Ethereum lastly broke above $3,000 right this moment, a psychological stage it’s struggled with for months. However what’s notable is what drove the transfer; a spike in short-term pockets exercise that means retail demand is waking up.

Mixed with constant ETF inflows and structural resistance ranges now being examined, ETH seems poised for its subsequent main transfer. The actual query: can this momentum maintain?

Retail Demand is Waking Up, and It’s Seen On-Chain

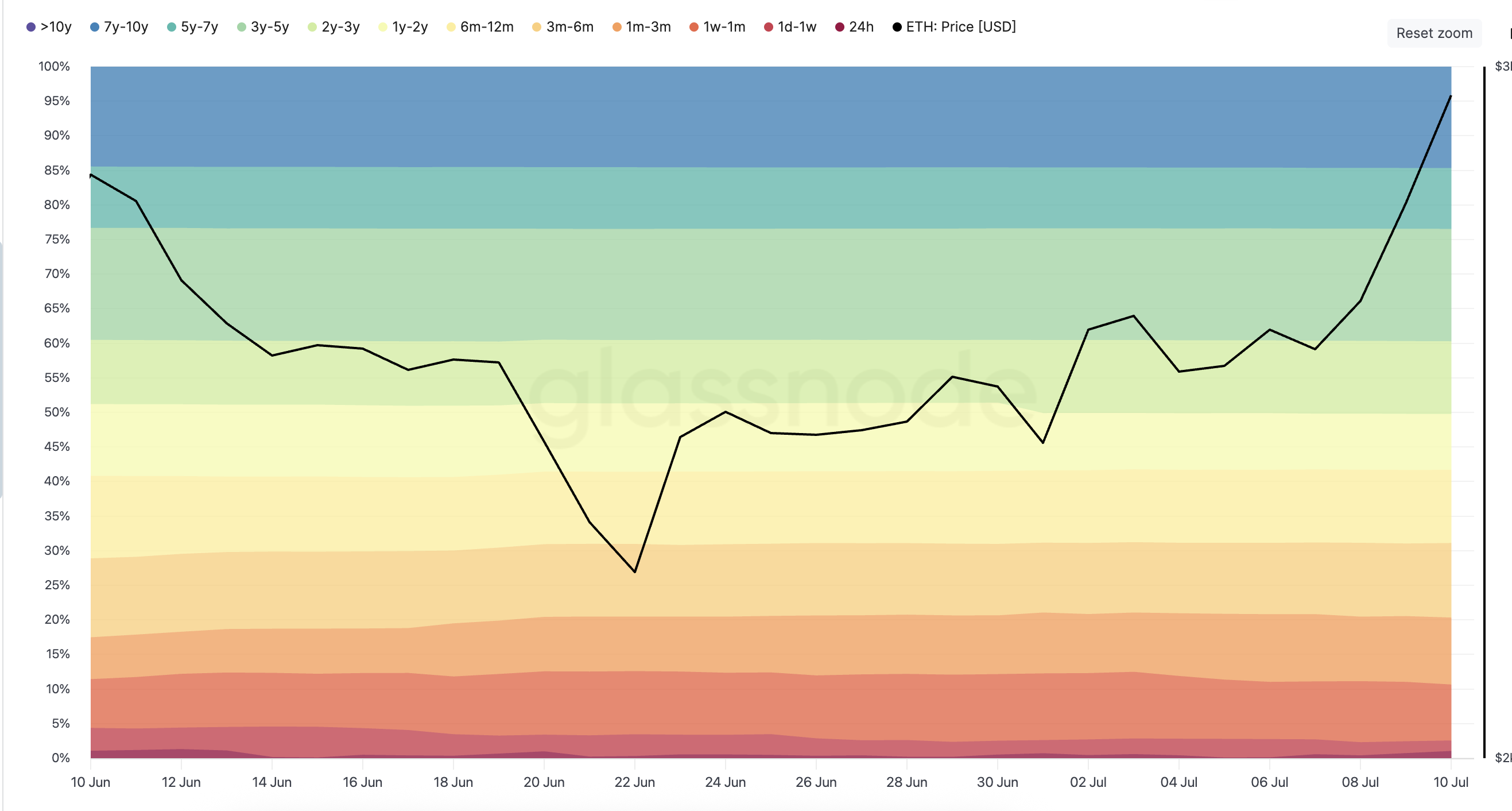

ETH worth break above $3,000 isn’t simply technical; it’s behavioral. In keeping with Glassnode’s HODL Waves, which measure the proportion of ETH held throughout completely different age bands, short-term holders (particularly 1w–1m, 1m–3m, and even 10Y bands) have grown steadily over the previous few days.

HODL waves and ETH worth (1 month interval): Glassnode

This spike exhibits elevated participation from newer wallets, a proxy for retail demand.

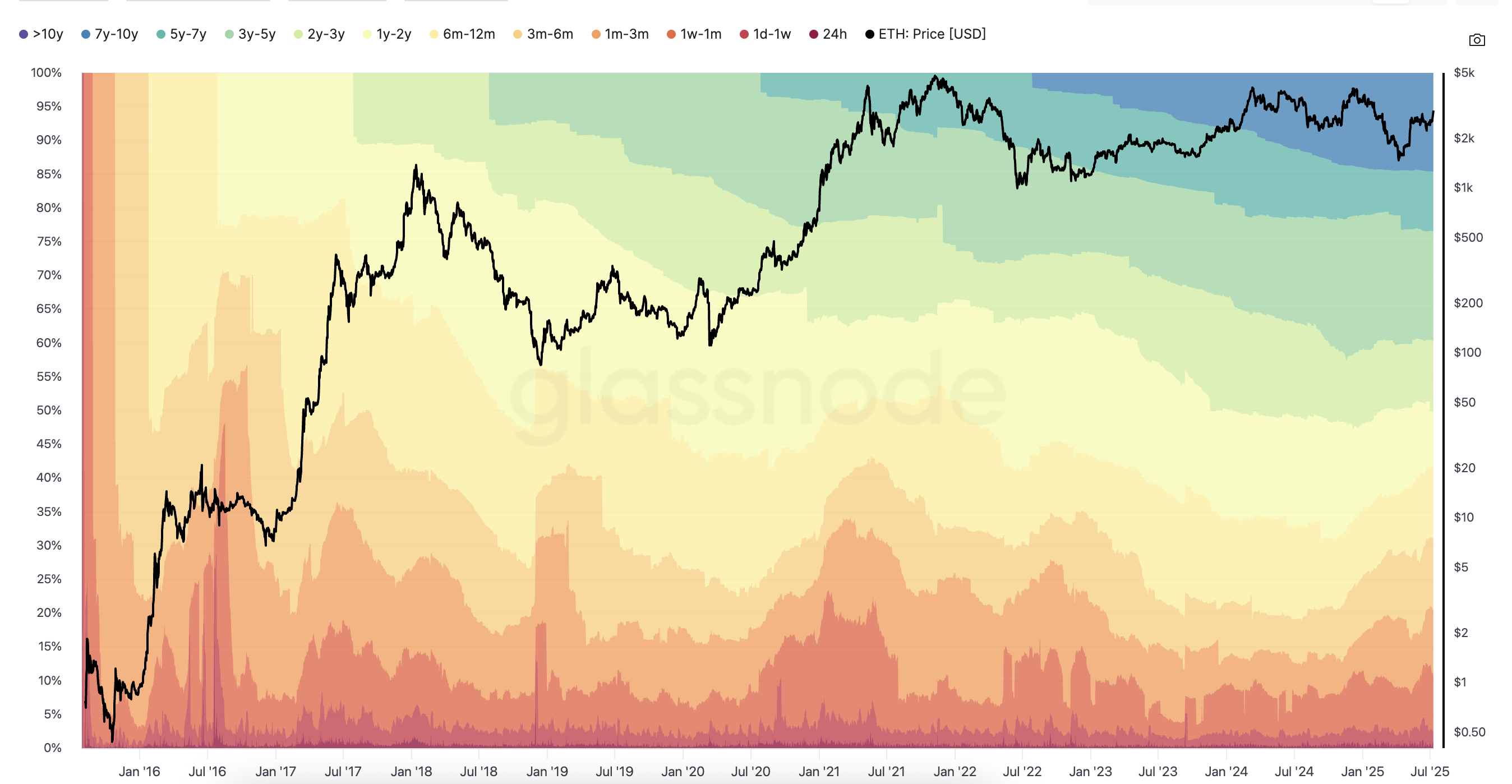

In comparison with the all-time HODL wave chart, the place long-term holding bands normally stay dominant, this sudden bump in short-term cohorts stands out. It indicators a rotation into energetic buying and selling habits.

All-time HODL Waves chart: Glassnode

HODL Waves symbolize how lengthy cash sit in wallets. Progress in short-term bands indicators renewed retail exercise (new ETH acquires), whereas long-term bands symbolize chilly storage and conviction. In ETH’s case, it’s each.

Pockets Clusters May Dictate Momentum’s Subsequent Transfer

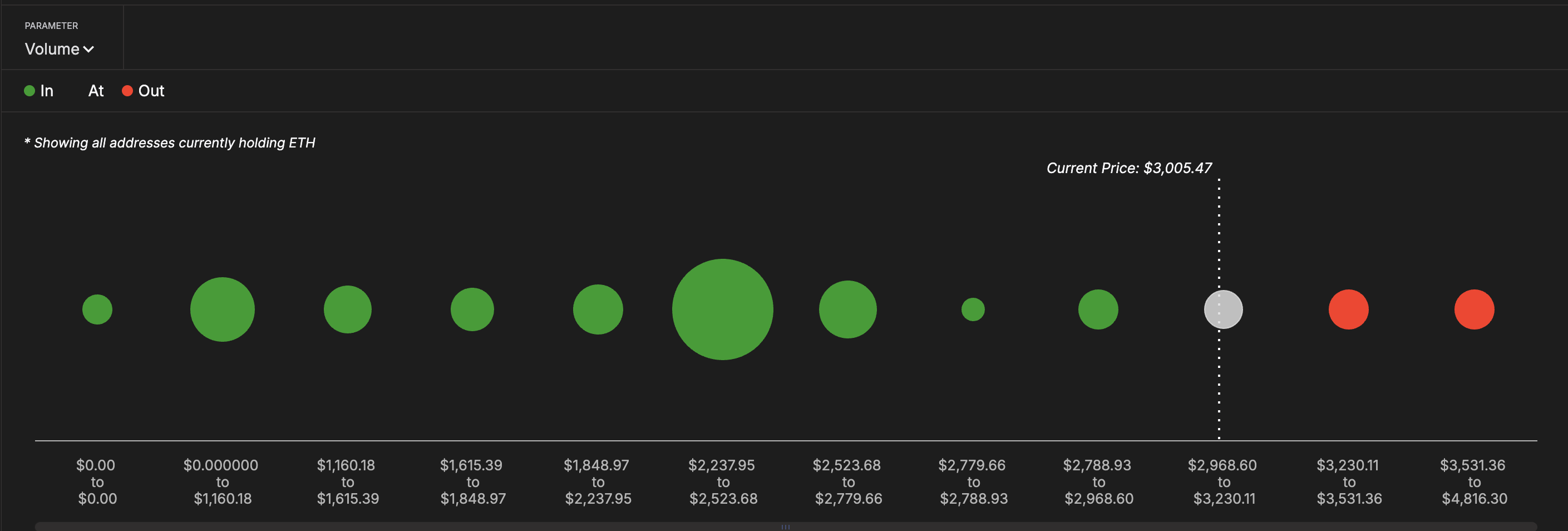

As Ethereum assessments the $3,000 zone, the In and Out of the Cash information provides important context to how a lot leg room this rally truly has.

At present, the biggest on-chain pockets cluster sits between $2,237 and $2,523, the place hundreds of thousands of addresses are presently in revenue. This vary serves as the bottom of the present transfer, indicating the place conviction seemingly originated. If momentum weakens, this stage is more than likely to behave as robust help, as holders in revenue are likely to double down moderately than promote.

Key pockets clusters utilizing In/Out of Cash indicator: IntoTheBlock

Above present ranges, nevertheless, Ethereum is getting into a breakeven-heavy band between $2,968 and $3,230. Previous this, the following crimson zone of out-of-the-money holders sits above $3,230, the place profit-taking danger will increase.

The In/Out of the Cash metric exhibits the place present ETH holders purchased their cash. Clusters symbolize zones of purchaser density, usually appearing as comfortable help or resistance relying on sentiment.

The breakeven band Ethereum is navigating proper now could be the place momentum will get examined (strongest resistance to be exact). Break it cleanly, and the trail to $3,500 opens up. Lose it, and the rally dangers slipping again to stronger conviction zones round $2,523.

Value Ranges and Momentum Hinge on Fibonacci and OBV Divergence

Ethereum’s latest push above $3,000 brings it to a key resistance zone; the 0.618 Fibonacci extension, drawn utilizing trend-based ranges from the $1,388 swing low, $2,869 peak, and the retracement low of $2,123. This places $3,045 because the instant resistance, and $3,295 (0.786 Fib stage) as the following ceiling if the rally holds.

ETH worth evaluation: TradingView

These Fib ranges don’t simply stand alone. They intently align with the In and Out of the Cash resistance clusters between $2,968 and $3,230, the place a big group of ETH holders is sitting at breakeven. This confluence reinforces the concept momentum is being examined right here, each by technicals and pockets habits.

Above this vary, the following goal turns into $3,615; the 1 Fibonacci stage, however provided that momentum sustains.

ETH worth and OBV divergence: TradingView

Nonetheless, one key metric is flashing a warning. Regardless of ETH’s worth pushing greater, the On-Steadiness Quantity (OBV) has failed to interrupt previous its earlier excessive from the final peak at $2,890. This divergence signifies that quantity isn’t absolutely supporting the rally; a traditional signal of momentum stalling.

OBV tracks the cumulative internet quantity. If worth rises whereas OBV falls, it usually indicators weakening demand or fewer new patrons getting into the market.

A breakdown beneath $2,693 would verify the divergence’s weight on the 0.382 Fib stage. This stage would turn out to be the technical invalidation level and will push ETH costs in the direction of $2,475 or decrease.