Ether fell beneath the psychologically vital stage of $4,000 on Thursday, September 25 as substantial promoting exercise drove the digital forex decrease.

The world’s second-largest cryptocurrency by whole market worth dropped to roughly $3,825 through the day, based on Coinbase knowledge from Tradingview. At this level, the digital asset was buying and selling at its lowest level since early August.

“Ethereum’s slide beneath $4,000 was pushed by a wave of leveraged liquidations after key help broke, with over $300 million in longs worn out in 24 hours,” Joe DiPasquale, CEO of cryptocurrency hedge fund supervisor BitBull Capital, acknowledged through e-mail.

Dipasquale emphasised that a number of variables contributed to the sell-off, stating that “Macro jitters, together with the chance of a U.S. authorities shutdown, added to the risk-off tone, whereas slowing ETF inflows highlighted weaker institutional demand. The mixture of pressured promoting, macro uncertainty, and softer flows created an ideal storm for Ether’s newest decline.”

Julio Moreno, head of analysis for CryptoQuant, additionally weighed in, specializing in exercise within the crypto derivatives markets.

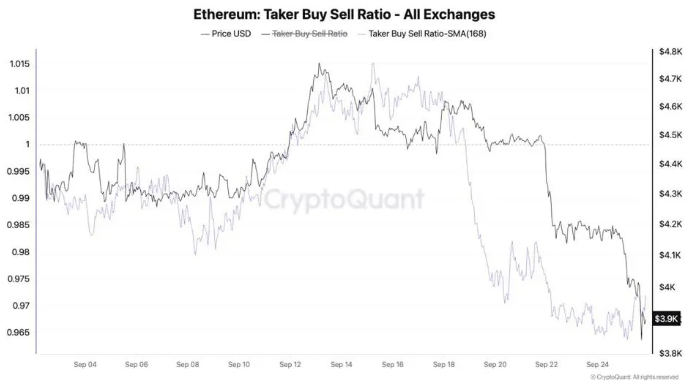

“At the moment’s worth decline appears to be attributable to merchants deleveraging within the perpetual futures market,” he acknowledged through Telegram. “Promote orders are outpacing purchase orders by essentially the most in virtually two months,” added Moreno.

The chart beneath helps illustrate this exercise by exhibiting the Taker Purchase Promote Ratio, which CryptoQuant defines as “The ratio of purchase quantity divided by promote quantity of takers in perpetual swap trades.”

The analyst added that “Open curiosity has declined by $1 billion within the final 24h, as lengthy positions get liquidated.”

The chart beneath illustrates this exercise:

Key Position Of Fed Coverage

Greg Magadini, director of derivatives for digital asset knowledge supplier Amberdata, additionally weighed in, specializing in the the impression that Federal Reserve coverage bulletins have had on the markets.

The Federal Open Market Committee is answerable for setting the goal vary for the benchmark federal funds price, which has broad implications for borrowing prices. This goal vary has generated vital visibility lately, as shoppers have grappled with inflation that reached its highest stage in many years.

Magadini tied considerations surrounding these coverage developments to ether’s worth actions, stating through e-mail that “The transfer decrease has been in-line with regular market gyrations, however the underlying trigger is probably going associated to the Fed and the long run path of rates of interest.”

“Going into final week’s FOMC determination all of the markets rallied as price cuts grew to become a foregone certainty. Now that the occasion has handed and Powell has been clear that inflation continues to be greater than anticipated, the market is starting to unwind its enthusiasm,” he added.

“That has introduced down crypto and danger belongings, sending ETH decrease immediately,” mentioned Magadini.

Going ahead, he emphasised the important thing function that the upcoming private consumption expenditures report, a key measure of inflation, may have on the Fed’s future coverage strikes. The subsequent report is scheduled to come back out Friday, September 26.

The information ought to give markets a greater sense of what the FOMC will do subsequent, Magadini claimed.