The Ether Machine, an institutional-grade Ethereum (ETH) yield and infrastructure firm, not too long ago introduced the addition of 15,000 ETH to its stability sheet. The acquisition coincided with Ethereum’s 10-year anniversary.

The Ether Machine Continues To Stack ETH

In a current announcement, The Ether Machine confirmed it had bought almost 15,000 ETH for $56.9 million, at a mean value of $3,809 per ETH. The acquisition coincides with a serious milestone for the Ethereum community.

For the uninitiated, The Ether Machine was established earlier this yr by a enterprise mixture between The Ether Reserve and Nasdaq-listed Dynamix Corp. The transaction – set to shut in This autumn 2025 – goals to take the corporate public underneath the ticker image ETHM with a fundraising goal of $1.6 billion.

The newest ETH buy brings The Ether Machine’s whole holdings to 334,757 ETH. In keeping with the corporate, it nonetheless holds roughly $407 million in money earmarked for future ETH acquisitions. Commenting on the event, Andrew Keys, Chairman and Co-Founder, acknowledged:

We couldn’t think about a greater option to commemorate Ethereum’s tenth birthday than by deepening our dedication to Ether. We’re simply getting began. Our mandate is to build up, compound, and assist ETH for the long run – not simply as a monetary asset, however because the spine of a brand new web economic system.

It must be recalled that Keys not too long ago made headlines for publicly favoring Ethereum over Bitcoin (BTC). He in contrast ETH’s dominance within the stablecoin area to Google’s dominance in search.

Notably, the 15,000 ETH buy was funded from $97 million in money proceeds raised by a beforehand introduced personal placement. The agency famous that extra ETH purchases are anticipated within the coming days.

Following the acquisition, The Ether Machine climbed to 3rd place on the checklist of firms with the biggest ETH reserves, in response to information from StrategicETHReserve. It now trails solely Bitmine Immersion Tech (625,000 ETH) and SharpLink Gaming (438,200 ETH).

Ethereum Taking The Highlight From Bitcoin?

Whereas Bitcoin stays the biggest cryptocurrency by market cap, Ethereum is more and more drawing institutional consideration. In 2025, quite a few companies have begun including ETH to their stability sheets.

For instance, Nasdaq-listed digital asset agency Bit Digital acquired 19,683 ETH final week, bringing its whole holdings to over 120,000 ETH. The corporate at the moment ranks seventh amongst companies with the biggest ETH reserves.

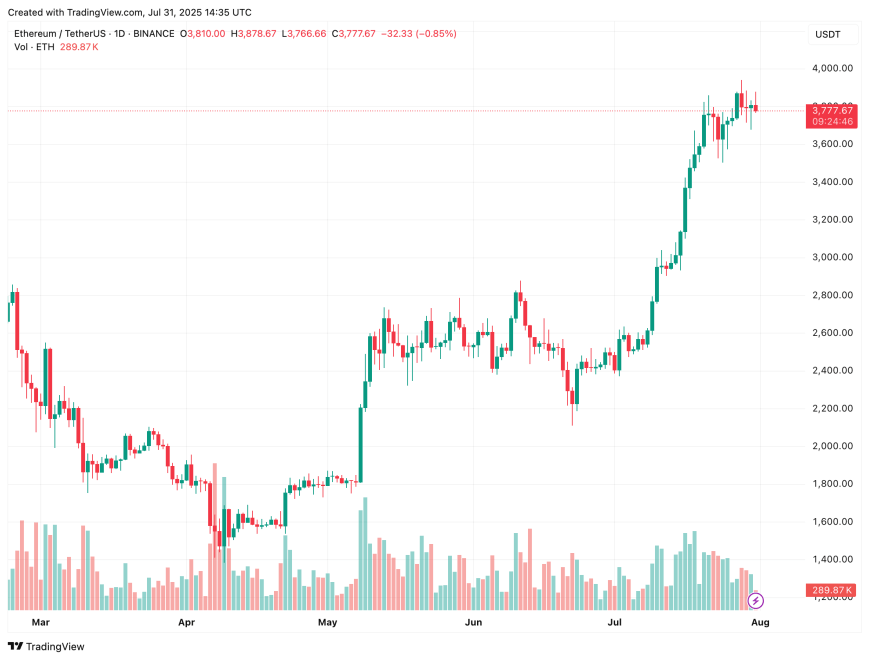

Equally, Ethereum-focused agency BTCS Inc. not too long ago unveiled plans to lift as much as $2 billion, with the majority of proceeds meant for increasing its ETH portfolio. At press time, ETH trades at $3,777, down 0.2% previously 24 hours.

Featured picture from Unsplash.com, charts from StrategicETHReserve.xyz and TradingView.com

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.