Ethereum (ETH) dipped over 7% within the final 24 hours regardless of Trump’s 90-day tariff pause. Key technical indicators recommend {that a} full development reversal could be unlikely within the quick time period.

The BBTrend stays strongly detrimental, and whale accumulation has stalled, each signaling warning. Mixed with a still-bearish EMA construction, Ethereum might have a stronger wave of shopping for strain earlier than it might escape of its present downtrend.

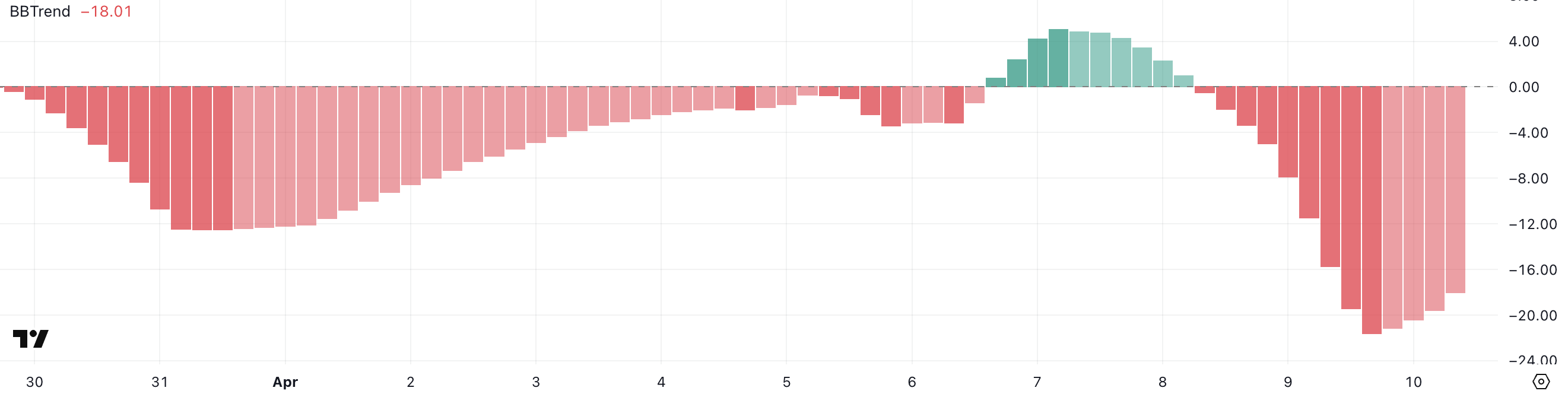

ETH BBTrend Is Strongly Damaging However Larger Than Yesterday

Ethereum’s BBTrend indicator has barely improved, at the moment studying -18, up from -21.59 simply earlier than Trump’s tariff pause announcement.

This shift means that bearish momentum could also be beginning to fade, though it nonetheless indicators total draw back strain. The BBTrend (Band-Based mostly Development) is a volatility-based indicator that helps gauge the energy and route of a development utilizing the connection between worth and Bollinger Bands.

Values above zero point out bullish momentum, whereas detrimental values level to bearish developments—the farther from zero, the stronger the directional conviction.

ETH’s BBTrend has remained in detrimental territory since April 8, reflecting sustained weak point in current classes. Whereas the current uptick may trace at early stabilization, the present worth of -18 suggests Ethereum hasn’t but flipped the broader development.

For bullish affirmation, ETH would wish to push BBTrend again towards impartial or optimistic territory, ideally supported by quantity and powerful worth motion.

Till then, the chart factors to a market nonetheless in correction mode however with some indicators of doable reversal forward.

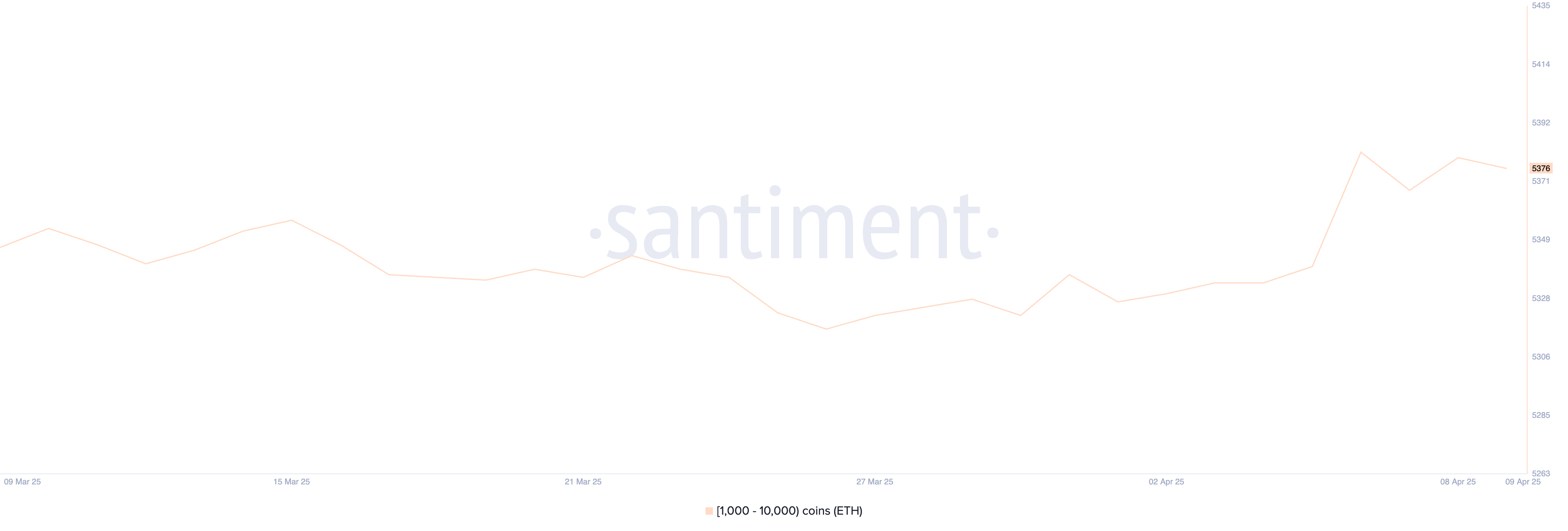

Whales Are Nonetheless Not Accumulating

The variety of Ethereum whales—wallets holding between 1,000 and 10,000 ETH—rose from 5,340 to five,382 between April 5 and 6, marking a short uptick in accumulation.

Nevertheless, the metric has since stabilized and at the moment sits at 5,376, displaying little change in current days.

Monitoring whale exercise is important as a result of these massive holders usually have the affect to maneuver markets, both by initiating huge buys throughout dips or promoting into energy to take income.

Ethereum Whales. Supply: Santiment.

The current stabilization in whale numbers suggests a wait-and-see method from main holders. After a short accumulation spike, whales look like holding their positions quite than aggressively shopping for or promoting.

This might imply that confidence is returning however not but robust sufficient to gas a serious breakout.

For Ethereum to see sustained upward momentum, a renewed rise in whale accumulation could be a optimistic sign, indicating rising conviction from the biggest gamers available in the market.

Is The Present Ethereum Surge Simply Short-term?

Regardless of Ethereum’s current bounce following Trump’s tariff pause, its EMA construction stays bearish, with short-term shifting averages nonetheless positioned under the longer-term ones.

This lagging alignment usually displays continued draw back strain, even throughout reduction rallies.

When considered alongside different indicators—just like the still-negative BBTrend and stagnant whale accumulation—it turns into clear that Ethereum wants considerably extra shopping for quantity to shift right into a confirmed uptrend.

ETH Value Evaluation. Supply: TradingView.

If that bullish strain does emerge, Ethereum’s worth may goal to check resistance at $1,749, and a breakout there may open the trail to $1,954 and even $2,104. That could possibly be pushed by macro developments, just like the SEC’s current approval of choices buying and selling on BlackRock’s Ethereum ETF.

Nevertheless, if momentum fades, the value dangers coming into one other correction section.

Key assist lies at $1,412, and if that degree fails, ETH may slip under $1,400 and probably revisit sub-$1,300 territory.