Key takeaways

- ETH dangers dropping beneath $4,500 after dropping 3.5% of its worth.

- The assist degree at $4,350 might be the following goal if ETH fails to bounce.

ETH dips to $4,500 as market opens bearish

The cryptocurrency market opens a brand new week bearish after a wonderful efficiency final week. Bitcoin, the main cryptocurrency by market cap, misplaced 1% of its worth and briefly dropped beneath the $115k mark.

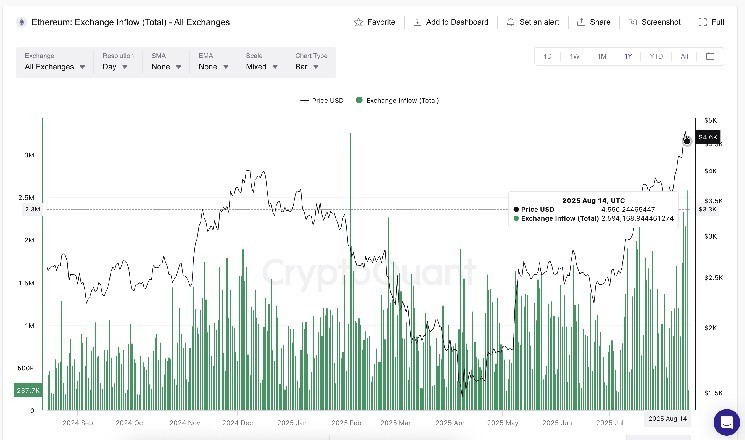

Ether, the main altcoin and the second-largest cryptocurrency by market cap, recorded an excellent larger loss. It dipped 3.5% within the final 24 hours to now commerce at $4,510.

The bearish efficiency comes regardless of the essential Fed fee determination later this week. Ether hit an all-time excessive above $4,900 in August however has did not construct on this momentum since then. It’s down 9% from its all-time excessive however might look to bounce again quickly.

This week’s worth motion might be decided by the Fed fee determination on Wednesday. A fee reduce by the Federal Reserve will ship BTC, ETH, and different crypto property flying within the close to time period.

Ether bulls goal new all-time excessive above $5k

The ETH/USD 4-hour chart stays bullish and environment friendly, suggesting that patrons stay in management regardless of the latest bearish worth motion. The momentum indicators additionally stay bullish, with ETH now concentrating on a brand new all-time excessive.

Ether has discovered assist briefly round $4,488. The RSI of 60 exhibits that ETH stays bullish on the upper timeframe. The MACD line can be inside the optimistic territory, suggesting a bullish bias.

If the $4,488 assist holds, Ether might prolong its rally in the direction of the all-time excessive worth of $4,956. An prolonged bullish run would enable it to surpass the $5k mark for the primary time in its historical past.

Nonetheless, failure to defend the assist degree at $4,488 might see ETH drop to the following main resistance degree at $4,350. The resistance degree can be a 4-hour TLQ and will present the required liquidity to surge increased.