Ethereum has been on a downward pattern for the previous few days, struggling to remain above the $2,700 degree. After failing to interrupt previous this key resistance, the worth continues to drop, leaving traders questioning if extra declines are on the best way. On this Ethereum worth prediction article, we’ll take a better have a look at what’s driving Ethereum’s current efficiency and what may occur subsequent.

How has the Ethereum Value Moved Just lately?

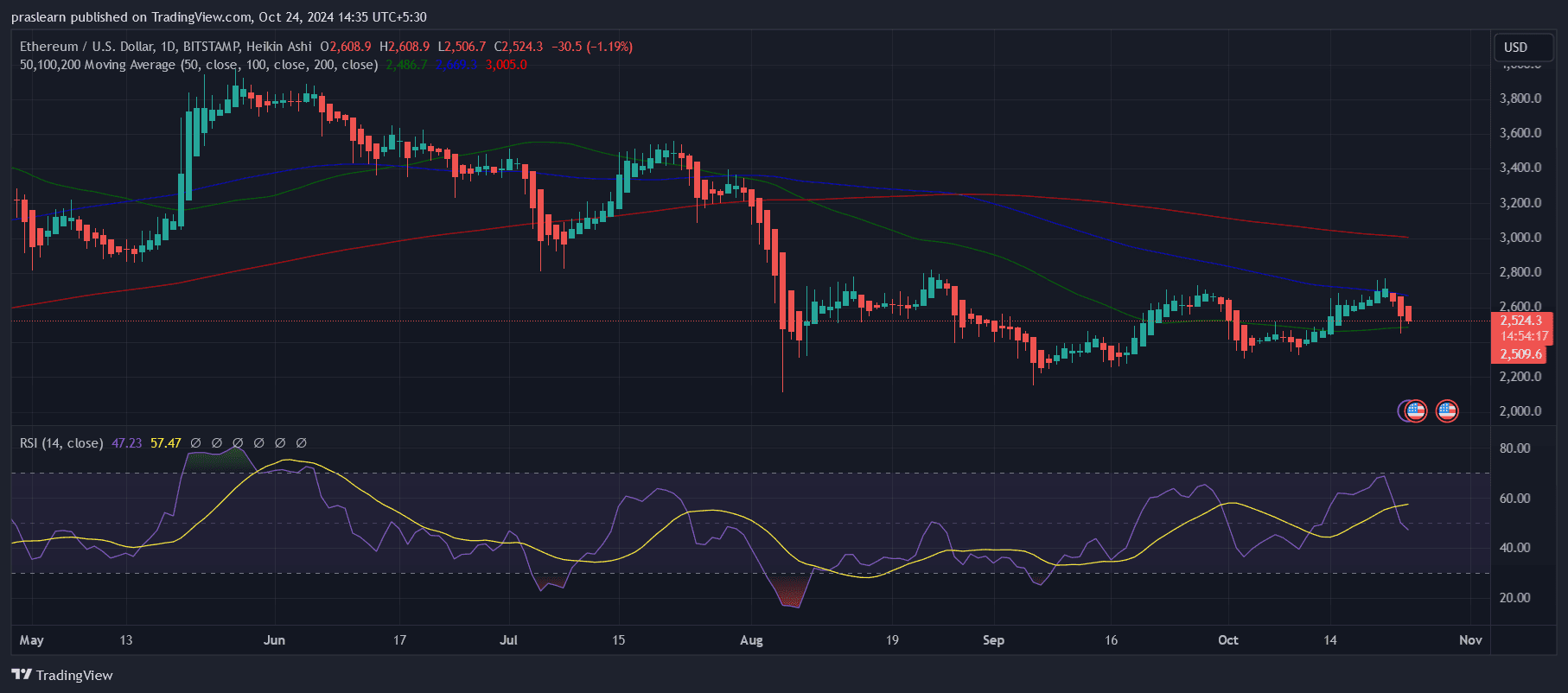

ETH/USD Each day Chart- TradingView

Ethereum is presently priced at $2,547.76, with a 24-hour buying and selling quantity of $26.99 billion, a market capitalization of $306.69 billion, and a market dominance of 13.10%. During the last 24 hours, Ethereum’s worth has dropped by 1.70%.

Ethereum’s all-time excessive was reached on November 10, 2021, when it traded at $4,867.17. Its lowest worth was recorded on October 21, 2015, at simply $0.42. Since hitting its peak, the bottom level Ethereum has fallen to is $897.01, whereas its highest rebound since then reached $4,094.18. At the moment, the market sentiment surrounding Ethereum is bearish, and the Worry & Greed Index sits at 69, indicating a “Greed” sentiment amongst traders.

The circulating provide of Ethereum stands at 120.38 million ETH, with a yearly provide inflation price of 0.09%, which means a further 111,486 ETH have been created previously 12 months.

Why is Ethereum Value Down?

Ethereum’s worth decline will be attributed to a mixture of things which have created uncertainty and weakened investor sentiment. On October 23, studies surfaced that the Ethereum Basis bought one other batch of ETH tokens, a transfer that sometimes alerts warning to the market.

Such actions typically trigger considerations amongst traders, because it implies that insiders might imagine the present worth is excessive or that they’re hedging in opposition to potential future declines. This information provides to the continuing struggles Ethereum has confronted, together with an underwhelming efficiency of a number of spot ETFs within the U.S., which had been anticipated to spice up curiosity and demand for ETH however did not ship the anticipated market influence.

One other key issue contributing to Ethereum’s worth dip is the decline in its Complete Worth Locked (TVL) throughout decentralized finance (DeFi) protocols. Since mid-June, Ethereum’s TVL has dropped by over 2% previously 30 days, underperforming different high layer-1 protocols like Solana, which skilled a 22% enhance in TVL throughout the identical interval.

The shrinking TVL signifies diminished exercise and capital flowing into the Ethereum community, signaling a possible lack of curiosity amongst builders and customers in its DeFi ecosystem. This drop from a year-to-date peak of $66 billion to the present $48 billion underscores the challenges Ethereum faces in sustaining its dominance within the DeFi house.

Wanting forward, Ethereum’s near-term worth actions might stay underneath stress until important catalysts, akin to main technical upgrades or shifts in market sentiment, emerge. Nevertheless, there are formidable targets inside Ethereum’s roadmap that might change its trajectory in the long run.

Co-founder Vitalik Buterin has not too long ago reiterated Ethereum’s plans to realize 1,000 transactions per second by way of the “Surge” section of its improvement. If Ethereum can efficiently implement these upgrades and enhance scalability, it may restore investor confidence and reignite demand. Within the quick time period, nevertheless, Ethereum might proceed to face bearish sentiment, particularly if broader market circumstances stay unsure and opponents like Solana proceed to realize momentum within the DeFi house.

Ethereum Value Prediction: How excessive can the Ethereum Value Go?

Ethereum’s potential for future worth development hinges on a mixture of constructive and difficult components. During the last 12 months, Ethereum has seen a worth enhance of 43%, reflecting its resilience and regular demand within the broader cryptocurrency market.

Moreover, Ethereum advantages from excessive liquidity, given its giant market cap and robust presence in decentralized finance (DeFi) and good contract platforms. Its comparatively low yearly inflation price of 0.09%, which means solely a small variety of new tokens are being created, helps forestall important dilution of present holdings, supporting long-term worth stability.

Nevertheless, Ethereum has underperformed in comparison with 59% of the highest 100 crypto property over the identical interval, and it has notably lagged behind Bitcoin. This underperformance signifies that whereas Ethereum has proven regular development, different property have attracted extra important consideration and capital, resulting in stronger features.

Moreover, Ethereum is presently buying and selling beneath its 200-day easy transferring common (SMA), a technical indicator that sometimes alerts bearish market sentiment within the close to time period. Solely 14 out of the final 30 days have been “inexperienced,” suggesting that Ethereum has struggled to take care of upward momentum not too long ago.

Regardless of these headwinds, Ethereum’s roadmap gives substantial upside potential in the long run. The formidable aim of reaching 1,000 transactions per second as a part of the “Surge” section may considerably improve Ethereum’s scalability, attracting extra customers and builders to its platform.

If these upgrades are efficiently carried out, Ethereum may regain its aggressive edge, positioning it as a number one blockchain for DeFi, NFTs, and decentralized purposes.

Wanting on the potential for worth development, if Ethereum can break above its present technical resistance, together with its 200-day SMA, and if broader market sentiment turns bullish, Ethereum may see important upward motion. Within the quick to medium time period, a rally in direction of its all-time excessive of $4,867.17 is feasible, notably if market circumstances enhance and Ethereum’s upgrades bolster its performance.

Nevertheless, any sustained rally would require a shift in investor sentiment and stronger efficiency relative to opponents like Bitcoin. In abstract, whereas Ethereum has the potential to maneuver considerably larger, it might want to overcome present market challenges and show the worth of its upcoming technical developments to unlock that development.