- Ethereum is making an attempt restoration after the Fed diminished charges by 50 foundation factors.

- ETH holders are displaying combined actions following its weak efficiency in opposition to Bitcoin.

- Ethereum may break above the $2,395 resistance stage.

Ethereum (ETH) is buying and selling above $2,330 on Wednesday because the market is recovering following the Federal Reserve’s (Fed) resolution to chop rates of interest by 50 foundation factors. In the meantime, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

Ethereum makes an attempt to stage restoration following Fed price minimize

Ethereum and the final crypto market are seeing shopping for momentum after the Fed diminished rates of interest by 50-basis-points to 4.75% – 5% on Wednesday. The transfer marks the primary price minimize since March 2020, when the company slashed rates of interest to 0%.

ETH may even see a restoration within the coming weeks as expectations are that traders could start to step into the market once more with heightened shopping for momentum following the speed minimize. Moreover, This fall has traditionally been the best-performing season for the crypto market. Therefore, the approaching months may show essential for Ethereum.

Breaking: Fed cuts rate of interest by 50 bps to 4.75%-5%

Learn Extra!➡️ https://t.co/xG9MSy6qau#Fed #Foreign exchange pic.twitter.com/yskwQ2mLFj

— FXStreet Information (@FXStreetNews) September 18, 2024

In the meantime, following the ETH/BTC plunge to a low final seen in April 2021, Ethereum holder’s exercise has remained pretty quiet, with a barely diverging technique among the many totally different cohorts, per CryptoQuant’s knowledge.

Massive holders with provide above 100K have been largely inactive, holding onto their tokens — probably throughout staking and DeFi yield-bearing protocols. Mid-tier holders (10K – 100K) are barely bullish, accumulating at a sluggish tempo. Nonetheless, small holders (100 – 1K) have been shedding their holdings steadily for the reason that starting of the 12 months, with August and September experiencing steeper promoting stress than in earlier months.

ETH Accumulation

However, US spot Ethereum ETFs posted web outflows of $15.1 million on September 17, with Grayscale’s ETHE shedding $17.9 million and its Ethereum Mini Belief seeing simply $2.8 million value of inflows.

Ethereum may rally to $2,817 if it closes above key resistance

Ethereum is buying and selling round $2,330 on Wednesday after seeing a rejection close to $2,395 on Tuesday. Previously 24 hours, ETH has seen over $22 million in liquidations, with lengthy and quick liquidations accounting for $17.69 million and $5.19 million, respectively.

Ethereum is buying and selling inside a key rectangle channel with resistance and assist ranges at $2,395 and $2,207, respectively. A descending trendline extending from Might 27 and the 50-day and 200-day Easy Transferring Averages (SMAs) additionally stand as potential resistance.

ETH/USDT 4-hour chart

ETH’s subsequent transfer might be decided by the Fed’s resolution to chop charges by 50 foundation factors. The transfer may see ETH break the $2,395 resistance and rally towards $2,817. If ETH fails to see a rejection round $2,817, the following goal is $3,237.

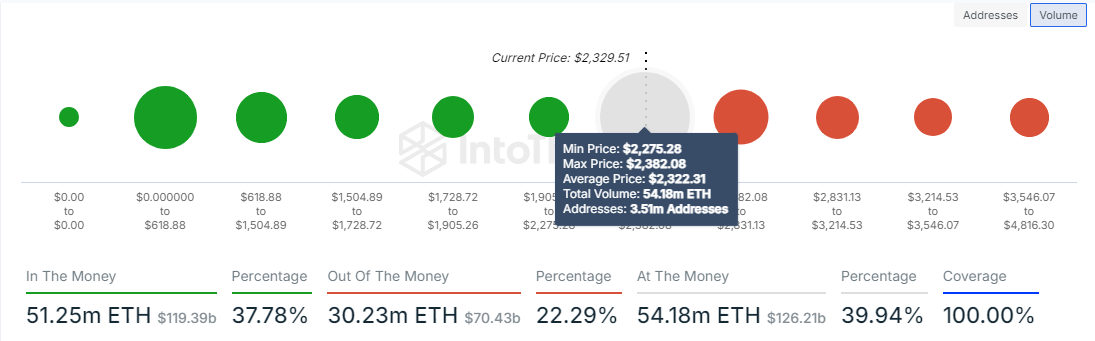

On the draw back, ETH may bounce across the $2,207 assist stage. This stage has established itself as vital assist, contemplating it’s closest to ETH’s highest demand zone, the place traders bought 54.18 million ETH tokens. Therefore, patrons could step in to defend their cash from falling into losses.

ETH International In/Out of the Cash

If the assist does not maintain, ETH may decline towards $2,111. A each day candlestick shut under this stage will invalidate the thesis and set off vital losses.

Share: Cryptos feed