Ethereum is at the moment testing a decisive resistance area close to the 200-day shifting common at $2.5K, which has triggered a consolidation part.

Whereas a deeper short-term correction stays potential attributable to prevailing provide and overbought situations, market construction and momentum counsel a possible bullish breakout within the mid-term.

Technical Evaluation

By ShayanMarkets

The Every day Chart

ETH’s latest bullish momentum has pushed the value towards the essential $2.5K resistance zone, which aligns with the 200-day shifting common—a traditionally important degree of provide and market response. Upon testing this confluence of resistance, Ethereum has misplaced its upward momentum, getting into a short lived consolidation part.

A decisive breakout above this psychological barrier and the 200-day MA would sign a shift in market sentiment, probably marking the start of a broader bullish reversal. Such a transfer may propel the value towards the $3K threshold within the mid-term.

Nevertheless, the presence of a resting provide at this degree, mixed with the RSI indicator displaying overbought situations, will increase the probability of a short-term corrective transfer. A continued consolidation inside the $2.1K–$2.5K vary stays believable, providing the market time to reset earlier than one other breakout try.

The 4-Hour Chart

Within the 4-hour timeframe, Ethereum’s rally has visibly stalled on the $2.5K mark, with indicators of distribution and promoting stress changing into obvious. This consolidation has shaped a bullish continuation wedge—an typically dependable sample suggesting a short lived pause earlier than a possible breakout.

If the wedge’s decrease boundary efficiently holds, Ethereum may quickly provoke a bullish breakout, reclaiming momentum and probably breaching the $2.5K resistance zone. Conversely, a breakdown under this sample would point out a deeper correction, possible driving the value towards the important thing help degree of $2.1K.

In abstract, ETH stays in a state of consolidation underneath a significant resistance degree. Merchants ought to intently monitor the wedge construction and the $2.1K–$2.5K vary for clues on the subsequent important transfer.

Onchain Evaluation

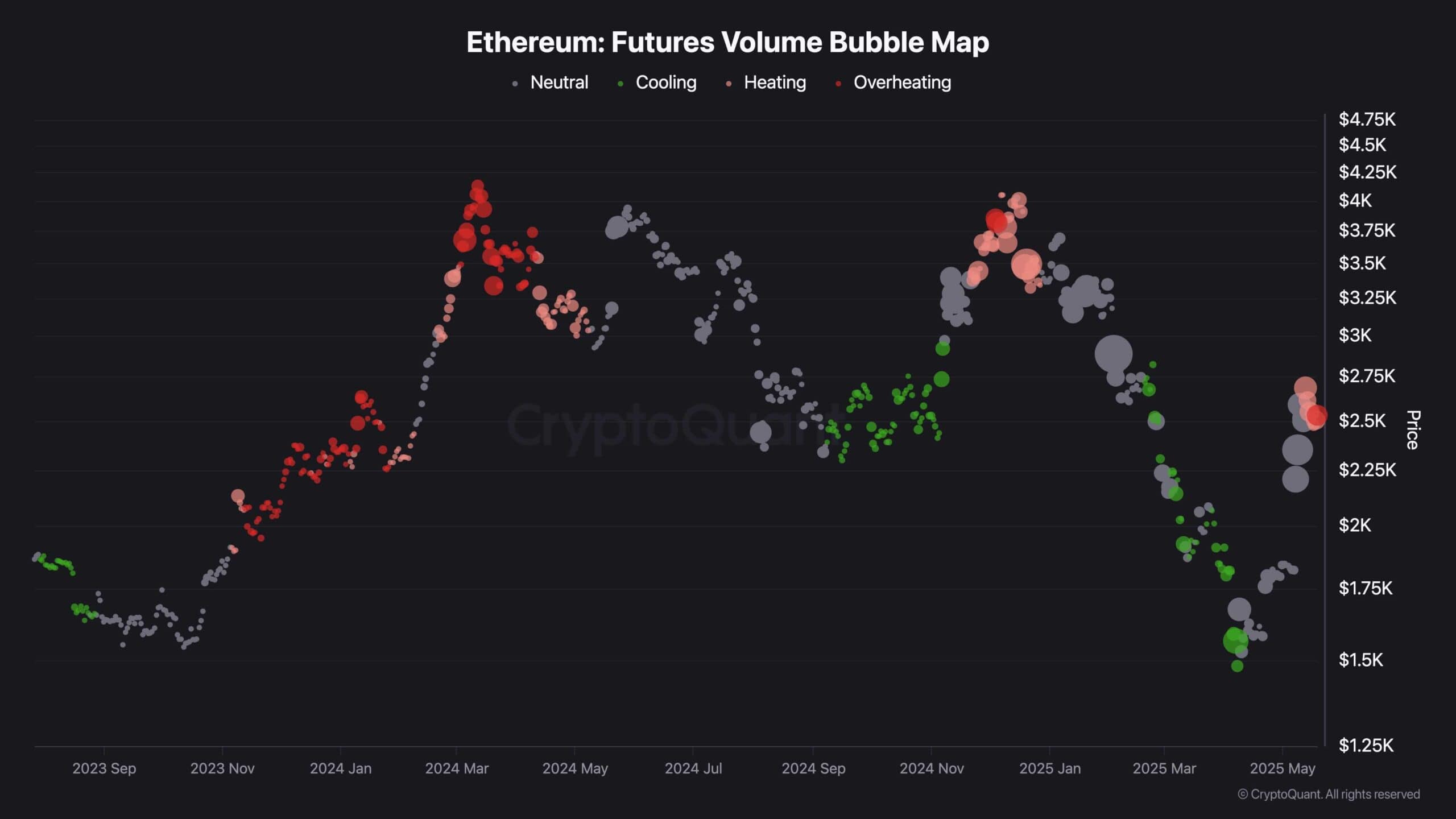

The bubble chart under illustrates whole buying and selling quantity throughout all exchanges, the place bubble measurement displays quantity magnitude and color signifies the speed of quantity change, categorized as Cooling, Impartial, Overheating, and Extremely Overheating.

As proven, Ethereum’s strategy to the essential $2.5K resistance degree has led to an overheating state, characterised by a big surge in buying and selling quantity. This spike is primarily pushed by profit-taking exercise and the presence of resting provide at this psychologically important value zone. The overheated situation factors to a possible short-term correction because the market cools down, paving the best way for renewed accumulation.

Consequently, Ethereum is predicted to proceed its consolidation part till recent demand emerges to drive a breakout above this resistance vary within the mid-term.