Ethereum reached a notable milestone earlier this month when the US Securities and Trade Fee (SEC) accepted choices buying and selling for a number of spot exchange-traded funds (ETFs). The transfer is predicted to extend liquidity, appeal to curiosity from institutional buyers, and solidify Ethereum’s place as a significant cryptocurrency.

But Ethereum’s smaller market cap relative to Bitcoin means it is usually susceptible to gamma squeezes, thereby growing investor dangers. BeInCrypto consulted an skilled in derivatives buying and selling and representatives from FalconX, BingX, Komodo Platform, and Gravity to investigate the potential influence of this new attribute.

Ethereum ETF Choices Achieve SEC Approval

The Ethereum group rejoiced earlier this month when the SEC accepted choices buying and selling for current Ethereum ETFs. This approval marks a major regulatory improvement for digital property.

This week marked the official debut of choices buying and selling for spot Ethereum ETFs in america. BlackRock’s iShares Ethereum Belief (ETHA) was the primary to record choices, with buying and selling commencing on the Nasdaq ISE.

Shortly after, a broader availability of choices adopted, together with these for the Grayscale Ethereum Belief (ETHE) and the Grayscale Ethereum Mini Belief (ETH), in addition to the Bitwise Ethereum ETF (ETHW), all of which started buying and selling on the Cboe BZX alternate.

This transfer permits a wider vary of buyers, past crypto merchants, to profit from hedging and hypothesis alternatives on Ethereum’s value via choices on acquainted funding autos like ETFs with out direct possession.

The timing of this information is especially constructive, as Ethereum has been shedding some floor available in the market currently.

Choices Buying and selling to Bolster Ethereum’s Market Place

A big decline in market confidence surrounded Ethereum this week, with BeInCrypto reporting its value had plummeted to its lowest level since March 2023. This drop coincided with a broader market downturn, worsened by Donald Trump’s Liberation Day.

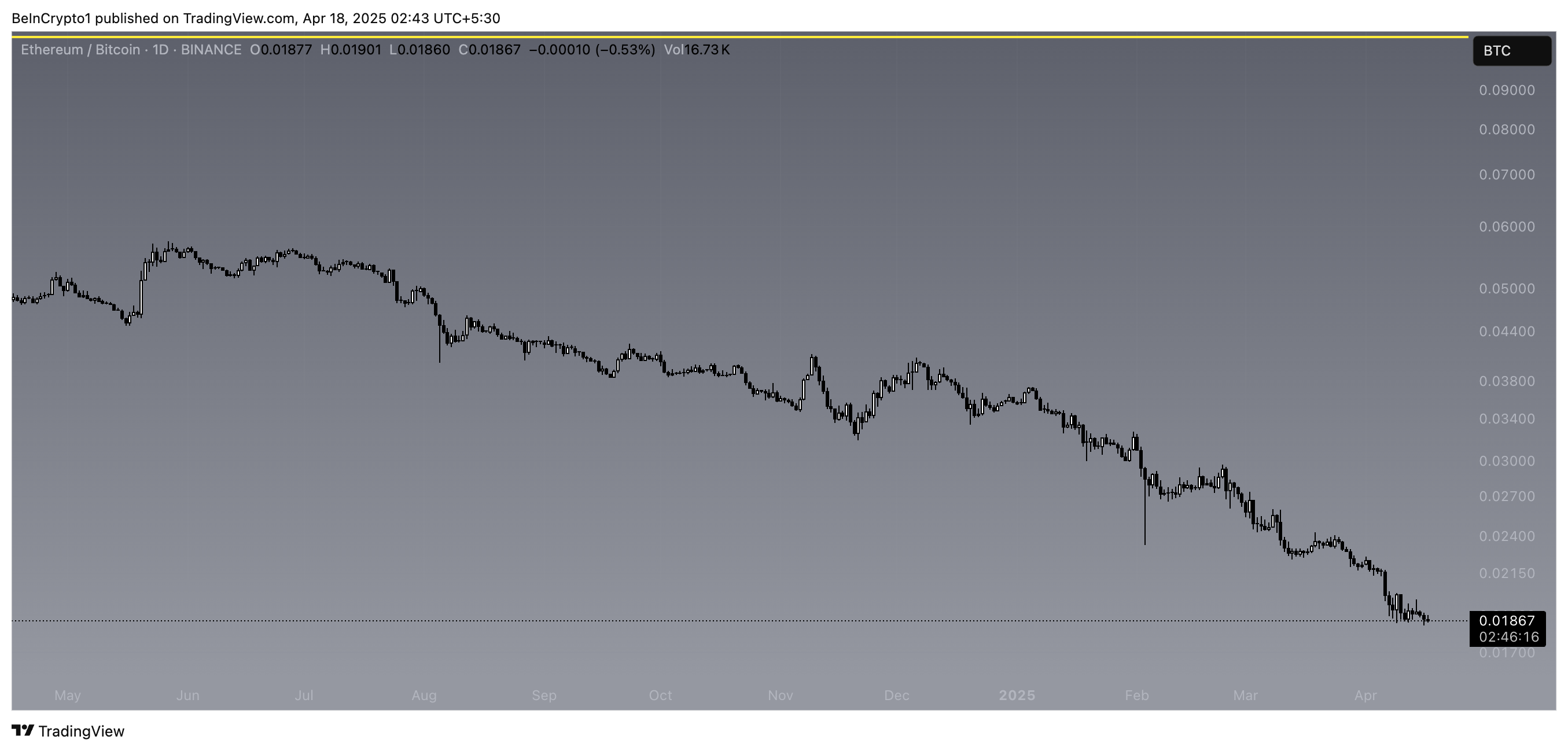

Additional fueling this bearish sentiment, the ETH/BTC ratio has reached a five-year low, highlighting Bitcoin’s rising dominance over Ethereum.

ETH/BTC ratio. Supply: TradingView.

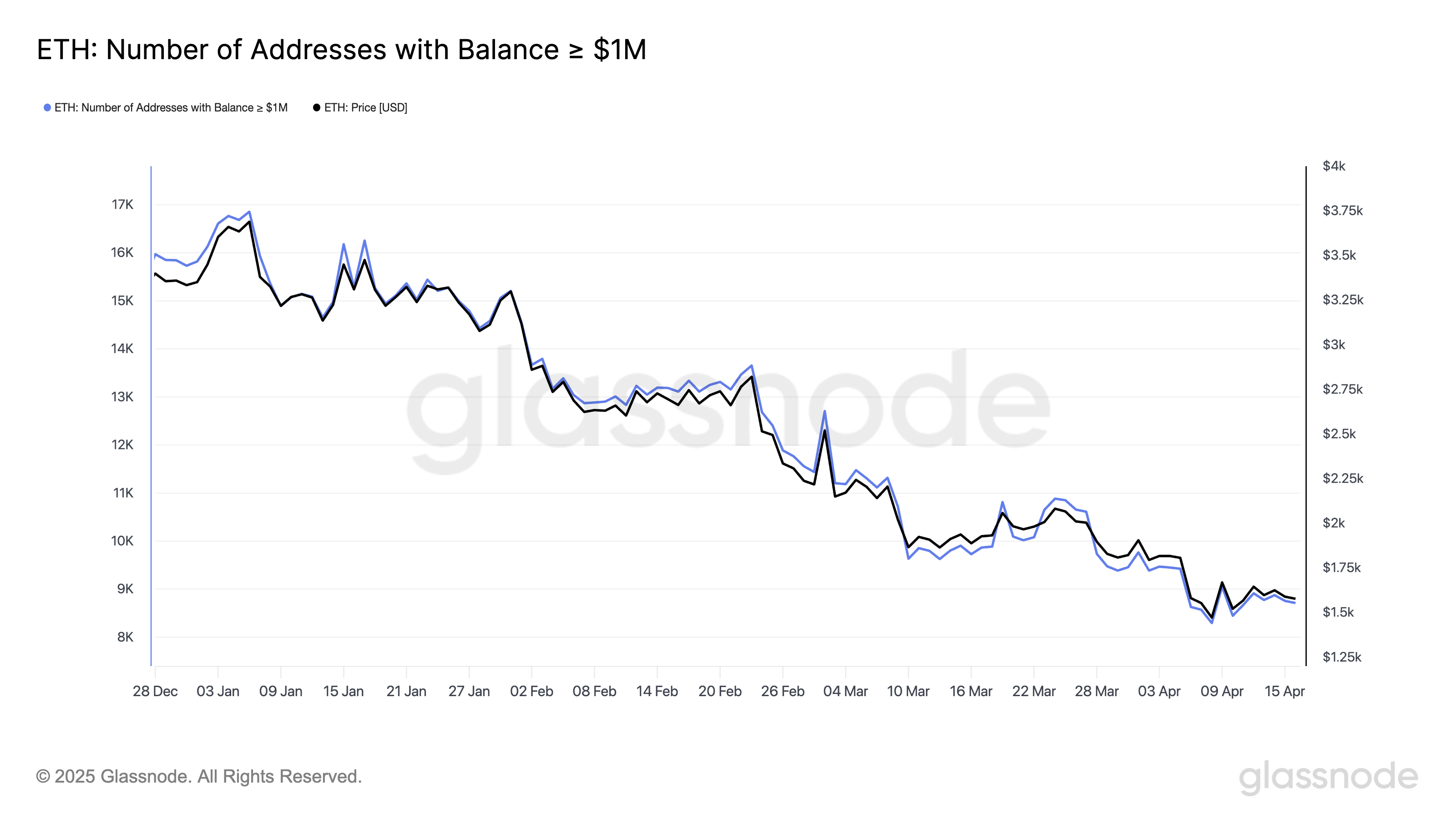

In the meantime, massive Ethereum holders are more and more promoting off substantial quantities, placing downward stress on their costs. Ethereum’s worth has fallen sharply by 51.3% because the starting of 2025, and investor confidence has waned, as evidenced by a lower in addresses holding at the least $1 million in ETH.

Holders with at the least $1 million price of ETH. Supply: Glassnode.

With choices buying and selling now accessible to extra merchants, specialists anticipate that Ethereum’s market place will enhance.

“ETH’s been leaking dominance, caught sub-17%. Choices give it institutional gravity. It turns into extra programmable for fund methods. Extra instruments imply extra use instances, which then in flip means extra capital sticking round,” Martins Benkitis, CEO and Co-Founding father of Gravity Crew, predicted.

This newfound accessibility of choices buying and selling will create further alternatives for buyers and the broader Ethereum ecosystem.

Larger Investor Entry and Liquidity

The SEC’s approval of Ethereum ETFs in July 2024 was vital as a result of it allowed conventional buyers to enter the crypto market with out instantly holding the property. Now, with choices buying and selling additionally obtainable, these advantages are anticipated to be even higher.

“It will present further alternatives for portfolio diversification and create extra avenues for ETH-based merchandise. With choices past the restricted Bitcoin ETF choices, buyers could rethink how they allocate their funds. This shift might consequence in extra subtle buying and selling methods and higher participation in Ethereum-based merchandise,” Vivien Lin, Chief Product Officer at BingX, instructed BeInCrypto.

The Ethereum ETF market will naturally turn out to be extra liquid with elevated participation via choices buying and selling.

Excessive Buying and selling Volumes and Hedging Calls for

The SEC’s recent approval of choices buying and selling for Ethereum ETF buyers means that the market will seemingly initially expertise a excessive buying and selling quantity. Because of this, market makers have to be ready.

A rise in name choices would require institutional market makers to hedge by shopping for extra Ethereum to satisfy demand.

“This is the canonically accepted dynamic of choices markets bringing higher liquidity to spot markets,” defined derivatives dealer Gordon Grant.

Ethereum may also safe a novel benefit, notably in institutional buying and selling, enhancing its perceived high quality and driving optimism amongst key market members.

“ETH simply received a critical institutional tailwind. With choices now in play, Ether is stepping nearer to BTC by way of tradable devices. This ranges up ETH’s legitimacy and utility in hedging methods, narrowing the hole on Bitcoin’s dominance narrative,” Benkitis instructed BeInCrypto.

But, speedy surges in choices buying and selling might even have unintended penalties on Ethereum’s value, particularly within the brief run.

Will Buyers Undergo a Gamma Squeeze?

As market makers rush to amass extra of the underlying asset in case of a better quantity of choices calls, Ethereum’s value will naturally enhance. This example might result in a pronounced gamma squeeze.

When market makers hedge their positions on this state of affairs, the ensuing shopping for stress would create a constructive suggestions loop. Retail buyers will really feel extra inclined to affix in, hoping to revenue from Ethereum’s rising value.

The implications of this state of affairs are particularly pronounced for Ethereum, contemplating its market capitalization is notably smaller than that of Bitcoin.

Retail merchants’ aggressive shopping for of ETHA name choices might compel market makers to hedge by buying the underlying ETHA shares, doubtlessly resulting in a extra pronounced impact on the value of ETHA and, by extension, Ethereum.

“We imagine choice sellers will typically dominate in the long-run however in brief bursts we might see retail momentum merchants turn out to be large consumers of ETHA calls and create gamma squeeze results, related to what we’ve seen on meme coin shares like GME. ETH will be simpler to squeeze than BTC given it is just $190 billion market cap vs BTC’s $1.65 trillion,” Joshua Lim, International Co-head of Markets at FalconX, instructed BeInCrypto.

In the meantime, Grant predicts arbitrage-driven flows will additional exacerbate value swings.

Arbitrage Alternatives Anticipated to Emerge

Skilled buyers in choices buying and selling could pursue arbitrage to realize earnings and cut back danger publicity.

Arbitrage entails exploiting value variations for a similar or almost an identical property throughout completely different markets or kinds. That is completed by shopping for within the cheaper market and promoting within the costlier one.

In response to Grant, merchants will more and more search for and exploit these value variations as the marketplace for ETH choices on completely different platforms develops.

“I would anticipate extra arbitrage behaviors between deribit CME and spot eth choices and whereas one sided flows throughout all three markets might be briefly destabilizing, higher liquidity via a numerous array of venues ought to finally dampen the extrema of positioning pushed dislocations and the frequency of such dislocations. For occasion, it seems –anecdotally as the knowledge is nonetheless inchoate– that vol variance on btc is declining submit intro of iBit choices,” he defined.

Whereas arbitrage exercise is predicted to refine pricing and liquidity inside the Ethereum choices market, the asset continues to function below the shadow of Bitcoin’s established market management.

Will Landmark Choices Approval Assist Ethereum Shut the Hole on Bitcoin?

Although Ethereum achieved a significant landmark this week, it faces competitors from a significant rival: Bitcoin.

In late fall of 2024, choices buying and selling began on BlackRock’s iShares Bitcoin Belief (IBIT), changing into the primary US spot Bitcoin ETF to supply choices. Although not even a 12 months has handed because the unique launch, choices buying and selling on Bitcoin ETFs skilled robust buying and selling volumes from retail and institutional buyers.

In response to Kadan Stadelmann, Chief Know-how Officer of Komodo Platform, choices buying and selling for Ethereum ETFs will likely be comparatively underwhelming. Bitcoin will nonetheless be the cryptocurrency of alternative for buyers.

“In comparison with Bitcoin’s Spot ETF, Ethereum’s ETF has not seen such stalwart demand. Whereas choices buying and selling provides institutional capital, Bitcoin stays crypto’s first mover and enjoys a higher total market cap. It isn’t going anyplace. It should stay the dominant crypto asset for institutional portfolios,” Stadelmann instructed BeInCrypto.

Consequently, his outlook doesn’t embody Ethereum’s market place surpassing Bitcoin’s within the quick time period.

“The once-promised flippening of Bitcoin’s market capitalization by Ethereum stays unlikely. Conservative and more-monied buyers seemingly want Bitcoin because of its perceived security in comparison with different crypto property, together with Ethereum. Ethereum, so as to obtain Bitcoin’s prominence, should depend upon rising utility in DeFi and stablecoin markets,” he concluded.

Whereas that could be the case, choices buying and selling doesn’t hurt Ethereum’s prospects; it solely strengthens them.

Can Ethereum’s Choices Buying and selling Period Capitalize on Alternatives?

Ethereum is now the second cryptocurrency with SEC approval for choices buying and selling on its ETFs. This single transfer will additional legitimize digital property for establishments, growing their presence in conventional markets and boosting total visibility.

Regardless of latest vital blows to Ethereum’s market place, this information is a constructive improvement. Though it may not be enough to surpass its main competitor, it represents a step in the suitable route.

As buyers get used to this new alternative, their participation degree will reveal how useful it is going to be for Ethereum.