Ethereum worth is down by greater than 5% right now, buying and selling round $4,300. This marks one in all its sharpest every day drops in weeks. But, month-to-month features stay intact at greater than 13%, displaying that the broader uptrend isn’t damaged.

The query now’s whether or not right now’s fall is simply noise or the beginning of one thing deeper. On-chain and technical alerts counsel the dip might not final lengthy, with revenue reserving easing and whales stepping in.

Revenue Taking Eases As Whales Add $1 Billion ETH

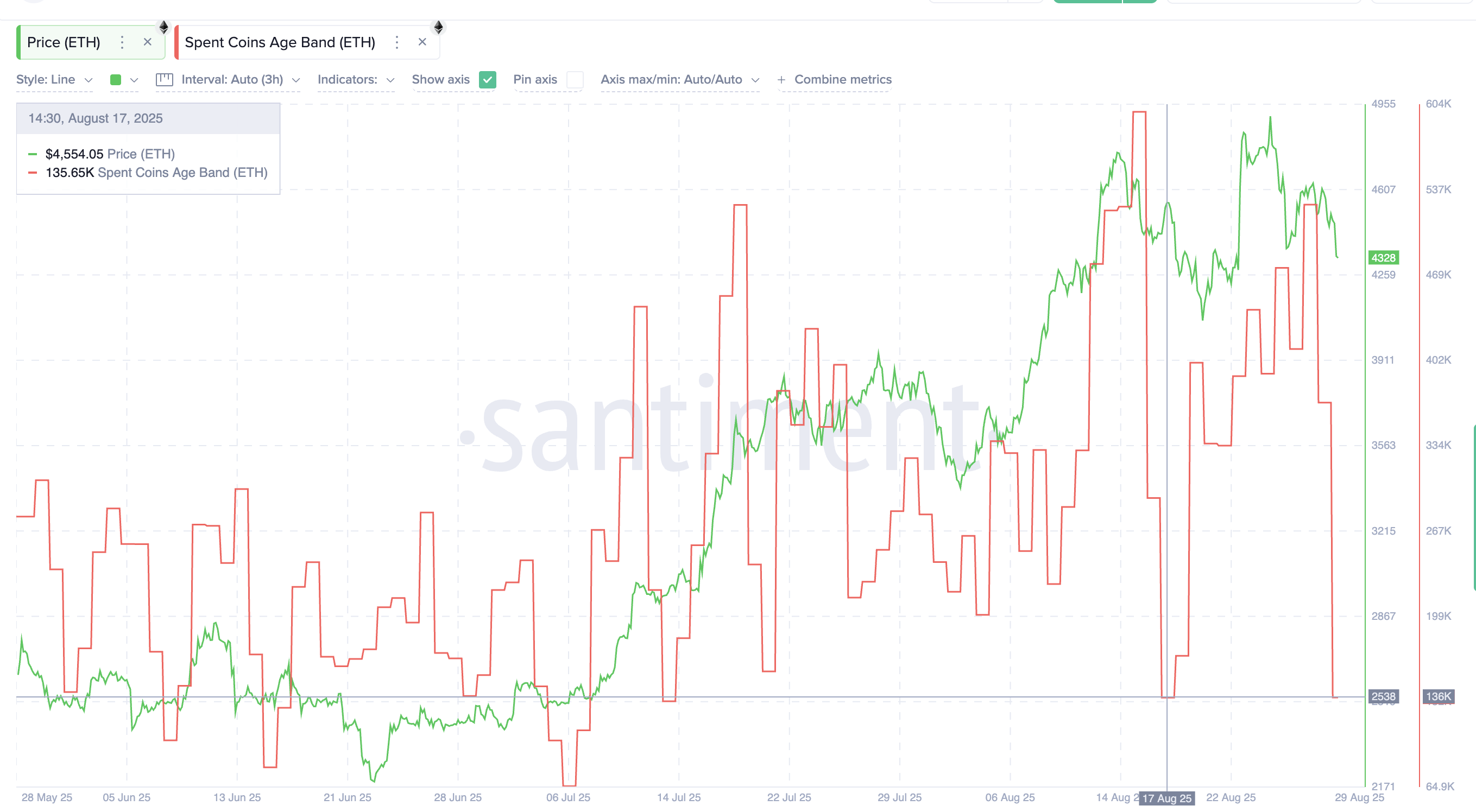

The Spent Cash Age Band, which tracks when long-held cash are bought, has dropped to a month-low of about 135,000 ETH. Which means that long-term holders are promoting much less — profit-taking has eased sharply in comparison with earlier in August, when the metric was above 525,000 ETH. That’s a 74% drop.

Ethereum Revenue Taking Eases: Santiment

Historical past reveals that when this metric bottoms out, Ethereum usually bounces. For instance:

- On July 7, spent cash fell to 64,900 ETH, and the Ethereum worth rallied from about $2,530 to $3,862 — a 52% bounce.

- On August 17, the identical sample led to a 20% transfer, as ETH climbed from $4,074 to $4,888.

Now, the most recent drop again to native lows might once more counsel that the wave of promoting is waning.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

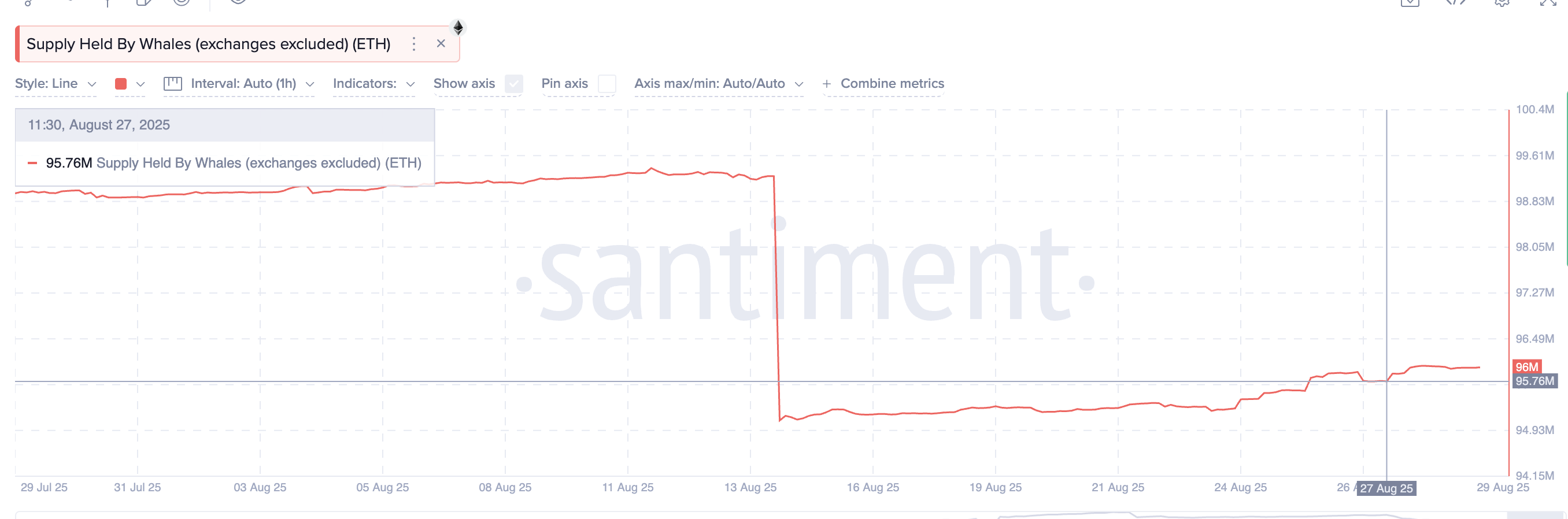

Moreover, whales have been quietly shopping for the dip. Addresses holding over 10,000 ETH have elevated their stash from 95.76 million ETH on August 27 to about 96 million ETH now.

Ethereum Whales Accumulating: Santiment

At present costs, which means whales added roughly $1 billion value of ETH in simply two days. Collectively, easing revenue reserving and recent whale accumulation give Ethereum a base for the following leg larger.

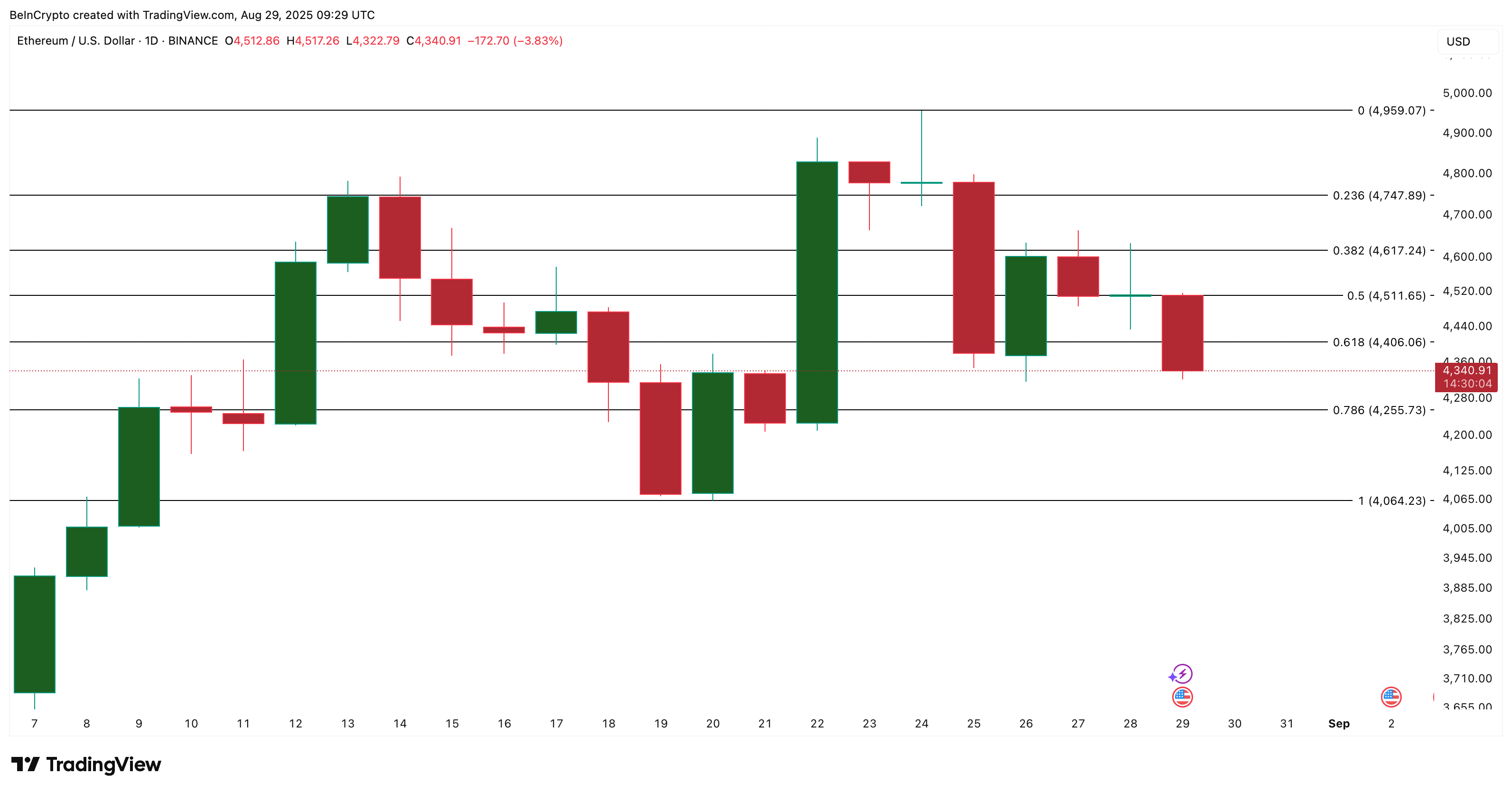

Ethereum Worth Motion and Liquidation Map Align At Key Ranges

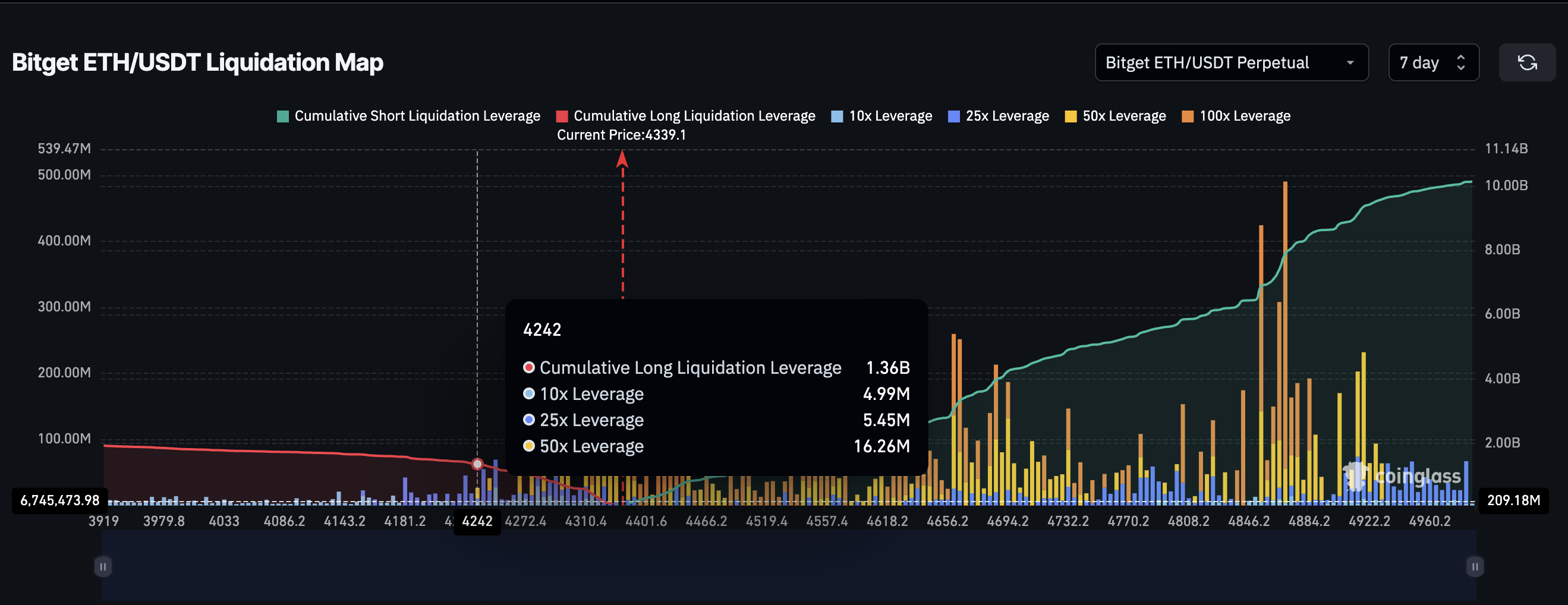

Past on-chain alerts, the charts additionally align with the uptrend view. On the Bitget liquidation warmth map, brief place stacking begins at $4,400, which makes the extent a vital pivot.

If ETH manages a every day candle shut above $4,406, it may set off liquidations of these shorts, forcing merchants to purchase again and pushing the Ethereum worth larger.

Liquidation mapping reveals the place merchants have positioned heavy leverage positions (longs and shorts) and at what worth ranges liquidations would happen.

Ethereum Liquidation Map: Coinglass

On the draw back, instant help sits round $4,255, which aligns with the $4,242 stage on the liquidation map. That is the extent the place probably the most leveraged lengthy positions get liquidated.

Due to this fact, if the Ethereum worth manages to carry at $4,255, a dip reversal could be possible as leveraged draw back threat weakens.

If the ETH worth breaks under that, the following key stage is $4,064. A dip underneath this stage would possible flip the development bearish within the brief time period.

Ethereum Worth Evaluation: TradingView

The alignment between liquidation clusters and worth chart ranges provides credibility to those zones. It means merchants are all watching the identical numbers, making the response at these factors even stronger.

For now, the trail is evident: maintain above $4,255 and reclaim $4,406, and the case for a reversal strengthens. Fail at these ranges, and the Ethereum worth dangers extending its dip.

The put up Ethereum Dip Could Be Momentary with $1 Billion Whale Buys and Slower Revenue Taking appeared first on BeInCrypto.