- Ethereum co-founder Vitalik Buterin recommended changing the EVM with RISC-V to supply potential effectivity positive factors of 100%.

- Adam Cochran argued that swapping the EVM for RISC-V may have an effect on Ethereum’s L2-centric roadmap.

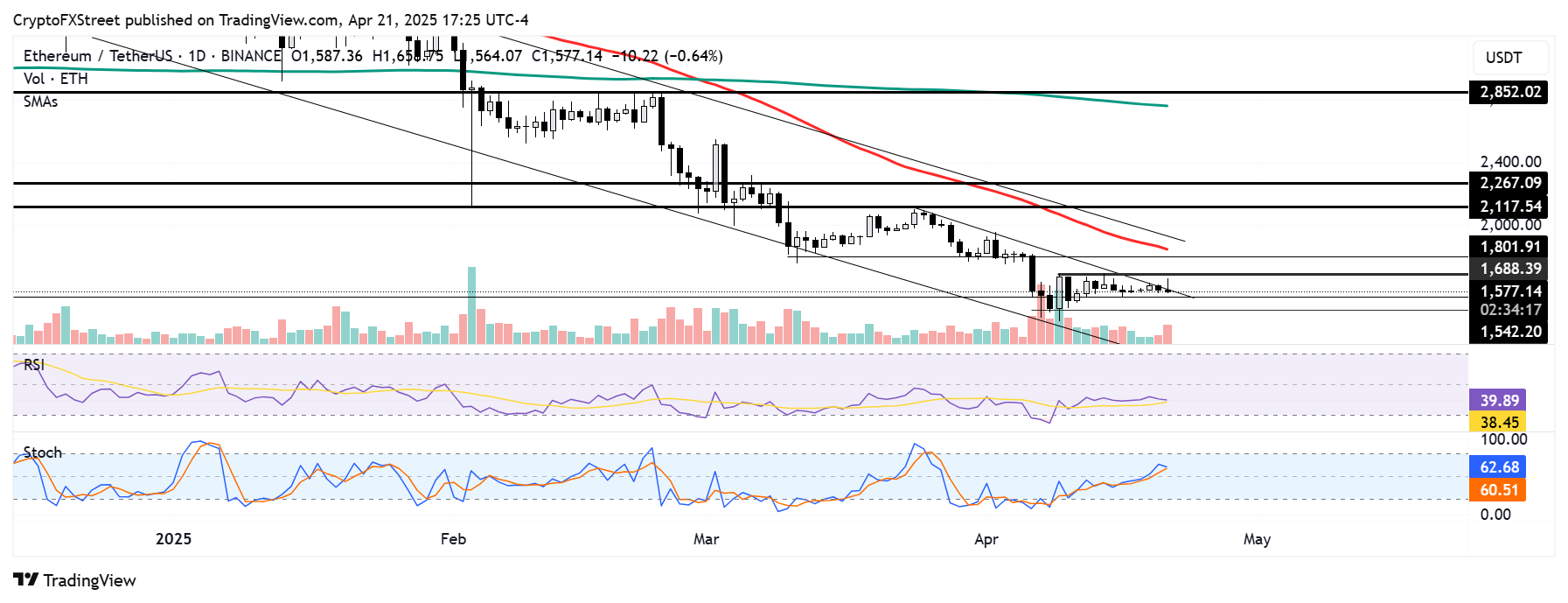

- ETH may sort out the higher boundary of a key descending channel if it smashes the $1,688 resistance.

Ethereum (ETH) is down 1% on Monday following a proposal by co-founder Vitalik Buterin to switch its present Ethereum Digital Machine (EVM) good contract language surroundings with a extra “environment friendly” RISC-V.

Vitalik Buterin proposes altering the EVM to RISC-V

In a Sunday submit on the Ethereum Magicians discussion board, Vitalik Buterin proposed an bold change to Ethereum’s execution layer (EL) that might present effectivity positive factors of 100%. He recommended changing the present EVM good contract language surroundings with the open-source RISC-V (Diminished Instruction Set Computing model 5) structure.

“It [RISC-V] goals to tremendously enhance the effectivity of the Ethereum execution layer, resolving one of many main scaling bottlenecks, and also can tremendously enhance the execution layer’s simplicity – the truth is, it’s maybe the one approach to take action,” wrote Buterin.

He highlighted a number of methods to implement such adjustments with out affecting the developer expertise, together with enabling assist for each the EVM and RISC-V, “utilizing an EVM interpreter contract written in RISC-V that runs their current EVM code” or “enshrine the idea of a ‘digital machine interpreter’ and require its logic to be written in RISC-V.”

Whereas a number of builders are debating the proposal’s viability, Adam Cochran, companion at Cinneamhain Enterprise, argued that swapping EVM for RISC-V may have an effect on Ethereum’s L2-centric roadmap.

“This could be nice for L1 execution, however that lowers the worth add of L2s, competing towards ourselves, and would not add a lot worth to that roadmap in trade for an enormous technical raise,” famous Cochran.

In the meantime, Tomasz Stańczak, co-executive director on the Ethereum Basis (EF), shared that the group’s current management restructuring has freed up time for Buterin to hold out analysis and exploration that “accelerates main lengthy‑time period breakthroughs” for Ethereum. Nonetheless, he cautioned that Buterin’s proposals are primarily aimed toward sparking conversations and pushing progress in key analysis areas.

“Neighborhood assessment could refine them considerably and even reject them,” wrote Stańczak. “Ethereum researchers typically ask that readers acknowledge the exploratory nature of their posts and proposals,” he added.

Stańczak acknowledged that the EF would deal with L1 and L2 scaling and UX enchancment within the upcoming Pectra, Fusaka and Glamsterdam upgrades.

Ethereum core builders scheduled the Pectra improve for Might 7, aiming to introduce a number of options to mainnet, together with pockets restoration, transaction batching, blobspace growth and enhancing the utmost validator staking restrict to 2,048 ETH.

The upcoming adjustments and proposals come at a time when L2s and Solana are taking quantity from the Ethereum L1, inflicting a plunge in its income over the previous 12 months.

Ethereum Worth Forecast: ETH exams $1,688 resistance after rising above key descending trendline

Ethereum noticed $53.44 million in futures liquidations up to now 24 hours, per Coinglass information. The entire quantity of lengthy and quick liquidations is $27.33 million and $26.11 million, respectively.

ETH broke above a descending trendline extending from March 24 after a week-long consolidation round $1,600. Nonetheless, the highest altcoin confronted resistance at $1,688 — a degree that bears have mounted promoting strain on since April 9.

ETH/USDT every day chart

If ETH holds the descending trendline as a assist degree and smashes the $1,688 resistance, it may sort out the higher boundary of a key descending channel extending from December 16. The channel’s higher boundary is strengthened by the 50-day Easy Shifting Common (SMA).

On the draw back, a sustained transfer under the descending trendline may see ETH discovering assist close to $1,450. A breakdown under $1,450 could ship ETH plunging 30% towards the decrease boundary of the descending channel at $1,150.

The Relative Power Index (RSI) and Stochastic Oscillator (Stoch) are trending downwards after preliminary upward motion, indicating a gradual improve in bearish momentum.