Ethereum worth in the present day: $2,420

- Ethereum spot and by-product markets have skilled sluggish motion, with traders exhibiting much less shopping for exercise over the previous few days.

- Ethereum has seen development in community utilization regardless of costs remaining range-bound.

- ETH confronted rejection on the $2,500 stage after posting an inverted hammer.

Ethereum (ETH) is down 1% in early buying and selling hours on Friday, as market exercise stays cautious following low realized revenue and loss, together with regular open curiosity. Regardless of this, Ethereum’s community utilization has rebounded, with transaction counts rising from 1.23 million to 1.75 million on Wednesday, spurred by a rise in energetic addresses.

Ethereum worth stays range-bound amid development in community exercise

Ethereum’s shopping for and promoting exercise throughout its derivatives and spot markets have been pretty impartial prior to now few days, revealing that cautious sentiment nonetheless largely prevails available in the market.

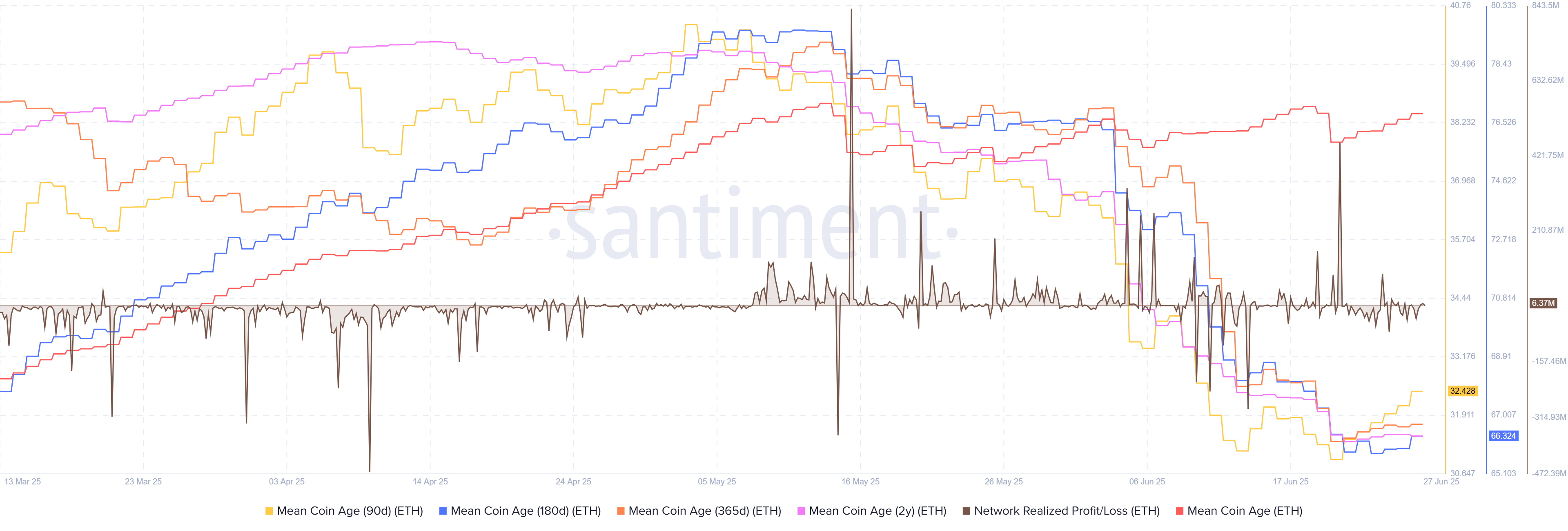

The Community Realized Revenue/Loss and Imply Coin Age metrics point out that traders have scaled again their buying and selling exercise, with every day losses and earnings remaining under the $100 million mark, and distribution/accumulation remaining flat over the previous few days.

ETH Community Realized Revenue/Loss & Imply Coin Ages. Supply: Santiment

The stability of whales holding between 10,000 and 100,000 ETH has additionally been steady for the reason that starting of the week, rising by a mere 7,000 ETH, in keeping with CryptoQuant’s information. That is accompanied by an change reserve that has tilted upward barely, indicating a modest improve in promoting strain within the week.

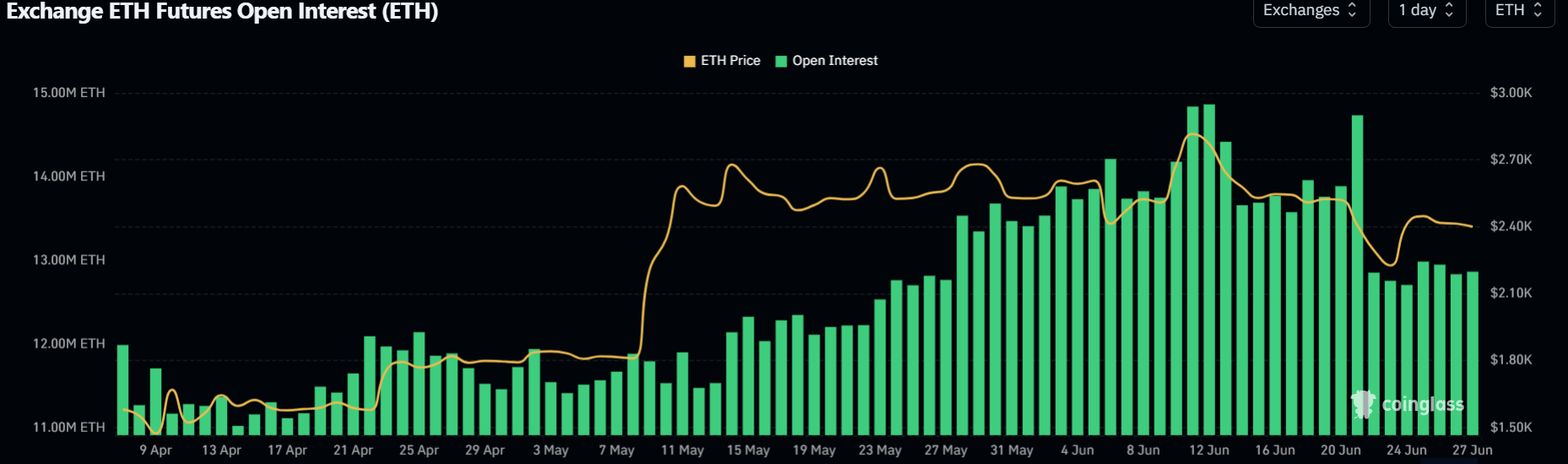

The derivatives market paints an analogous image, with open curiosity (OI) failing to surpass the 13 million ETH mark because it declined on Saturday. Open curiosity refers back to the whole worth of excellent or unsettled contracts in a derivatives market.

ETH Open Curiosity. Supply: Coinglass

Whereas these metrics paint a cautious market sentiment with a slight bias towards the draw back, Ethereum’s community utilization and institutional sentiment are considerably tilted towards a bullish leaning.

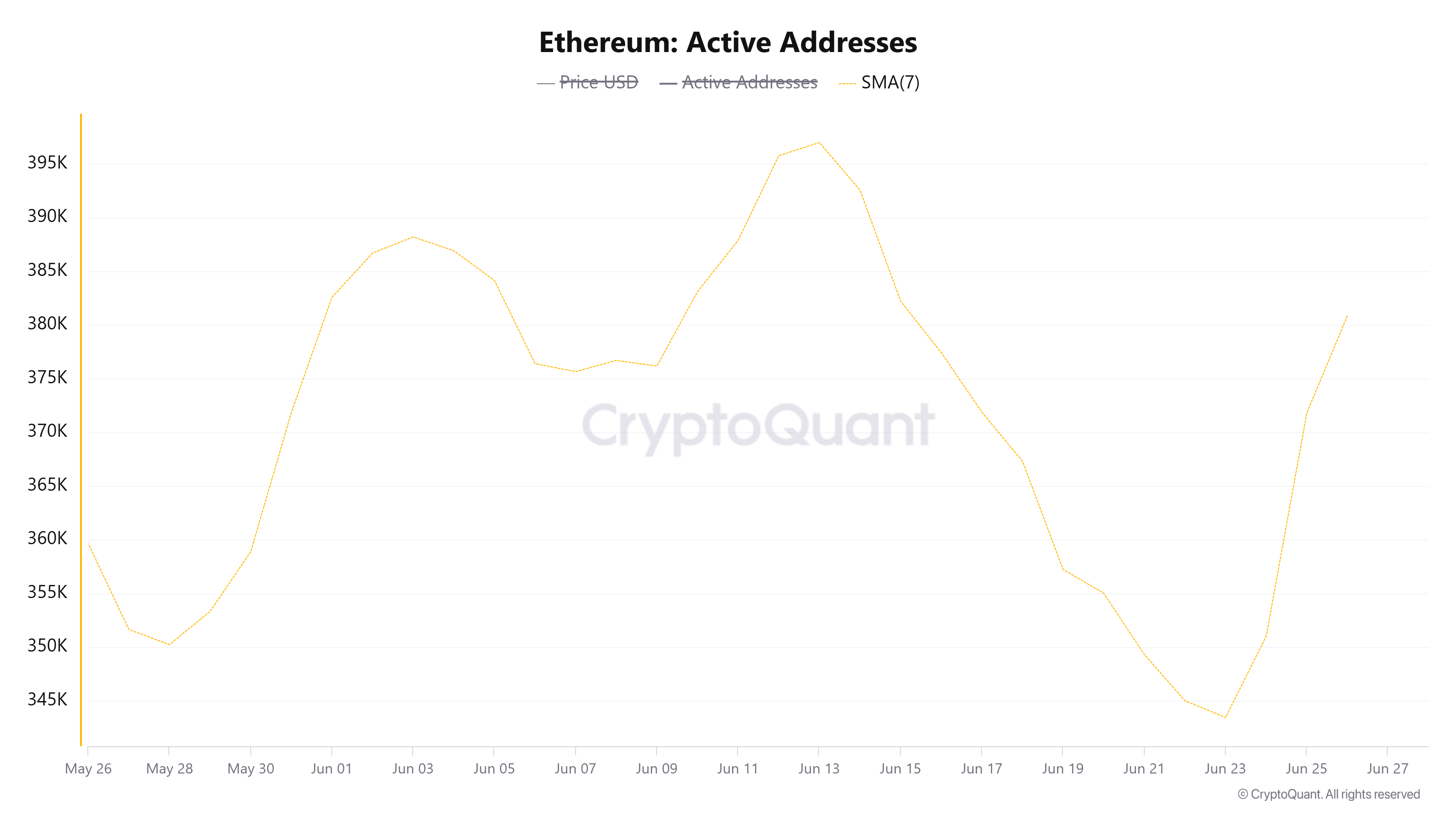

Ethereum’s energetic addresses have been rising once more, breaking its downtrend that started on June 13, regardless of costs remaining largely horizontal.

ETH Energetic Addresses. Supply: CryptoQuant

These addresses have additionally been energetic in making transactions, as Ethereum’s transaction rely elevated from 1.23 million to 1.75 million between Sunday and Wednesday, signaling rising curiosity within the Ethereum ecosystem.

Such development in community exercise signifies power and sometimes kinds the muse for a long-term restoration if macroeconomic components align. Nonetheless, that appears unclear for now as market contributors look like following a wait-and-see method attributable to uncertainty surrounding President Trump’s 90-day tariff pause, which is nearing its July 9 deadline. This has left a bearish shadow hanging over ETH and far of the crypto market.

https://x.com/KobeissiLetter/standing/1938291119483224102

Ethereum Value Forecast: ETH assessments $2,500 key stage after posting inverted hammer

Ethereum skilled $75.11 million in futures liquidations prior to now 24 hours, with liquidated lengthy and quick positions reaching $37.08 million and $38.03 million, respectively.

After briefly reclaiming the $2,500 stage for the primary time prior to now week, ETH noticed a rejection on the 100-period Easy Shifting Common (SMA), posting an inverted hammer within the course of. If ETH holds the assist close to $2,400 and breaks the $2,510 resistance, it will validate a bullish reversal.

ETH/USDT 12-hour chart

Nonetheless, a decline under the assist line close to $2,400 may ship ETH to check the higher boundary line of a descending channel. If ETH falls under the higher boundary of the channel and the decrease boundary of a symmetrical triangle, it would validate a bearish flag sample, which may see its worth drop under the $2,110 key stage.

The Relative Energy Index (RSI) is testing its impartial stage whereas the Stochastic Oscillator is above its midline. A crossover above the impartial stage within the RSI may strengthen the bullish momentum.

Associated information

- Ethereum Value Forecast: Bitcoin miner pivots to ETH treasury technique

- Ethereum Value Forecast: ETH defies Powell’s hawkish tone as Israel-Iran ceasefire fuels bullish sentiment

- Crypto may very well be used as an asset for mortgage in 2025: This is why