- BlackRock and Constancy Ethereum ETF buyers are actually greater than 21 p.c down as ETH treads far beneath their entry costs.

- Since Might 16, ETFs have recorded 9 consecutive days of inflows of $435.6 million regardless of losses.

- Though Ethereum has not consolidated above $3,000 simply but, institutional demand is as excessive as it’s.

Ethereum ($ETH) is struggling beneath $2,650 whereas most ETF holders are nonetheless deep within the pink. Glassnode recorded that the typical price bases of BlackRock and Constancy’s Ether ETFs are $3,300 and $3,500, respectively. ETH is at the moment buying and selling at $2,621, taking the full quantity of unrealized losses owing to the worth correction to greater than 20%.

📉 The typical ETH ETF investor is in a BIG LOSS.

In response to Glassnode, the typical prices foundation for the ETF buyers are $3.3k & $3.5k for BlackRock & Constancy respectively.

Have they got an opportunity this cycle? 🤔 pic.twitter.com/SvQvaMSFRC

— Coin Bureau (@coinbureau) Might 30, 2025

Nonetheless, prior to now two weeks, sentiment has turned. Geopolitical tensions and U.S. tariffs had fueled a chronic selloff from Ether, however the cryptocurrency has since risen by 44% from its yearly low of $1,472 in April.

$435.6 million was additionally famous in spot Ether ETFs flowing in throughout 9 consecutive days that started on Might 16. Inflows adopted a U.S. federal court docket’s determination to dam most of Trump’s import tariffs on excessive macro strain on crypto markets.

Regardless of this, nonetheless, analysts at Glassnode famous that the ETF does little to have an effect on spot value. On the time of launch, merchandise represented just one.5% of commerce quantity, hitting 2.5% solely briefly in November 2024 earlier than fading.

Institutional buyers, nonetheless, wouldn’t be leaping rapidly, this tepid response suggests, particularly for following earlier withdrawal waves in August 2024 and Q1 2025. Since launch, cumulative inflows for Ethereum ETFs have added as much as $2.94 billion, with institutional urge for food genuinely remaining albeit with dialled-back enthusiasm.

Market Construction Alerts Upside Potential

In response to Crypto Caesar, Ethereum broke out of a chronic downtrend in early Might after confirming a market construction shift (MsS). After the breakout, ETH cleared many resistance zones to achieve new help at $2,485.52. Now, analysts are in search of a continuation sample being set with larger lows surrounding the important thing degree.

Technical indicators additional help a bullish bias. Sustained demand pushes the RSI near progress within the overbought territory close to 66. Whereas not within the bearish space but, MACD readings are indicating a slower bullish momentum. A possible bounce from the $2,487 help may see the market check ranges round $2,880 after which $3,200 in time.

Supply: Buying and selling View

Additional success for Ethereum in reclaiming the $3,000 mark would gasoline renewed ETF shopping for that would assist institutional buyers wipe off their paper losses. If present help fails to carry, it could topple to $2,300 or beneath.

On-Chain Metrics Spotlight Tight Provide

In response to CryptoQuant trade reserve information, Ethereum balances on exchanges are nonetheless dropping. As of Might 30, the variety of ETH held on centralized platforms is at 19.5 million after reaching above 30 million earlier this yr. This long-term drawdown signifies much less sell-side strain as most buyers develop extra assured in self-custody.

Supply: CryptoQuant

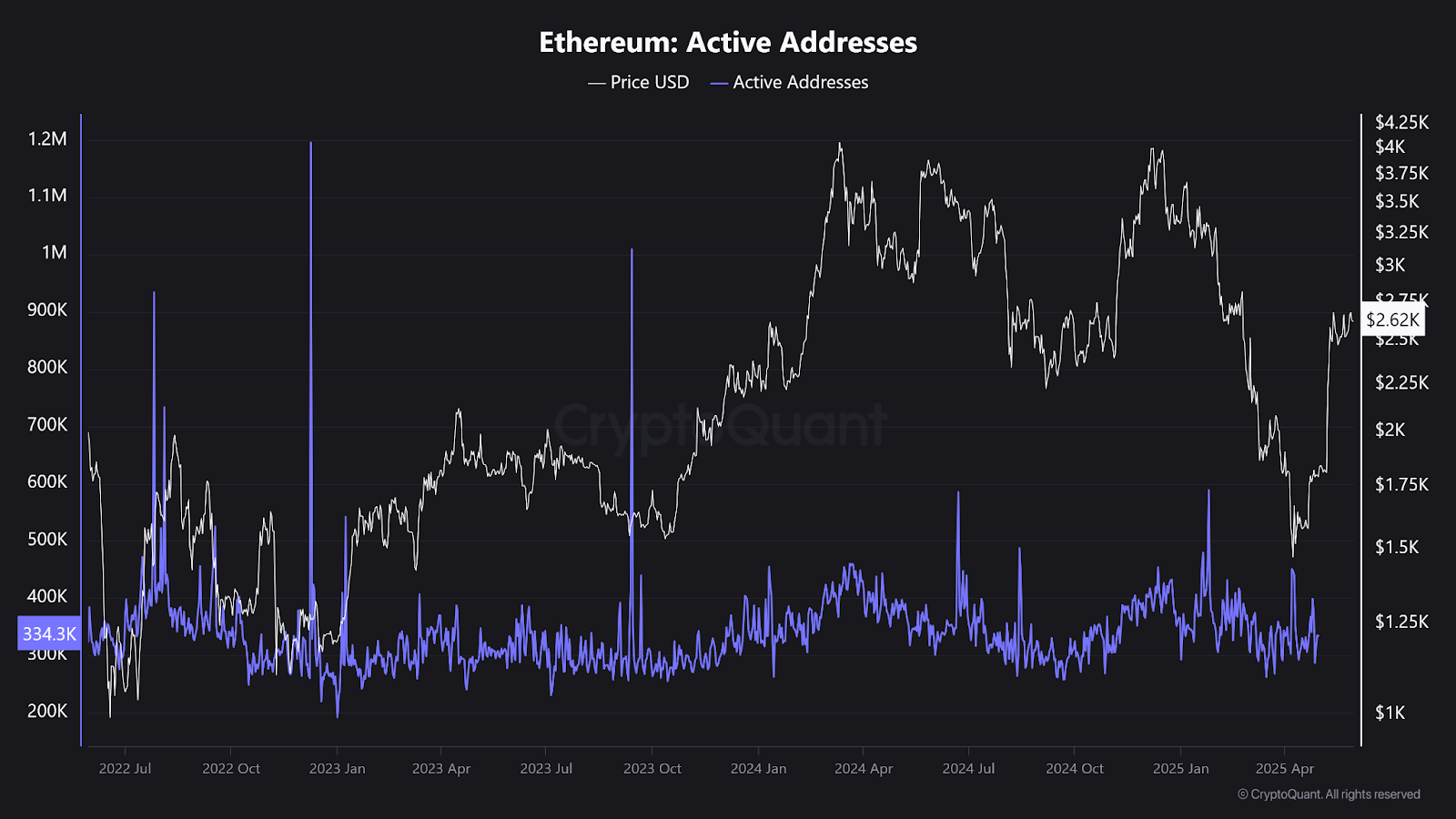

Energetic tackle counts, in the meantime, have dropped to 334,000, a degree not seen since early 2023. This dip might point out a lull in retail exercise, but it surely falls consistent with the present market construction dominated by ETFs when establishments buy in giant portions and with fewer addresses.

Supply: CryptoQuant

Ethereum derivatives open curiosity has risen to $35 billion, a rise of 8.8% within the final week. CoinGlass stated that constructive funding charges point out most merchants had been taking lengthy positions. In response to choices information, retail merchants are hoping to push the worth to $3,000 this month, whereas institutional gamers need to take it to $3,500 by June.