- Whales are accumulating ETH, with wallets holding 10K–100K ETH rising by 24%, signaling robust investor confidence.

- Ethereum’s stablecoin dominance and potential ETF approval may gasoline market enlargement and long-term adoption.

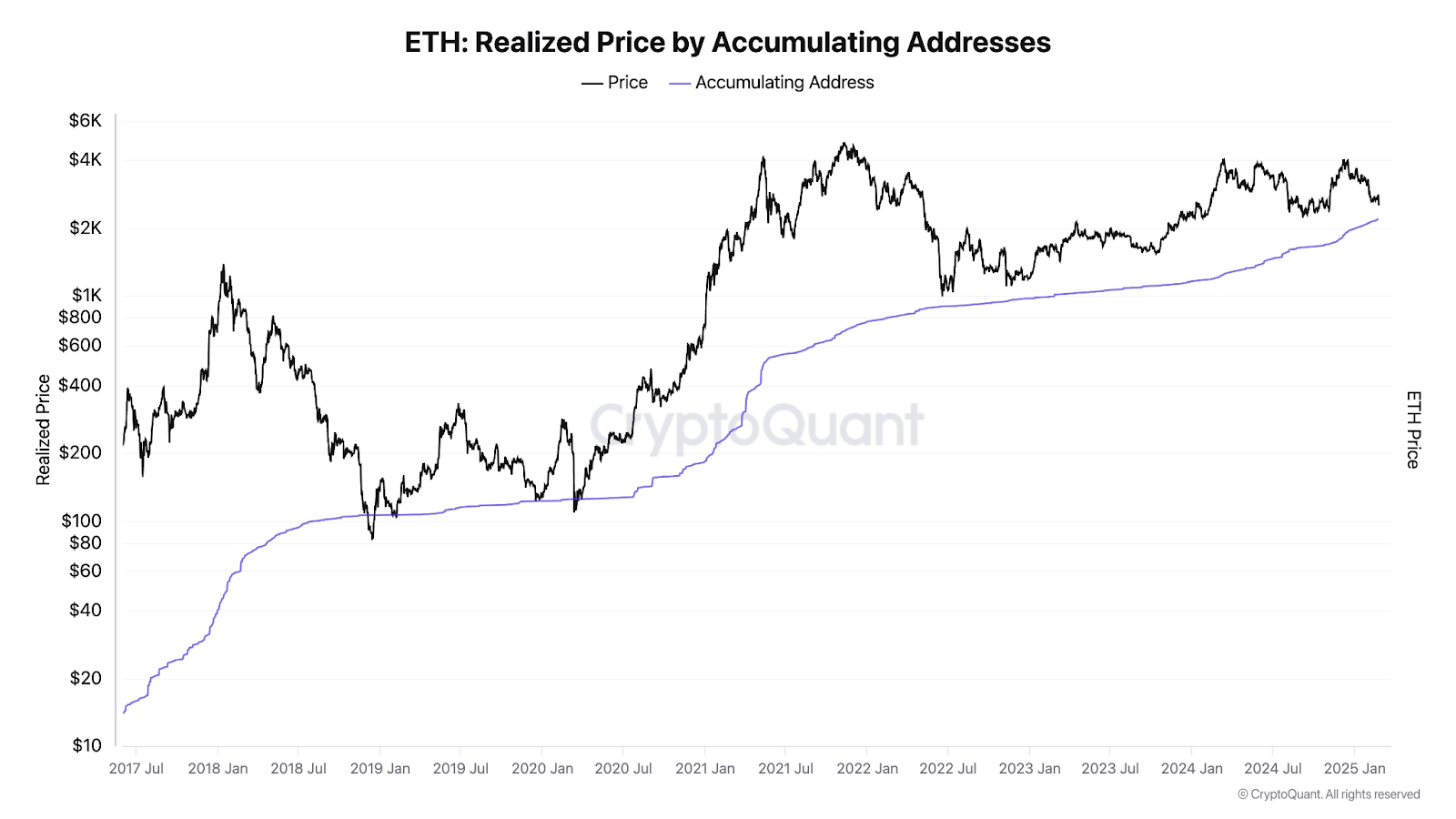

- Rising realized worth amid accumulation suggests ETH traders are making ready for a possible breakout in 2024.

Ethereum (ETH) experiences strong accumulation signaling a bull run for 2024. Based on Ki Younger Ju, CryptoQuant CEO, there isn’t any promote strain following the Bybit hack. Market indicators are impartial, but whale wallets sign extra accumulation. This pattern indicators that long-term traders are establishing for a possible breakout.

Whales Are Accumulating ETH

Information reveals that wallets holding 10,000 to 100,000 ETH have grown by 24% over the previous 12 months. These wallets primarily acquired ETH from smaller wallets holding lower than 1,000 ETH. Moreover, Kate The Alt experiences that the price foundation for accumulating addresses stands at $2,199, whereas ETH’s present worth sits at $2,505. This means that traders proceed shopping for ETH above their preliminary entry ranges, reinforcing confidence in Ethereum’s future progress.

Supply: Kate the Alt

Furthermore, Ethereum retains 56% market dominance within the stablecoin market cap. With the promise of cryptocurrency-friendly insurance policies underneath Trump, companies can extra depend on ETH-based stablecoins and good contracts. This will likely additionally additional consolidate Ethereum’s market standing in 2025.

Regulatory Tailwinds and ETF Affect

Moreover, the approval of an ETH spot ETF provides additional upside potential. Regulatory readability may set off a “Giant Cap ETF altseason,” benefiting Ethereum considerably. Historic patterns recommend that such regulatory milestones drive institutional curiosity, main to cost surges.

Moreover, Over time, Ethereum’s realized worth by handle accumulation has elevated constantly. This measure, which reveals steady accumulation even throughout dangerous occasions, repeatedly goes upward in distinction to market worth swings. The realized worth remained resilient by market downturns, indicating sustained investor curiosity.

Market Cycles and Lengthy-Time period Outlook

Ethereum noticed important surges and falls in its market worth since 2017. The value peaked a lot earlier within the first months of the 12 months 2018 earlier than crashing, leaving the market recuperating in 2020. With a powerful bull run in 2021, ETH was pushed to report highs once more earlier than experiencing one other dip. Accumulation has continued, which signifies that traders have retained their religion regardless of the value turbulence.

By early 2024, Ethereum’s market worth remained above the realized worth, signaling power. The widening hole between realized and market costs signifies long-term holding patterns. In addition to, constant accumulation throughout downturns reinforces Ethereum’s bullish outlook. Consequently, the mix of whale exercise, regulatory help, and rising adoption positions ETH for progress in 2024.