Ethereum (ETH) prolonged its downward development in the present day, resulting in widespread liquidations and thousands and thousands in losses for crypto merchants.

This comes amid a broader decline within the crypto market. Main cryptocurrencies are persevering with to undergo losses, and in the present day isn’t any exception.

Ethereum’s Market Correction Hits Merchants Arduous

BeInCrypto Markets knowledge confirmed that ETH has slipped 7.3% for the reason that starting of the week. This dip follows the second-largest cryptocurrency’s rise to multi-year highs.

Ethereum’s worth has decreased 1.54% over the previous day alone. On the time of writing, it was buying and selling at $4,166.

Ethereum (ETH) Worth Efficiency. Supply: BeInCrypto Markets

Whereas corrections are typical, they proved expensive for many who wagered in the marketplace transferring upwards. CoinGlass knowledge revealed complete liquidations reached $486.6 million over the previous 24 hours.

This determine mirrored the liquidation of 136,855 merchants. Ethereum bore the brunt of the market drop, with $196.8 million in positions liquidated. Of this, $155.15 million got here from lengthy positions.

Lookonchain, a blockchain analytics agency, just lately spotlighted a dealer who profited thousands and thousands by going lengthy on Ethereum, solely to see almost all these positive aspects worn out inside two days.

The dealer started with a $125,000 deposit into Hyperliquid 4 months in the past. He strategically entered lengthy positions on ETH throughout two accounts. The dealer used his earnings to spice up his place to 66,749 ETH.

With this technique, his complete fairness surged from $125,000 to a powerful $29.6 million. Moreover, earlier this week, this dealer closed all 66,749 ETH lengthy positions, securing a revenue of $6.86 million.

Nonetheless, amid the latest market crash, the dealer re-entered the ETH market however was finally liquidated, dropping $6.22 million within the course of.

“Beginning with simply $125,000, he grew his accounts to $6.99 million (peaking $43 million+). Now solely $771,000 stays—4 months of positive aspects almost worn out in simply 2 days,” Lookonchain famous.

James Wynn, a high-risk leverage dealer, additionally skilled partial liquidation. Lookonchain reported that Wynn opened a 25x leveraged lengthy on ETH after claiming 19,206.72 USDC (USDC) in referral rewards. Nonetheless, because the market went south, his place was partially liquidated.

“James Wynn’s ETH lengthy was partially liquidated, leaving him with an extended place of 71.6 $ETH ($300,000),” the put up learn.

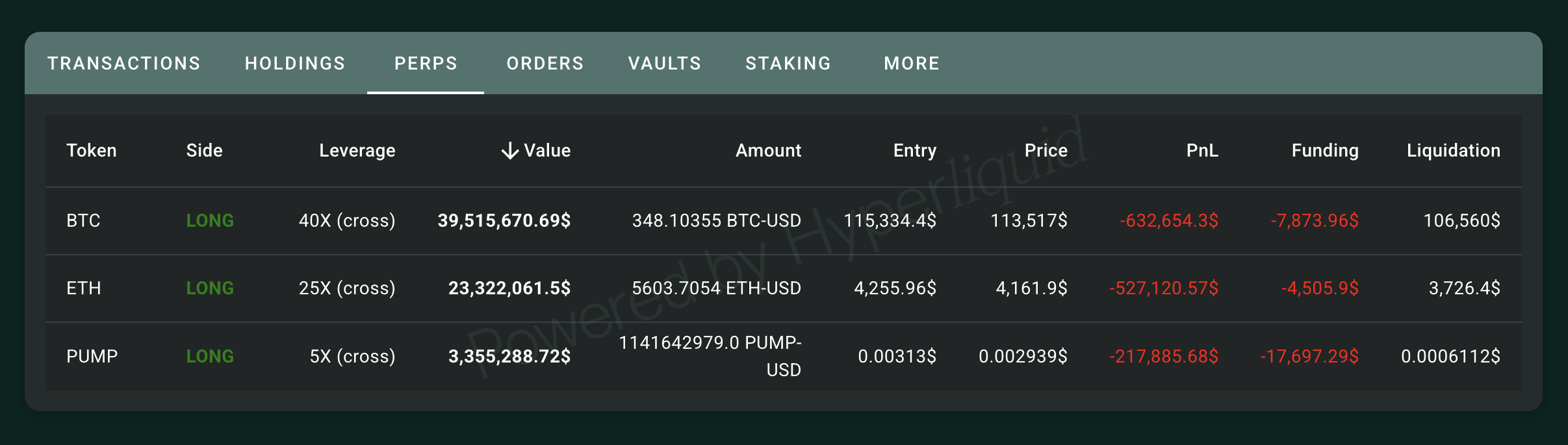

As well as, the blockchain analytics agency famous {that a} dealer made a 1 million USDC deposit into Hyperliquid yesterday. The funds have been used to open maximum-leverage lengthy positions on ETH, Bitcoin (BTC), and Pump.enjoyable (PUMP).

Nonetheless, the newest knowledge from HypurrScan confirmed that the dealer now faces unrealized losses exceeding $1 million.

Hyperliquid Dealer’s Lengthy Positions in Loss. Supply: HypurrScan

Institutional Buyers Are Shopping for The Dip

Amid the widespread liquidations, institutional traders are capitalizing on the ETH dip. Bitmine Immersion, the most important publicly traded ETH holder, acquired 52,475 ETH, pushing its complete ETH holdings to 1,575,848 ETH value almost $6.6 billion.

“SharpLink purchased 143,593 ETH($667 million) at $4,648 final week and presently holds 740,760 ETH ($3.19 billion). Along with Bitmine, they purchased 516,703 ETH($2.22 billion) final week,” Lookonchain wrote.

Moreover, two institution-linked wallets, 0x50A5 and 0x9bdB, acquired 9,044 ETH, valued at roughly $38 million, from FalconX. In addition to shopping for, panic-selling was additionally prevalent.

Whales are panic-selling $ETH because the market plummets!

0x1D8d deposited 17,972 $ETH($77.4M) to #Coinbase an hour in the past.

0x5A8E deposited 13,521 $ETH($57.72M) to #Binance prior to now 12 minutes.

0x3684 deposited 3,003 $ETH($12.89M) to #Binance 20 minutes in the past.… pic.twitter.com/oxKPQsl9Nv

— Lookonchain (@lookonchain) August 19, 2025

This highlights the varied methods traders are using in response to market situations. Nonetheless, institutional shopping for does sign robust confidence in Ethereum’s long-term potential.

The put up Ethereum Dip Triggers Million-Greenback Losses for Merchants appeared first on BeInCrypto.