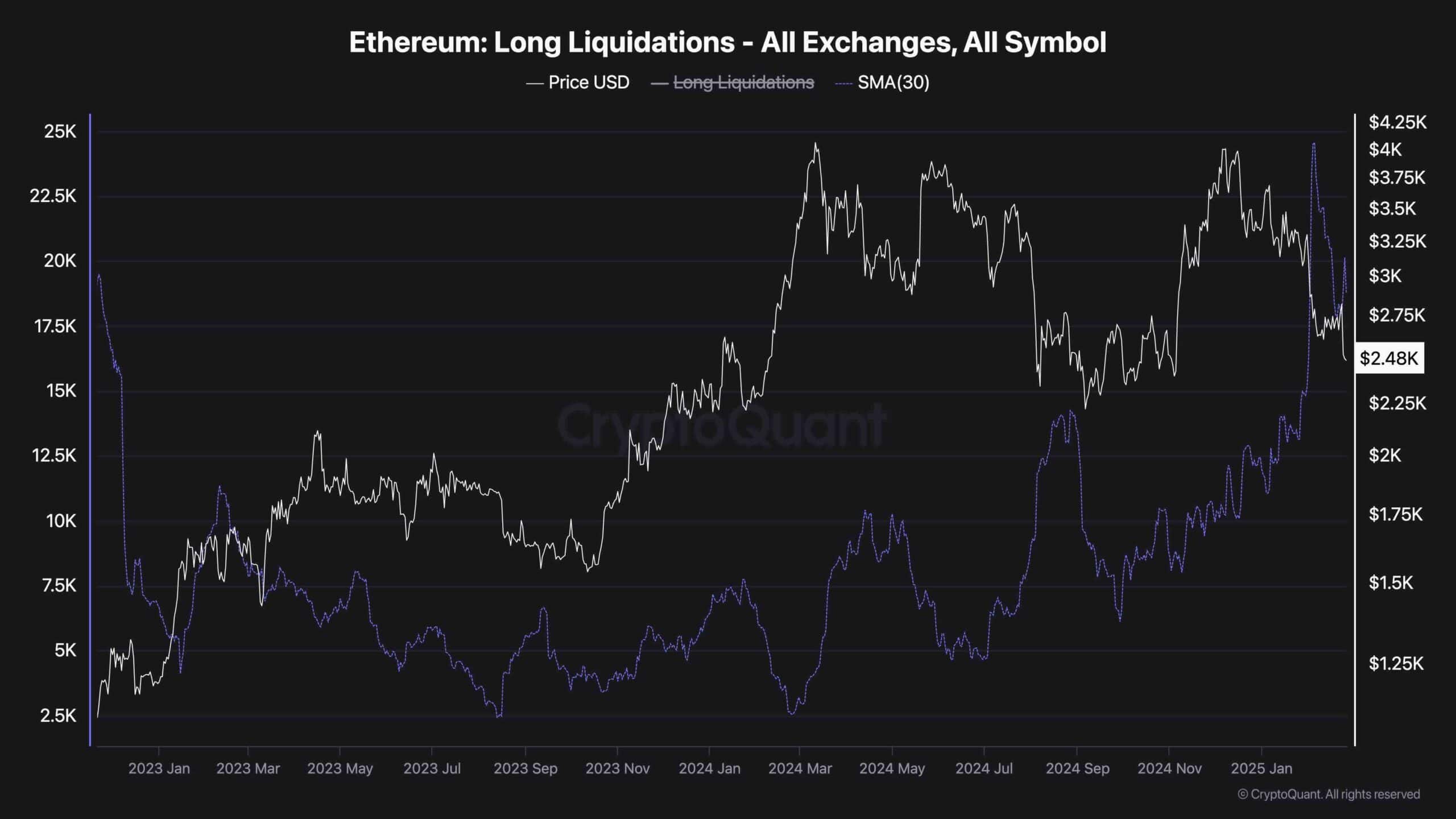

Lengthy Liquidations (30-day Shifting Common)

This chart presents the Ethereum lengthy liquidations, one of the crucial vital metrics that ought to all the time be monitored when the value experiences a big drop. This metric measures the variety of lengthy futures positions liquidated every day.

Because the graphic exhibits, in the course of the current crash, the market skilled a large lengthy liquidation cascade, the most important up to now couple of years. If these liquidations proceed, extra draw back might be anticipated because the closure of those lengthy positions will add to the present promoting stress.

But, contemplating the magnitude of current liquidations, the futures market is certainly cooling down, and a extra sustainable value motion can be extra seemingly within the brief time period.