The Ethereum (ETH) market has skilled some latest good fortunes rising by over 5% previously 24 hours. Regardless of this worth achieve, the distinguished altcoin stays in a downtrend as indicated by its 11.17% loss previously week. Nonetheless, distinguished analytics platform Glassnode has found an essential worth stage that might provide some short-term assist.

Buyers Enhance Accumulation By 300,000 ETH At This Worth Area – What May It Imply?

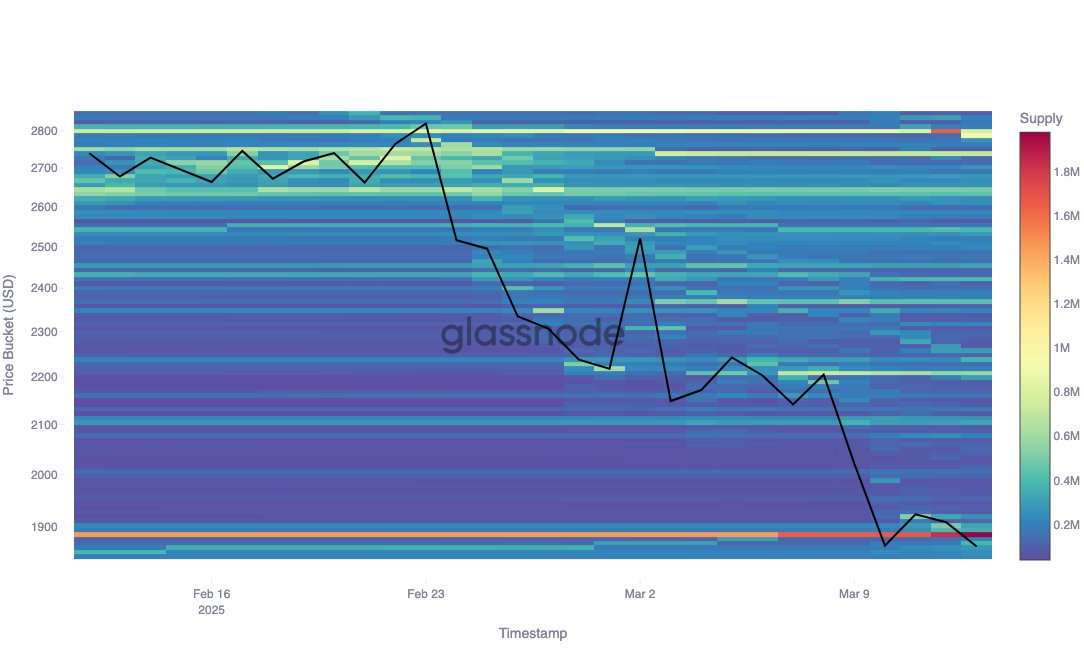

In an X submit on March 14, Glassnode supplied an intriguing evaluation of the ETH market highlighting a possible robust assist stage. Primarily based on the Price Foundation Distribution (CBD) metric, these analysts imagine ETH is more likely to hit a significant assist zone on the $1,886 worth stage within the case of an additional worth decline.

Within the crypto market, CBD represents an important on-chain metric that tracks the worth ranges at which tokens had been final bought or purchased. When a major variety of cash is acquired inside a particular worth vary, that zone typically serves as a assist or resistance stage.

In keeping with Glassnode, Ethereum’s CBD information reveals that buyers’ provide at $1,886 has grown from 1.6 million ETH to 1.9 million ETH indicating the acquisition of a further 300,000 ETH when worth final reached this stage. This improvement postulates that a good portion of buyers view $1,886 as an important worth level and are more likely to improve their holdings on this area to stop any additional decline thus making a viable assist zone.

Glassnode notes that this postulation aligns with insights from its customized capitulation metric design to seize worth capitulation occasions leveraging using weighted promote volumes and non-linear financial ache skilled by buyers. Nonetheless, it’s price noting that the $1,886 worth stage can solely provide short-term assist suggesting a possible worth capitulation within the presence of overwhelming promoting stress.

Ethereum Worth Overview

On the time of writing, Ethereum trades at $1,924 following a 5% achieve on the final day as beforehand said. In the meantime, the market’s day by day buying and selling quantity is down by 29.29% and valued at $12.91 billion. Curiously, the Relative Power Index metric suggests Ethereum may quickly enter the oversold area and probably expertise a worth reversal.

Nonetheless, ETH bulls are confronted with a number of resistance zones at $2,249, $2,539, and $2,829 if they’re to tug off any vital rebound and halt the present downtrend. However, any decisive worth fall under $1,886 may result in decrease ranges Similar to $1,650 and $1,132.

Featured picture from iStock, chart from Tradingview