Regardless of a latest value decline, Ethereum (ETH) bulls seem like setting their sight on a renewed rally, based on information obtained by BeInCrypto on-chain. In the present day, ETH’s value is $3,130 — down from its latest peak of $3,434 on November 12.

Traders, nevertheless, stay resolute that the cryptocurrency pullback is momentary. Here’s a breakdown of what might occur amid the present sentiment.

Ethereum Traders Resolve To not Promote

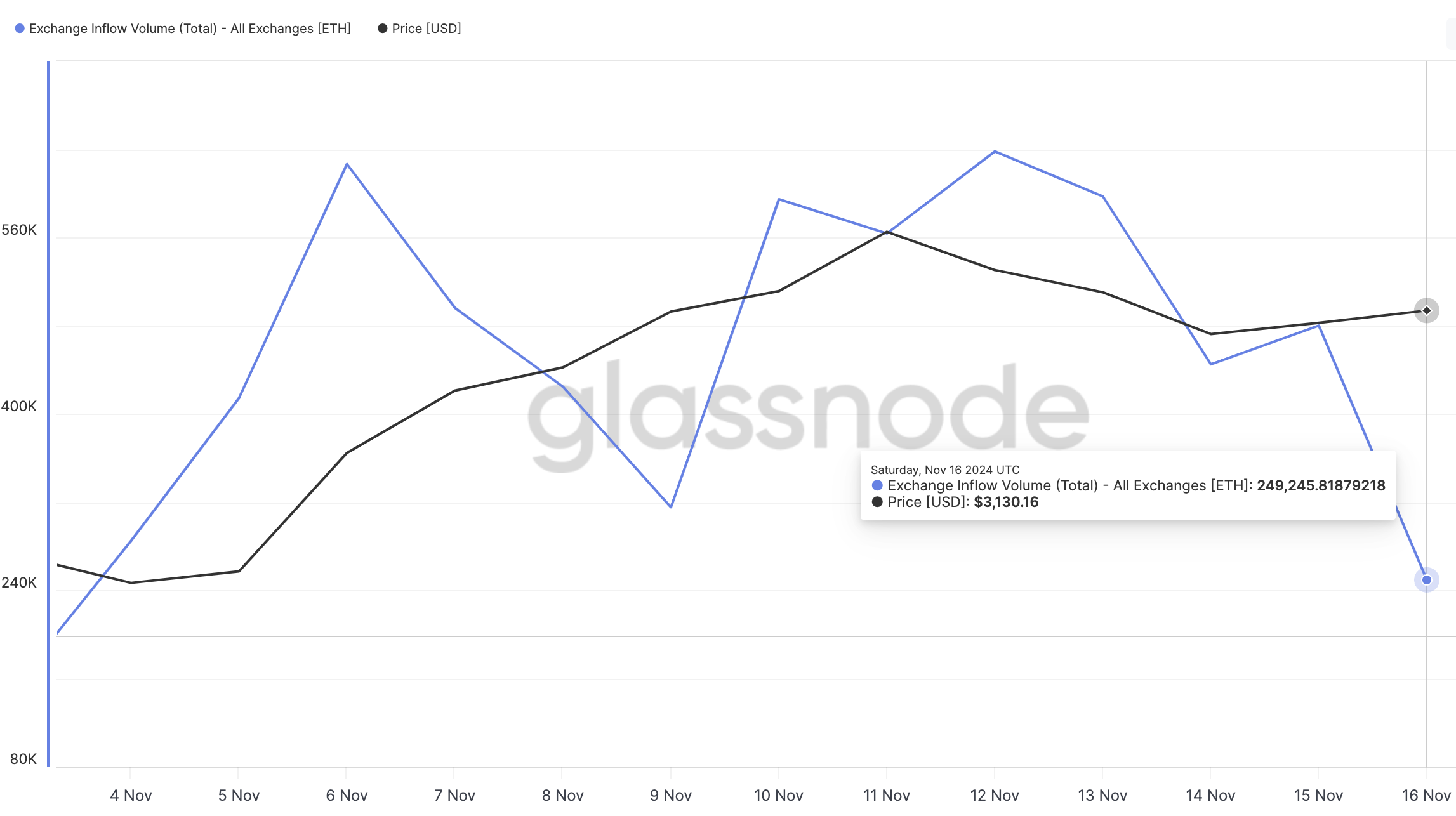

Based on Glassnode, the overall Ethereum change influx is 249,245 as of this writing. Trade influx is the variety of cash despatched to exchanges inside a given timeframe. When this metric will increase, it implies that extra holders are prepared to promote, which could possibly be bearish for the cryptocurrency.

Alternatively, a lower within the change influx signifies that traders are eradicating their holdings from exchanges. For ETH, the present determine, valued at roughly $780 million, is a lower from the worth on Friday, November 15.

Due to this fact, this means that the majority ETH holders are refraining from promoting. If this continues, the cryptocurrency may not expertise a decline under $3,000 within the brief time period.

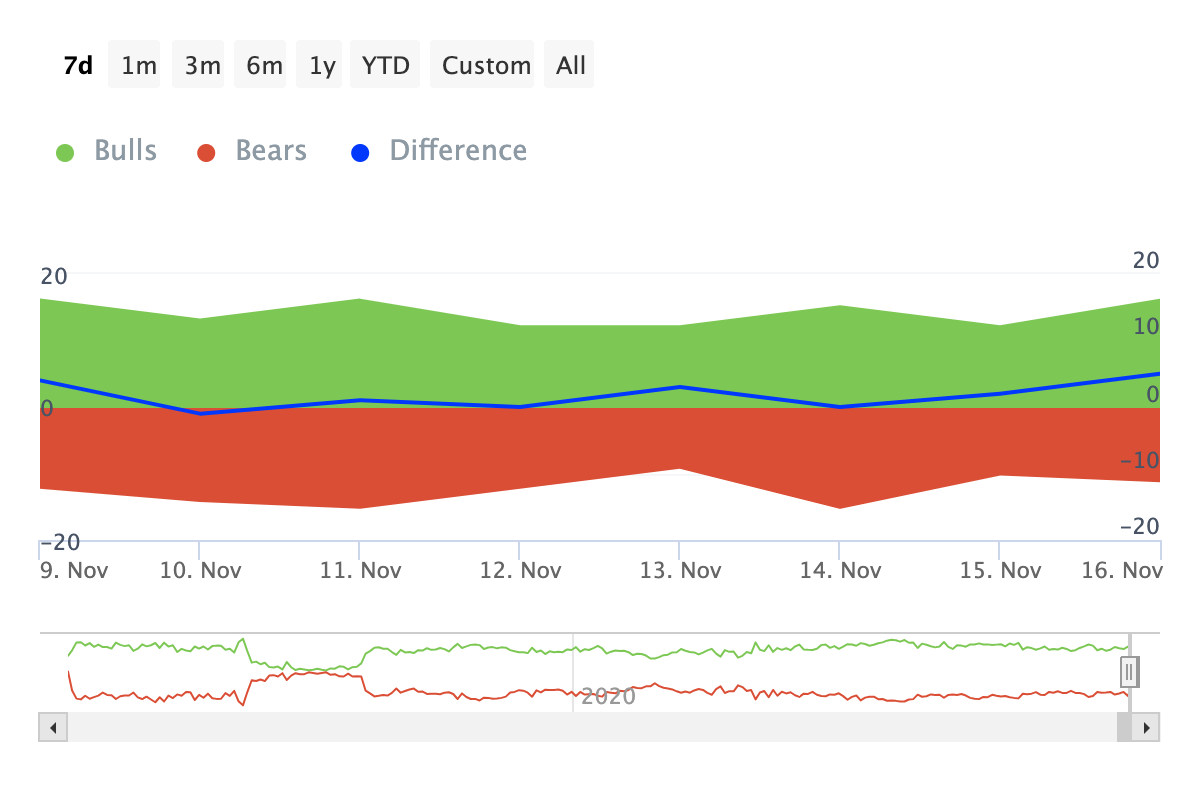

Information from IntoTheBlock reveals that ETH bulls are actively working to maintain the value. That is evident from the Bulls and Bears indicator, which tracks whether or not addresses buying and selling a minimum of 1% of a cryptocurrency’s quantity are predominantly shopping for or promoting.

When the indicator reveals extra bulls, it indicators that members are primarily shopping for. Conversely, a better variety of bears signifies elevated promoting exercise.

Over the previous 24 hours, Ethereum bulls have outnumbered bears, suggesting ETH’s value might surpass $3,130 within the brief time period.

Ethereum Bulls and Bears Indicator. Supply: IntoTheBlock

ETH Worth Prediction: Extra Assist for the Upside

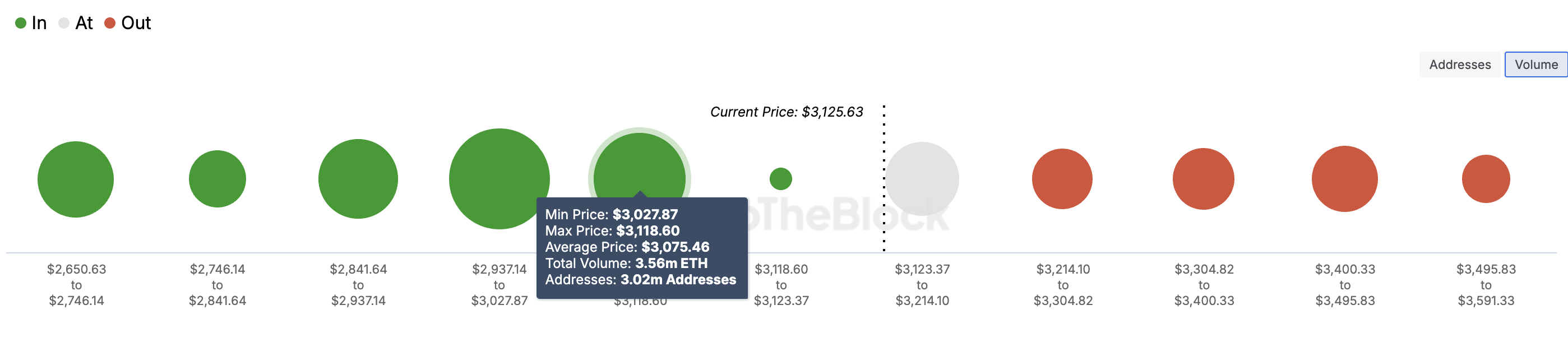

From an on-chain perspective, the In/Out of Cash Round Worth (IOMAP) helps the bias that ETH’s value might commerce increased. The IOMAP indicator helps merchants establish key value ranges the place important shopping for or promoting exercise is probably going based mostly on person positions and profitability.

It additionally highlights areas of help and resistance, relying on the quantity at a value vary. Sometimes, the bigger the cluster of quantity, the stronger the help or resistance.

Within the picture under, roughly 3 million addresses collected Ethereum on the $3,075 value stage, collectively holding 3.56 million ETH. These addresses are “within the cash,” indicating they’re at present worthwhile based mostly on the prevailing market value.

Ethereum In/Out of Cash Round Worth. Supply: IntoTheBlock

This cluster suggests sturdy help at $3,075, as holders at this stage could resist promoting at virtually each different stage between $3,251 and $3,591. Contemplating this place, Ethereum’s value is more likely to rally towards $3,600.

Nevertheless, if promoting stress will increase, this may not occur. In that state of affairs, ETH’s worth might lower under $3,000.