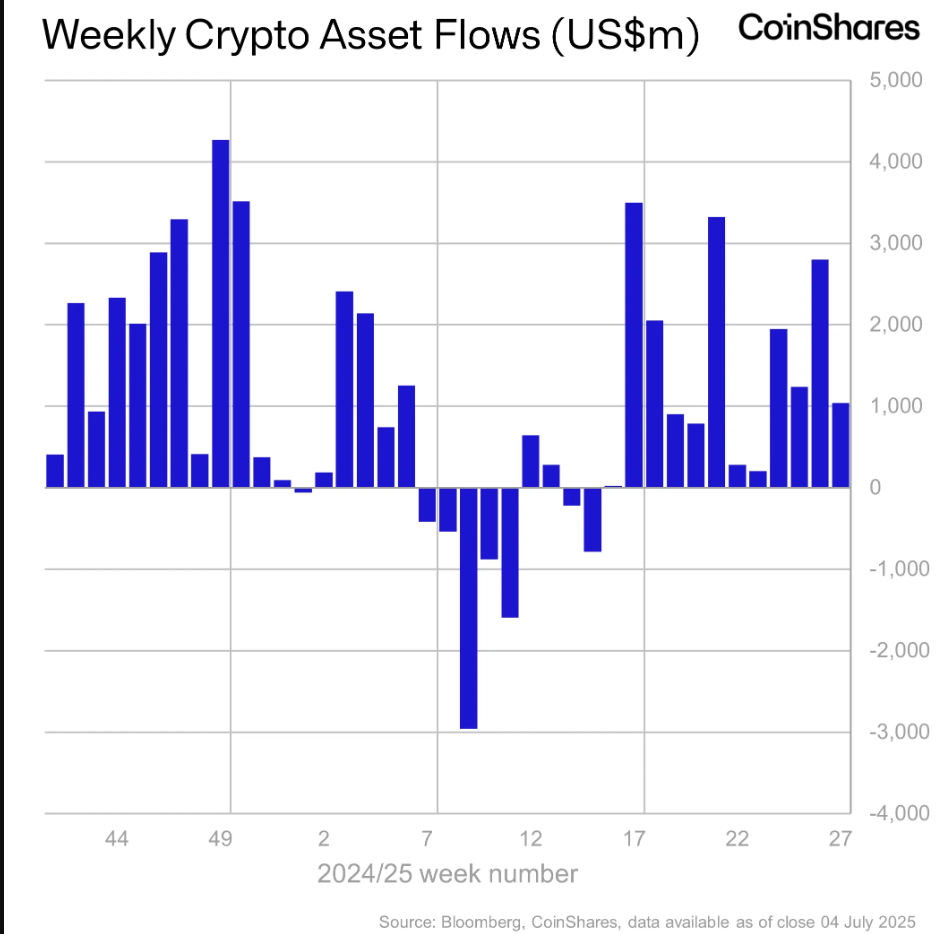

Institutional digital asset funding automobiles have loved over $18 billion in inflows during the last twelve weeks, in response to crypto asset administration agency CoinShares.

In its newest Digital Asset Fund Flows Weekly Report, CoinShares finds that inflows into institutional crypto funding automobiles within the final twelve weeks have pushed belongings underneath administration (AuM) to new all-time highs.

“Digital asset funding merchandise recorded inflows of US$1.04bn final week, marking the twelfth consecutive week of inflows, which now complete US$18bn. Value positive aspects over the week pushed complete belongings underneath administration (AuM) to a brand new all-time excessive of US$188bn. Buying and selling volumes reached US$16.3bn, consistent with the weekly common to this point this yr.”

Supply: CoinShares

Regionally talking, the US led the cost with $1 billion in inflows. Switzerland and Germany additionally offered inflows of $33.7 million and $38.5 million. In the meantime, Canada and Brazil noticed outflows of $29.3 million and $9.7 million, respectively.

Bitcoin (BTC), as is the flagship crypto’s customized, loved the largest inflows, however this time, with a catch.

“Bitcoin funding merchandise noticed inflows of US$790m final week, marking a slowdown from the earlier three weeks, which averaged US$1.5bn.

The moderation in inflows means that traders have gotten extra cautious as Bitcoin approaches its all-time excessive value ranges.”

Ethereum (ETH) continued its eleventh consecutive week of inflows, including $226 million in inflows final week alone in a continued outperformance of altcoins.

“On a proportional foundation, weekly inflows throughout this run have averaged 1.6% of AuM, considerably greater than Bitcoin’s 0.8%, highlighting a notable shift in investor sentiment in favor of Ethereum.”