As of Sept. 23, 2024, ethereum is buying and selling at $2,646, with an intraday worth vary of $2,531 to $2,684. Over the previous 24 hours, ethereum has recorded a buying and selling quantity of $16.36 billion and a market capitalization of $318.56 billion. The cryptocurrency’s worth is holding regular, reflecting a balanced market with blended indicators from technical indicators.

Ethereum

Ethereum’s (ETH) 1-hour chart displays a current rally from $2,525 on Sept. 21 to a peak of $2,687, adopted by a slight consolidation within the $2,660–$2,680 vary. This short-term pullback is accompanied by lowered quantity, suggesting a possible for a breakout as merchants await additional motion. Key oscillators just like the superior oscillator and transferring common convergence divergence (MACD) point out a impartial stance, whereas the Stochastic oscillator indicators that ethereum could also be barely overbought at this degree.

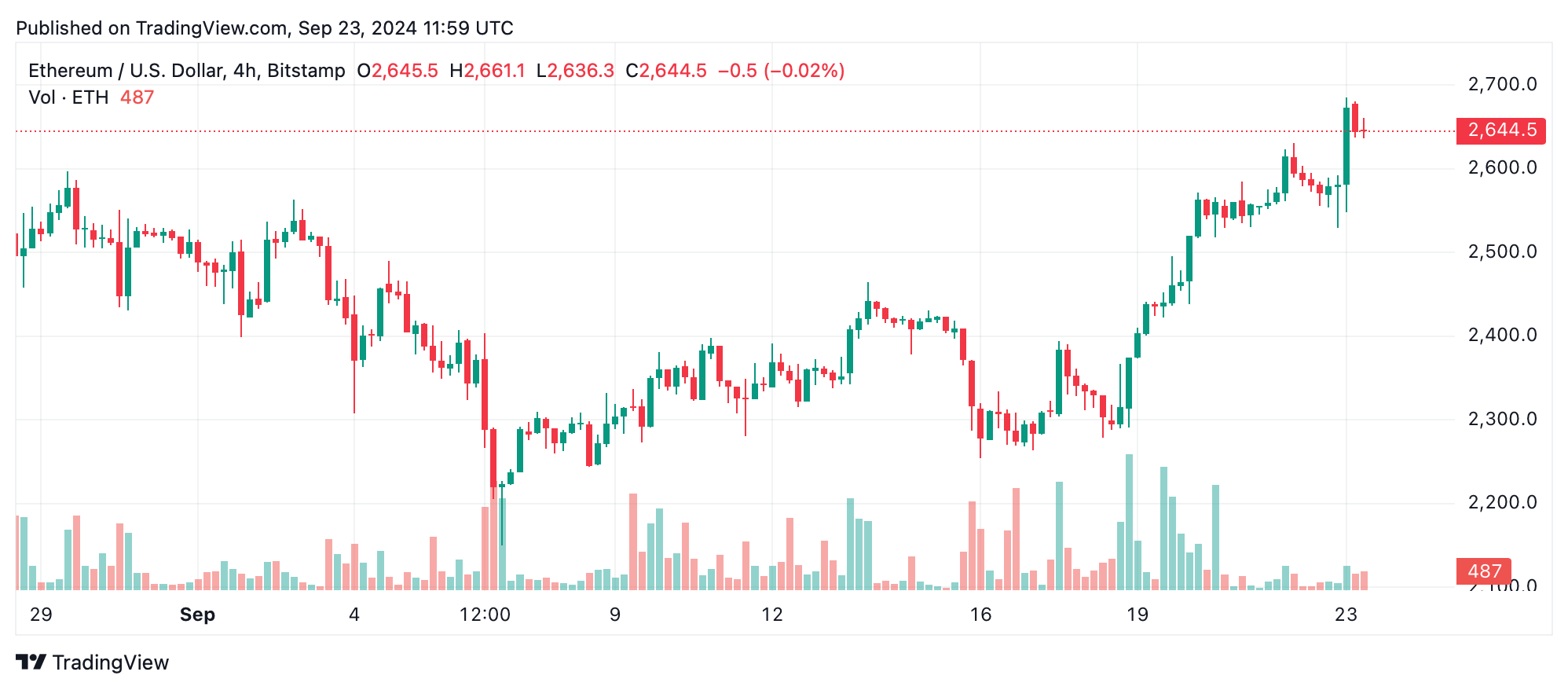

On the 4-hour chart, ethereum continues to reveal a gradual uptrend since Sept. 18, when the worth rebounded from $2,276. With resistance presently sitting close to $2,687, ethereum is consolidating round $2,600. Decrease buying and selling volumes throughout this pullback trace at a interval of accumulation, setting the stage for a possible take a look at of the subsequent resistance degree, which lies between $2,750 and $2,800.

The every day chart reveals that ethereum has rebounded from a current low of $2,149 in mid-September, following a broader market sell-off. This restoration has taken the worth again to the $2,600 vary, the place resistance at $2,687 stays intact. If ethereum retraces to the $2,500–$2,550 vary, this might current a strong shopping for alternative, given the sturdy help noticed in earlier retracements.

Oscillators current blended indicators, with the relative energy index (RSI) impartial at 60.2 and the commodity channel index (CCI) equally impartial at 183.7. Whereas the Stochastic oscillator means that ethereum is overbought, the MACD stays in impartial territory, indicating continued upward stress. Momentum, nevertheless, could also be waning barely, as mirrored in a impartial stance from the superior oscillator.

Transferring averages (MAs) present a usually optimistic outlook, with short-term indicators resembling the ten, 20, and 50-period exponential transferring averages (EMAs) and easy transferring averages (SMAs) all signaling bullish alternatives. Nevertheless, the 100 and 200-period transferring averages replicate a bearish divergence, because the long-term developments recommend resistance above $2,800. These blended indicators point out that whereas ethereum might push larger within the brief time period, it might face stronger headwinds because it approaches these ranges.

Bull Verdict:

Ethereum stays in a bullish consolidation section, supported by sturdy shopping for indicators from short-term transferring averages and key technical indicators just like the MACD. A breakout above the $2,687 resistance might see the worth push towards $2,750 and past, with momentum favoring continued upward motion. So long as ethereum holds above $2,600, the outlook stays optimistic for additional beneficial properties.

Bear Verdict:

Whereas ethereum has proven resilience above $2,600, bearish indicators from longer-term transferring averages and oscillators such because the Stochastic and Momentum point out potential overbought situations. A failure to interrupt above $2,687 or a breakdown under $2,600 might set off a deeper correction, with a attainable retest of the $2,500 help degree. On this state of affairs, warning is suggested as bearish stress might enhance.