Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, is poised for a large upside rally because it has fashioned bullish value motion on the every day timeframe. Regardless of the current decline within the cryptocurrency market over the previous few days, the value motion means that sentiment is able to shift from a downtrend to an uptrend.

Ethereum (ETH) Technical Evaluation and Upcoming Degree

Based on skilled technical evaluation, Ether has damaged out of a bullish falling wedge sample that it has been forming since November 2024. Following the breakout, sentiment seems to have utterly shifted.

Primarily based on historic value momentum, if ETH efficiently closes a every day candle above the sample, i.e., the $3,400 stage, it’s doable to soar by 20% to succeed in the $4,100 stage sooner or later. Presently, Ether is going through modest resistance at $3,400, which might play an vital position in its future positive factors.

On the optimistic aspect, the Relative Energy Index (RSI) is at 55, indicating that ETH has sufficient energy to maintain upside momentum.

On-Chain Metrics Combined Sentiment

Nevertheless, regardless of the breakout and up to date positive factors amidst market uncertainty, long-term holders and traders have reportedly been dumping their belongings, based on on-chain analytics agency CoinGlass. Knowledge from spot inflows/outflows reveals that exchanges have seen a big influx of $103 million value of Ethereum.

Within the cryptocurrency business, influx refers back to the circulate of belongings from wallets to exchanges, indicating a possible sell-off, which might trigger promoting stress and additional value decline.

Nevertheless, not solely have long-term holders proven energy, however merchants have additionally been betting strongly on the lengthy aspect, indicating a bullish outlook.

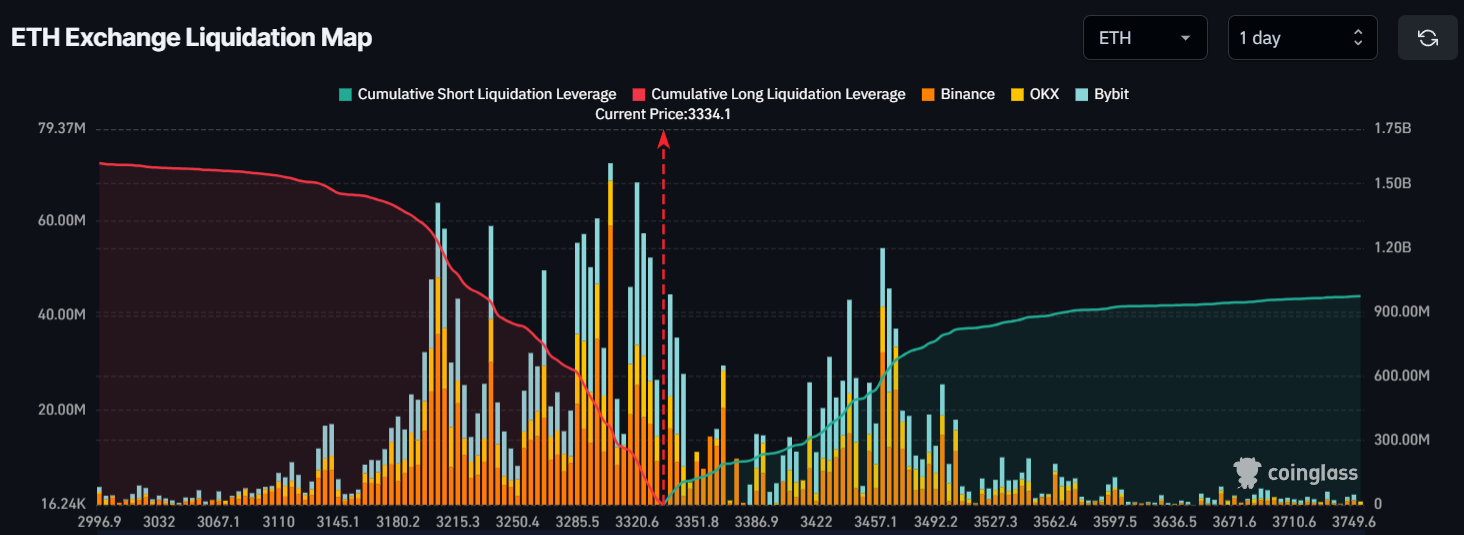

At press time, the foremost liquidation areas are $3,305 on the decrease aspect, the place bulls are over-leveraged and maintain $360 million value of lengthy positions. Conversely, $3,370 is the extent the place quick sellers appear to be over-leveraged, holding $190 million value of quick positions.

These on-chain metrics trace that bulls are strongly dominating the asset and will assist Ether in breaching the resistance stage of $3,400.

Present Value Momentum

ETH is presently buying and selling close to $3,350 and has skilled a value surge of over 1.50% prior to now 24 hours. Nevertheless, throughout the identical interval, its buying and selling quantity jumped by 10%, indicating heightened participation from merchants and traders, probably pushed by the current breakout.