Ethereum (ETH) at the moment trades roughly 11% under its native highs of round $2,730. Buyers are optimistic a few potential value surge within the coming days, pushed by encouraging on-chain information.

Key metrics from Glassnode point out a decline in ETH inflows into exchanges, suggesting that buyers are holding onto their property fairly than promoting. This development usually factors to elevated accumulation and will foreshadow a bullish breakout.

Because the broader crypto market evolves, Ethereum buyers stay vigilant, anticipating a bullish reclaim that would propel costs larger. The lower in alternate inflows may signify that merchants are positioning themselves for a possible upward motion, as they appear extra inclined to retain their holdings throughout this significant section.

Ought to Ethereum efficiently break above essential resistance ranges, it may reignite bullish momentum and entice additional funding. The subsequent few days will probably be pivotal for ETH, as merchants intently monitor value motion and on-chain metrics for indicators of a resurgence. With the precise situations, Ethereum could set its sights on new highs, reinforcing the general constructive sentiment out there.

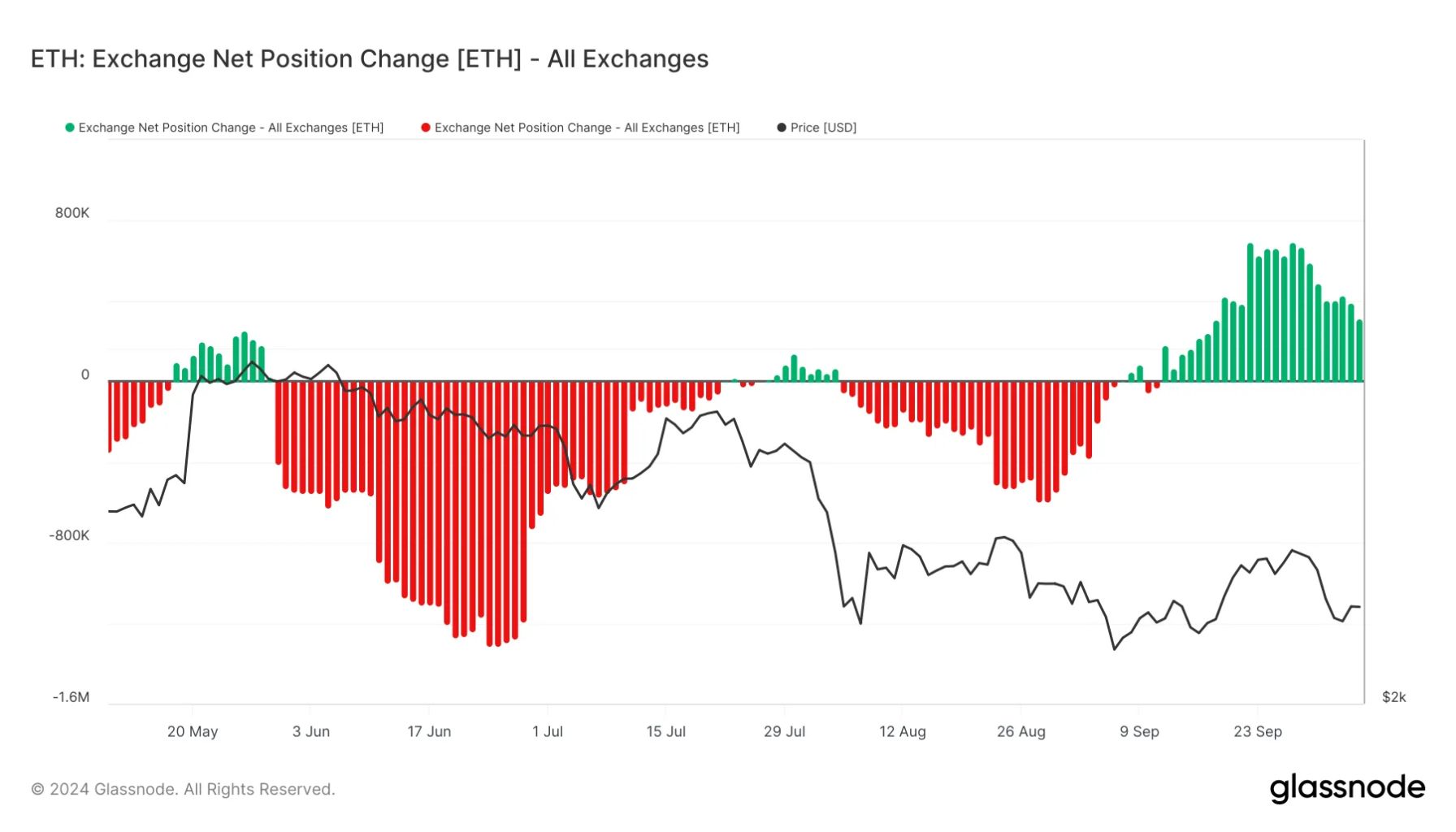

Ethereum Exchanges’ Internet Place Change Decreases

Ethereum (ETH) is at the moment at a vital value degree following a 15% dip from its native highs. The broader crypto business is brimming with anticipation for an enormous rally after the Federal Reserve’s choice to chop rates of interest a few weeks in the past. Nevertheless, regardless of the optimistic outlook, costs have struggled to climb larger, leaving many buyers on edge.

Luckily, on-chain information from Glassnode suggests a discount in promoting stress, which may enhance market sentiment and pave the best way for a possible ETH rebound. One key metric to contemplate is the Ethereum Exchanges’ Internet Place Change indicator, which has been downward since mid-September. This indicator tracks the stream of ETH into and out of exchanges, and its latest decline signifies that inflows have dropped considerably.

Decrease inflows usually point out diminished promoting stress, as fewer buyers are transferring their property onto exchanges to promote. This shift in momentum displays a constructive change in market sentiment, suggesting that buyers could also be much less inclined to liquidate their positions at present value ranges.

As promoting exercise decreases, Ethereum may achieve some much-needed respiratory room to recuperate from its latest decline.

Furthermore, elevated confidence amongst buyers may result in upward value motion within the coming days. Ethereum could also be positioned for a resurgence if this development continues, probably setting the stage for a bullish breakout as market dynamics shift in its favor. As merchants stay vigilant, all eyes will probably be on ETH to see if it could actually capitalize on this improved sentiment and regain upward momentum.

ETH Testing Essential Provide Ranges

Ethereum (ETH) is buying and selling at $2,448 after dealing with rejection on the 4-hour 200 exponential transferring common (EMA) at $2,516. The worth additionally struggled to keep up momentum above the 4-hour 200 transferring common (MA) at $2,458, indicating a essential second for ETH. If Ethereum fails to reclaim each of those key ranges within the coming days, it could be at severe danger of dropping in direction of the $2,200 space, probably triggering a deeper correction.

Conversely, if ETH manages to interrupt above and maintain these essential indicators, it may sign a bullish development reversal, opening the door for a surge towards the $2,700 resistance space. The result within the subsequent few days will probably be important for figuring out Ethereum’s trajectory.

Merchants and buyers will intently monitor these ranges, as the power to reclaim them may present the momentum wanted for ETH to regain power and try to check larger value ranges. The present value motion displays the uncertainty out there, making it crucial for ETH to claim itself decisively to encourage confidence and drive a rally.

Featured picture from Dall-E, chart from TradingView